Maine Real Estate Withholding Form REW 2 IncomeEstate Tax Division 2022

Understanding the Maine Real Estate Withholding Form REW-2

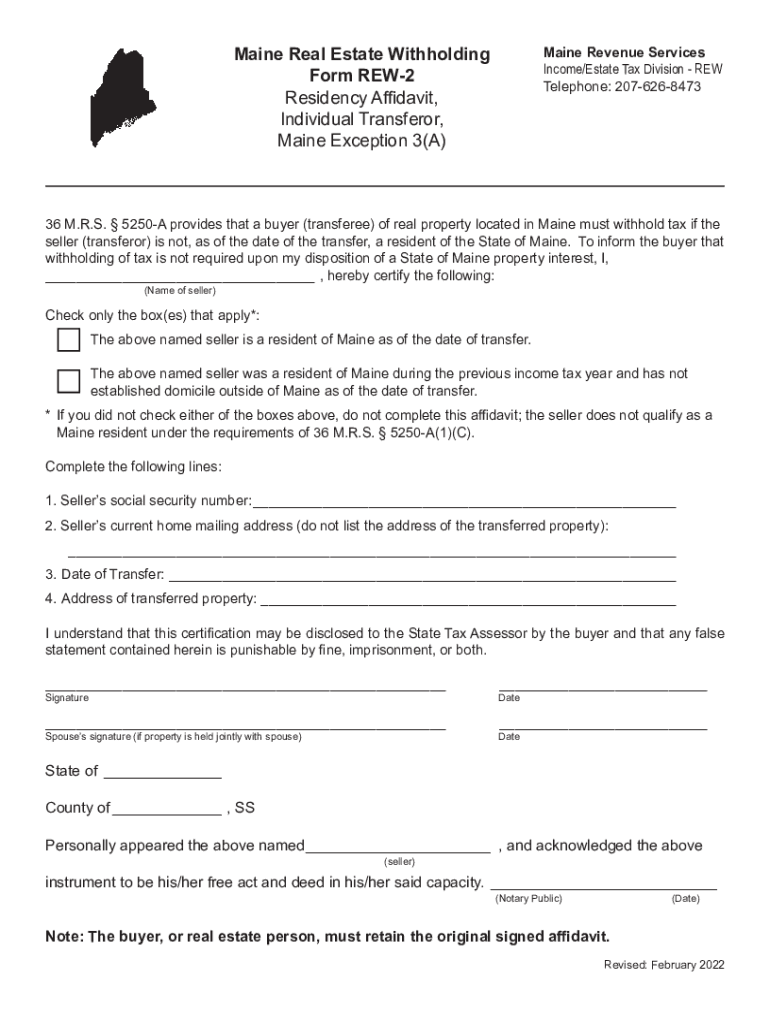

The Maine Real Estate Withholding Form REW-2 is a crucial document used during the sale of real estate in Maine. This form is primarily designed to ensure that the state collects income tax on the gains realized from the sale of property. When a property is sold, the seller may be required to withhold a portion of the proceeds to cover potential tax liabilities. This form is essential for both buyers and sellers to understand their obligations and rights under Maine tax law.

Steps to Complete the Maine Real Estate Withholding Form REW-2

Completing the Maine REW-2 form involves several important steps. First, gather all necessary information regarding the property being sold, including the address, sale price, and the names of all parties involved. Next, accurately fill out the form by providing details such as the seller's tax identification number and the amount to be withheld. After completing the form, ensure that all signatures are obtained before submission. It is advisable to keep a copy for your records.

Legal Use of the Maine Real Estate Withholding Form REW-2

The legal framework surrounding the Maine REW-2 form is established to ensure compliance with state tax regulations. This form must be submitted to the Maine Revenue Services at the time of the property transfer. Failure to properly complete and submit the REW-2 may result in penalties or delays in the closing process. Understanding the legal implications of this form is vital for both sellers and buyers to avoid potential legal issues.

Filing Deadlines and Important Dates for the Maine REW-2 Form

Timeliness is crucial when dealing with the Maine REW-2 form. The form must be filed with the Maine Revenue Services at the time of closing on the property sale. It is important to be aware of any specific deadlines that may apply, as failing to meet these deadlines can result in additional penalties. Sellers should consult with their real estate agent or attorney to ensure compliance with all relevant timelines.

