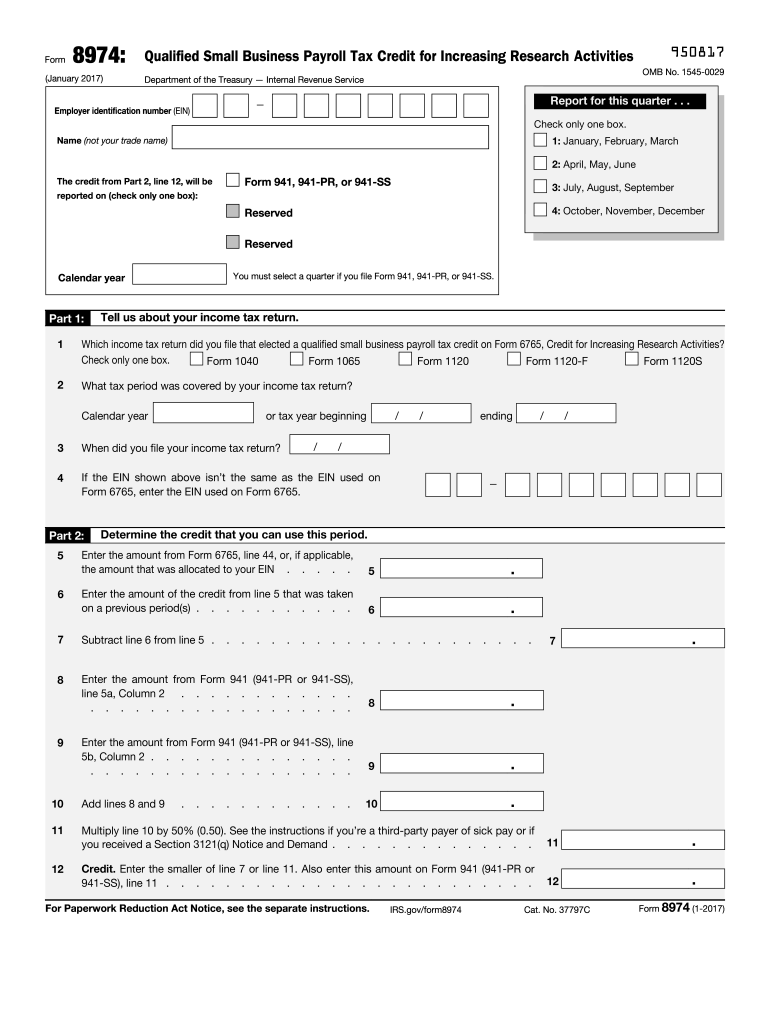

Form 8974 January Quarterly Small Business Payroll Tax Credit for Increasing Research Activities Irs 2017

What is the Form 8974?

The Form 8974 is a tax document used by small businesses to claim the quarterly payroll tax credit for increasing research activities. This form is specifically designed to help eligible businesses offset their payroll tax liabilities by applying for credits that encourage research and development. The IRS provides this form to facilitate the process of claiming credits that can significantly reduce tax burdens for qualifying entities.

How to use the Form 8974

Using the Form 8974 involves several steps to ensure compliance and accuracy. First, businesses must determine their eligibility for the payroll tax credit based on their research activities. After confirming eligibility, they should gather all necessary documentation, including records of qualified research expenses. Once all information is compiled, the form can be filled out, ensuring that all required fields are completed accurately. Finally, the completed form should be submitted according to IRS guidelines, either electronically or by mail.

Steps to complete the Form 8974

Completing the Form 8974 requires careful attention to detail. Follow these steps:

- Gather documentation related to research activities and expenses.

- Review the eligibility criteria to ensure your business qualifies for the credit.

- Fill out the form, making sure to provide accurate information in all required fields.

- Double-check the form for any errors or omissions.

- Submit the form by the designated deadline to the IRS.

Eligibility Criteria for the Form 8974

To qualify for the payroll tax credit using the Form 8974, businesses must meet specific eligibility criteria. These include being a qualified small business engaged in research activities as defined by the IRS. Additionally, the business must have incurred eligible research expenses during the tax year. It is essential to review the IRS guidelines to ensure that all criteria are met before submitting the form.

