Certification for No Information Reporting 1099 S on Principal

What is the Certification for No Information Reporting 1099 S on Principal

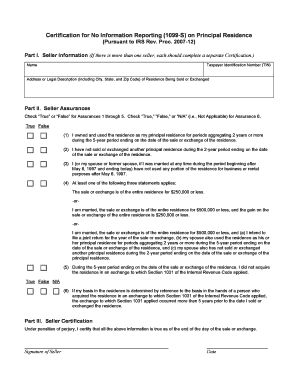

The Certification for No Information Reporting 1099 S is a specific tax form used in the United States to certify that the sale or exchange of a principal residence does not require the reporting of certain information to the IRS. This form is essential for individuals who sell their primary home and meet specific criteria, allowing them to avoid unnecessary tax reporting obligations. The form ensures that sellers can confirm their eligibility for this exemption, streamlining the process of reporting real estate transactions.

How to Use the Certification for No Information Reporting 1099 S on Principal

To effectively use the Certification for No Information Reporting 1099 S, individuals must first determine their eligibility based on the sale of their principal residence. Once eligibility is confirmed, the seller should complete the form accurately, providing necessary details such as the sale price and date of the transaction. After filling out the form, it should be submitted to the appropriate parties involved in the transaction, typically the closing agent or the buyer. This ensures that all parties are aware of the exemption and that the transaction is documented correctly.

Steps to Complete the Certification for No Information Reporting 1099 S on Principal

Completing the Certification for No Information Reporting 1099 S involves several key steps:

- Gather necessary information about the sale, including the sale price, date, and details of the property.

- Obtain the official form from the IRS or a trusted source.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form to the appropriate parties involved in the transaction.

Legal Use of the Certification for No Information Reporting 1099 S on Principal

The legal use of the Certification for No Information Reporting 1099 S is critical for ensuring compliance with IRS regulations. This form must be used in accordance with the specific guidelines set forth by the IRS, which include confirming that the sale qualifies for the exemption. Proper use of the form protects sellers from potential penalties associated with incorrect reporting and ensures that the transaction is documented in a legally binding manner.

Key Elements of the Certification for No Information Reporting 1099 S on Principal

Understanding the key elements of the Certification for No Information Reporting 1099 S is essential for proper completion. Important components include:

- The seller's name and contact information.

- The property's address and details of the sale.

- Certification statements confirming eligibility for the exemption.

- Signatures of the seller and any required witnesses or notaries.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Certification for No Information Reporting 1099 S. These guidelines outline the eligibility criteria for sellers, the necessary information to include on the form, and the proper submission process. Adhering to these guidelines is crucial for ensuring compliance and avoiding potential issues during tax filing.

Eligibility Criteria

To qualify for the Certification for No Information Reporting 1099 S, sellers must meet specific eligibility criteria. Generally, this includes owning the property as a primary residence for at least two of the last five years prior to the sale. Additionally, the sale price must fall below certain thresholds set by the IRS. Understanding these criteria is vital for sellers to ensure they can utilize the form correctly and benefit from the exemption.

Quick guide on how to complete certification for no information reporting 1099 s on principal

Complete Certification For No Information Reporting 1099 S On Principal effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without complications. Handle Certification For No Information Reporting 1099 S On Principal on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Certification For No Information Reporting 1099 S On Principal without breaking a sweat

- Locate Certification For No Information Reporting 1099 S On Principal and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive data using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of lost or misfiled documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Certification For No Information Reporting 1099 S On Principal and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certification for no information reporting 1099 s on principal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1099 s certification exemption form?

The 1099 s certification exemption form is a document used by businesses to signNow that they are exempt from certain 1099 reporting requirements. This form helps streamline the reporting process and ensures compliance with IRS regulations. By using the 1099 s certification exemption form, companies can avoid unnecessary tax reporting and simplify their accounting practices.

-

How can airSlate SignNow simplify the process of completing the 1099 s certification exemption form?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and electronically sign the 1099 s certification exemption form. With its user-friendly interface, you can quickly gather the necessary signatures and send the form for processing. This not only saves time but also reduces paperwork, making compliance more efficient.

-

Is there a cost associated with using airSlate SignNow for the 1099 s certification exemption form?

Yes, airSlate SignNow offers different pricing plans to meet the needs of various users. The cost will depend on the specific features you require and the number of users in your organization. However, the platform often provides a cost-effective solution for electronically signing documents, including the 1099 s certification exemption form.

-

What features does airSlate SignNow offer for managing the 1099 s certification exemption form?

airSlate SignNow offers several features that enhance the management of the 1099 s certification exemption form, including customizable templates, audit trails, and automated workflows. These features ensure that your documents are processed efficiently and securely. Additionally, the platform allows for seamless collaboration with team members, ensuring that everyone stays informed throughout the signing process.

-

Does airSlate SignNow integrate with other software for filing the 1099 s certification exemption form?

Yes, airSlate SignNow integrates with various accounting and payroll software to facilitate the seamless filing of the 1099 s certification exemption form. This means you can automatically update your records and streamline your document management process without manual entry. Integrations with popular platforms enhance the overall efficiency of managing your tax-related documents.

-

Can I track the status of my 1099 s certification exemption form with airSlate SignNow?

Absolutely! airSlate SignNow provides a tracking feature that allows you to monitor the status of your 1099 s certification exemption form in real-time. You can see when the document is sent, viewed, and signed, giving you full visibility into your document's journey. This feature keeps you informed and helps ensure that all necessary steps are completed timely.

-

How secure is the information on the 1099 s certification exemption form when using airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption methods to protect your data while completing the 1099 s certification exemption form. Additionally, the platform complies with industry standards to ensure your information is safe and secure during the signing process.

Get more for Certification For No Information Reporting 1099 S On Principal

- Of the stockholders of form

- Employee forms city of wisconsin rapids

- Letter to santa from precocious child form

- Waiver of notice waiver of notice of meeting with sample form

- Form of employment confidential information and

- Landlords consent to assignment form

- Acknowledgement of shipping delay form

- 19 01 tax increment interlocal agreements for south main form

Find out other Certification For No Information Reporting 1099 S On Principal

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free