Required Documents for the Maine Real Estate Withholding Form REW-2

To complete the Maine REW-2 form, certain documents are required. Sellers should have the property deed, a copy of the sales contract, and any other relevant documentation that supports the sale price and terms. Additionally, personal identification, such as a Social Security number or tax identification number, is necessary to ensure accurate processing of the form. Having these documents ready will facilitate a smoother completion process.

Examples of Using the Maine Real Estate Withholding Form REW-2

Understanding practical scenarios can help clarify the use of the Maine REW-2 form. For instance, if a resident sells their home for $300,000 and has a capital gain, they may need to withhold a percentage of the sale price as outlined in the form. Another example includes a non-resident seller who must also comply with the withholding requirements, ensuring that the state can collect any taxes owed on the sale. These examples illustrate the form's importance in various real estate transactions.

Quick guide on how to complete maine real estate withholding form rew 2 incomeestate tax division

Complete Maine Real Estate Withholding Form REW 2 IncomeEstate Tax Division effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents quickly without delays. Manage Maine Real Estate Withholding Form REW 2 IncomeEstate Tax Division on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Maine Real Estate Withholding Form REW 2 IncomeEstate Tax Division seamlessly

- Find Maine Real Estate Withholding Form REW 2 IncomeEstate Tax Division and click on Get Form to initiate the process.

- Utilize the resources we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal standing as a traditional wet ink signature.

- Verify the information and click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), an invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tiresome form searches, or errors that necessitate creating new copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Maine Real Estate Withholding Form REW 2 IncomeEstate Tax Division and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine real estate withholding form rew 2 incomeestate tax division

Create this form in 5 minutes!

People also ask

-

What is the Maine form REW2 and why is it important?

The Maine form REW2 is a crucial tax document required for reporting various income types in the state. It ensures compliance with Maine tax laws and helps you accurately report wages and other compensations. Using airSlate SignNow, you can easily prepare, send, and eSign this form, streamlining your tax filing process.

-

How can airSlate SignNow help me manage the Maine form REW2?

airSlate SignNow allows you to effortlessly manage the Maine form REW2 by facilitating easy document creation, editing, and electronic signing. Its user-friendly interface ensures that you can complete and send this form quickly, reducing the time spent on administrative tasks. Plus, you can securely store all your forms for easy access in the future.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Depending on your needs, you can choose from various plans that include essential features for managing documents like the Maine form REW2. These cost-effective solutions ensure that you get excellent value while streamlining your document processes.

-

Is airSlate SignNow compliant with Maine laws regarding the REW2 form?

Yes, airSlate SignNow ensures that all electronic signatures and document processes comply with Maine laws. This includes regulations surrounding the Maine form REW2, ensuring that your tax documents are legally valid and secure. By using our platform, you can confidently handle your compliance requirements without any hassle.

-

What features does airSlate SignNow offer for eSigning the Maine form REW2?

airSlate SignNow provides multiple features for eSigning the Maine form REW2, including customizable templates, in-document tagging for signers, and automated reminders. These tools enable a seamless signing process for all parties involved, making it simple to collect signatures quickly and efficiently. With our platform, you can minimize delays and frustration associated with traditional signing methods.

-

Can I integrate airSlate SignNow with other tools I use?

Absolutely! airSlate SignNow offers seamless integration with various third-party applications, allowing you to connect with tools like CRM systems, project management apps, and more. This means you can easily manage the Maine form REW2 alongside your other workflows, improving overall productivity and organization.

-

How can airSlate SignNow enhance collaboration on the Maine form REW2?

With airSlate SignNow, collaboration on the Maine form REW2 is signNowly enhanced through shared access and commenting features. Multiple users can review, edit, and sign the document simultaneously, ensuring everyone is on the same page. This collaborative approach reduces turnaround times and fosters efficient communication among team members.

Get more for Maine Real Estate Withholding Form REW 2 IncomeEstate Tax Division

- Commercial lease assignment from tenant to new tenant north carolina form

- Tenant consent to background and reference check north carolina form

- Residential lease or rental agreement for month to month north carolina form

- Residential rental lease agreement north carolina form

- Tenant welcome letter north carolina form

- Warning of default on commercial lease north carolina form

- Warning of default on residential lease north carolina form

- Nc partnership form

Find out other Maine Real Estate Withholding Form REW 2 IncomeEstate Tax Division

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online