Filing Deadlines for Form 8974

Filing deadlines for the Form 8974 are crucial for ensuring compliance with IRS regulations. Typically, the form must be submitted along with the employer's payroll tax return for the relevant quarter. Businesses should be aware of these deadlines to avoid penalties and ensure timely processing of their claims. Staying informed about any changes to deadlines is also important for compliance.

Form Submission Methods

The Form 8974 can be submitted through various methods, including electronic filing and traditional mail. Electronic submission is often preferred for its speed and efficiency, allowing for quicker processing times. However, businesses may also choose to mail the form if they prefer a paper submission. It is important to follow the IRS guidelines for the chosen submission method to ensure proper handling of the form.

Quick guide on how to complete form 8974 january 2017 quarterly small business payroll tax credit for increasing research activities irs

Uncover the easiest method to complete and endorse your Form 8974 January Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs

Are you still spending time organizing your official paperwork on physical copies instead of handling it online? airSlate SignNow offers a superior method to finalize and endorse your Form 8974 January Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs and comparable forms for public services. Our intelligent eSignature platform equips you with everything necessary to process documents swiftly and in compliance with formal standards - robust PDF editing, management, safeguarding, signing, and distribution tools all available within a user-friendly layout.

You only need to follow a few steps to complete and endorse your Form 8974 January Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs:

- Insert the fillable template into the editor using the Get Form button.

- Review what information you must provide in your Form 8974 January Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the gaps with your information.

- Update the content with Text boxes or Images from the top menu.

- Emphasize what is signNow or Redact sections that are no longer relevant.

- Select Sign to create a legally valid eSignature using your preferred option.

- Insert the Date next to your signature and conclude your task with the Done button.

Preserve your finalized Form 8974 January Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our platform also facilitates flexible form sharing. There is no need to print your forms when required to send them to the appropriate public office - transmit them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 8974 january 2017 quarterly small business payroll tax credit for increasing research activities irs

Create this form in 5 minutes!

How to create an eSignature for the form 8974 january 2017 quarterly small business payroll tax credit for increasing research activities irs

How to make an eSignature for the Form 8974 January 2017 Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs in the online mode

How to make an electronic signature for the Form 8974 January 2017 Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs in Google Chrome

How to create an electronic signature for putting it on the Form 8974 January 2017 Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs in Gmail

How to make an eSignature for the Form 8974 January 2017 Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs from your mobile device

How to create an eSignature for the Form 8974 January 2017 Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs on iOS devices

How to generate an eSignature for the Form 8974 January 2017 Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs on Android

People also ask

-

What is form 8974 and why is it important?

Form 8974 is used by businesses to claim the credit for employer differential wage payments. It's essential for companies looking to maximize their tax benefits and ensure compliance with IRS regulations. Properly completing this form can lead to signNow savings.

-

How can airSlate SignNow help me with form 8974?

airSlate SignNow offers an intuitive platform to easily fill out and eSign form 8974. With its electronic signature capabilities, you can streamline the process, ensuring timely submissions and compliance. This reduces the hassle of paper forms, making it efficient and quick.

-

Is there a cost associated with using airSlate SignNow for form 8974?

Yes, airSlate SignNow operates on a subscription-based pricing model, which is affordable for businesses of all sizes. The cost includes access to features that enhance the completion and submission of crucial documents like form 8974. Check the pricing page for specific plans and options.

-

What features does airSlate SignNow offer for completing form 8974?

airSlate SignNow provides several features tailored for form 8974, including templates, automated workflows, and secure storage. You can easily customize templates for repetitive use, ensuring accuracy whenever you need to complete this form. The platform's collaborative tools also allow for real-time input from team members.

-

Can I integrate airSlate SignNow with other software for form 8974?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enabling you to manage form 8974 effectively within your existing tools. Whether you're using accounting software or other productivity tools, integration can streamline your workflow and data management.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing, including form 8974, offers numerous benefits such as enhanced security, reduced turnaround time, and improved tracking. Electronic signatures are legally binding, making your submissions reliable and reducing the need for printing. This approach signNowly enhances document handling efficiency.

-

Is airSlate SignNow compliant with regulations for form 8974?

Yes, airSlate SignNow adheres to stringent security and compliance standards, ensuring that your use of form 8974 meets legal requirements. The platform is designed to protect sensitive information while providing a straightforward eSigning experience. You can count on airSlate SignNow for reliable compliance support.

Get more for Form 8974 January Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs

Find out other Form 8974 January Quarterly Small Business Payroll Tax Credit For Increasing Research Activities Irs

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free