Form 8974 Rev December Quarterly Small Business Payroll Tax Credit for Increasing Research Activities 2024-2026

Understanding Form 8974 for Small Business Payroll Tax Credit

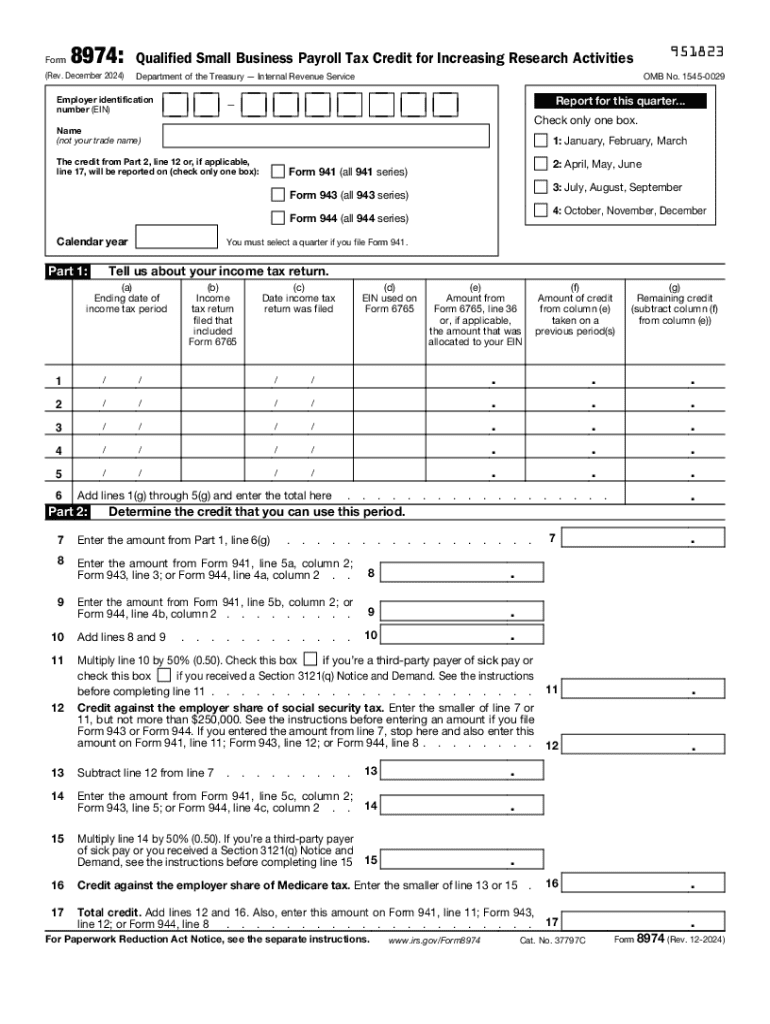

The Form 8974, also known as the Quarterly Small Business Payroll Tax Credit for Increasing Research Activities, is essential for small businesses seeking to claim tax credits related to research activities. This form allows eligible businesses to receive a payroll tax credit that can significantly reduce their tax liability. It is specifically designed for small businesses that have qualified research expenses and meet certain criteria established by the IRS.

Steps to Complete Form 8974

Completing Form 8974 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including records of qualified research expenses. Next, fill out the form by providing detailed information about your business and the research activities conducted. Be sure to accurately calculate the credit amount based on your eligible expenses. Finally, review the completed form for accuracy before submission to avoid any potential penalties or delays.

Eligibility Criteria for Form 8974

To qualify for the payroll tax credit using Form 8974, businesses must meet specific eligibility criteria. These criteria include being a small business with fewer than five hundred employees and having incurred qualified research expenses during the tax year. Additionally, the research activities must meet the IRS guidelines for qualified research, which typically involve developing or improving products, processes, or software.

Required Documents for Form 8974

When preparing to submit Form 8974, certain documents are required to support your claim. These documents may include payroll records, documentation of qualified research expenses, and any relevant financial statements. It is crucial to maintain accurate records to substantiate your eligibility for the payroll tax credit and to ensure a smooth filing process.

Filing Deadlines for Form 8974

Timely submission of Form 8974 is critical to avoid penalties and ensure you receive your credit. The form must be filed quarterly, aligning with the payroll tax filing schedule. It is advisable to check the IRS guidelines for specific deadlines for each quarter to ensure compliance and avoid any late filing penalties.

IRS Guidelines for Form 8974

The IRS provides comprehensive guidelines for completing and submitting Form 8974. These guidelines outline the eligibility requirements, the types of expenses that qualify for the credit, and the calculation methods for determining the credit amount. Familiarizing yourself with these guidelines is essential for accurately completing the form and maximizing your potential tax benefits.

Create this form in 5 minutes or less

Find and fill out the correct form 8974 rev december quarterly small business payroll tax credit for increasing research activities

Create this form in 5 minutes!

How to create an eSignature for the form 8974 rev december quarterly small business payroll tax credit for increasing research activities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are payroll activities and how can airSlate SignNow help?

Payroll activities refer to the processes involved in managing employee compensation, including calculating wages, withholding taxes, and distributing payments. airSlate SignNow streamlines these activities by allowing businesses to easily send and eSign payroll documents, ensuring compliance and efficiency.

-

How does airSlate SignNow improve the efficiency of payroll activities?

By automating document workflows, airSlate SignNow reduces the time spent on payroll activities. The platform allows for quick eSigning and document management, which minimizes delays and errors, ultimately enhancing the payroll process.

-

What features does airSlate SignNow offer for managing payroll activities?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking that are essential for managing payroll activities. These tools help ensure that all payroll documents are processed accurately and efficiently.

-

Is airSlate SignNow cost-effective for small businesses handling payroll activities?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Its pricing plans are flexible, allowing small businesses to manage payroll activities without incurring high costs, making it an ideal choice for budget-conscious companies.

-

Can airSlate SignNow integrate with existing payroll software?

Absolutely! airSlate SignNow offers integrations with various payroll software solutions, allowing businesses to seamlessly incorporate eSigning into their payroll activities. This integration ensures that all payroll processes are synchronized and efficient.

-

What benefits does airSlate SignNow provide for payroll activities?

The primary benefits of using airSlate SignNow for payroll activities include increased efficiency, reduced paperwork, and enhanced security. By digitizing the payroll process, businesses can save time and resources while ensuring that sensitive information is protected.

-

How secure is airSlate SignNow for handling payroll activities?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive payroll information. This ensures that all payroll activities are conducted safely, giving businesses peace of mind.

Get more for Form 8974 Rev December Quarterly Small Business Payroll Tax Credit For Increasing Research Activities

Find out other Form 8974 Rev December Quarterly Small Business Payroll Tax Credit For Increasing Research Activities

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU