About Form 8974, Qualified Small Business Payroll Tax IRS 2023

Understanding Form 8974: Qualified Small Business Payroll Tax

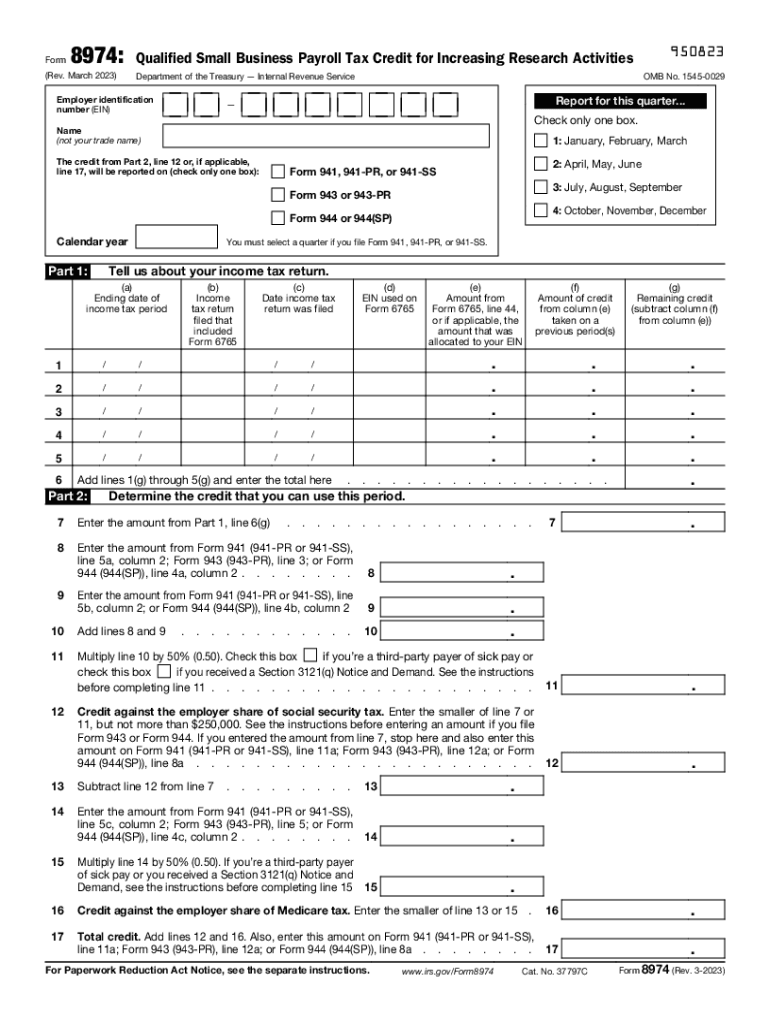

The form 8974 is a crucial document for small businesses seeking to claim payroll tax credits under the Qualified Small Business Payroll Tax Credit program. This form allows eligible employers to report their payroll tax credits, which can significantly reduce their tax liabilities. The IRS provides specific guidelines on who qualifies for these credits, making it essential for businesses to understand their eligibility before completing the form.

Steps to Complete Form 8974

Completing the form 8974 involves several key steps to ensure accuracy and compliance. Start by gathering necessary information about your business, including your Employer Identification Number (EIN) and payroll details. Next, follow these steps:

- Fill out your business information in the designated sections.

- Calculate the total payroll tax credits you are eligible for based on your qualified activities.

- Report any adjustments or corrections from previous filings, if applicable.

- Review the completed form for accuracy before submission.

Legal Use of Form 8974

The legal validity of form 8974 hinges on compliance with IRS regulations. To ensure that your submission is recognized, it is vital to adhere to the guidelines set forth by the IRS. This includes using the most current version of the form and providing accurate information. Additionally, utilizing a reliable eSignature solution can enhance the legal standing of your submission, as it ensures that all signatures are verifiable and compliant with eSignature laws.

Filing Deadlines for Form 8974

Timely filing of form 8974 is essential to avoid penalties and ensure that your payroll tax credits are processed efficiently. The IRS typically sets specific deadlines for submitting this form, which may vary based on your business's tax year. It is advisable to check the IRS website or consult with a tax professional to confirm the exact deadlines applicable to your situation.

Examples of Using Form 8974

Understanding practical applications of form 8974 can provide clarity on its importance. For instance, a small business that has recently hired new employees may use this form to claim payroll tax credits for the wages paid to those employees. Additionally, businesses that have experienced significant payroll expenses due to growth can leverage this form to offset their tax liabilities effectively. These examples highlight the strategic value of form 8974 in managing business finances.

Eligibility Criteria for Form 8974

To successfully utilize form 8974, businesses must meet specific eligibility criteria established by the IRS. Generally, qualifying businesses are those that have fewer than five hundred employees and have engaged in qualified payroll activities. It is important to review the detailed eligibility requirements on the IRS website to ensure compliance and maximize potential tax benefits.

Quick guide on how to complete about form 8974 qualified small business payroll tax irs

Facilitate About Form 8974, Qualified Small Business Payroll Tax IRS effortlessly on any gadget

Digital document management has become favored among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle About Form 8974, Qualified Small Business Payroll Tax IRS on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

The simplest way to modify and eSign About Form 8974, Qualified Small Business Payroll Tax IRS without hassle

- Obtain About Form 8974, Qualified Small Business Payroll Tax IRS and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure confidential information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your alterations.

- Choose your preferred method for sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors requiring new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign About Form 8974, Qualified Small Business Payroll Tax IRS and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8974 qualified small business payroll tax irs

Create this form in 5 minutes!

How to create an eSignature for the about form 8974 qualified small business payroll tax irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8974 and why do I need it?

Form 8974 is an essential document for businesses claiming the IRS's Indian Employment Credit. Utilizing airSlate SignNow simplifies the process of completing and submitting Form 8974, ensuring compliance and accuracy in claiming this valuable tax credit.

-

How does airSlate SignNow help with filing Form 8974?

airSlate SignNow offers a streamlined platform for filling out and eSigning Form 8974. With our user-friendly interface, you can easily input necessary details and securely submit the document digitally, making the filing process more efficient.

-

Is there a cost associated with using airSlate SignNow for Form 8974?

Yes, airSlate SignNow offers competitive pricing plans tailored for individual and business needs. Each plan provides access to essential features for managing and eSigning Form 8974, ensuring affordability for all users.

-

What features does airSlate SignNow provide for Form 8974?

airSlate SignNow includes features such as eSignature capabilities, document templates, and secure cloud storage. These tools enhance your ability to manage your Form 8974 effectively and ensure that your documentation is both secure and easily accessible.

-

Can I integrate airSlate SignNow with other applications for managing Form 8974?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. This interoperability allows you to manage your Form 8974 and related documents effortlessly across different platforms.

-

How secure is airSlate SignNow when handling Form 8974?

airSlate SignNow prioritizes the security of your data with end-to-end encryption and compliance with industry standards. When utilizing airSlate SignNow for Form 8974, you can trust that your sensitive information is protected throughout the entire signing process.

-

What are the benefits of using airSlate SignNow for Form 8974 submissions?

Using airSlate SignNow for your Form 8974 submissions streamlines the entire process, saving time and reducing the potential for errors. The digital nature of eSigning also provides a convenient, paperless solution that enhances productivity and operational efficiency.

Get more for About Form 8974, Qualified Small Business Payroll Tax IRS

- Carriers request for seasonal employee wage information

- The claims process the path of a claim form

- 800 372 7713 phone 512 804 4146 fax form

- A debtor is a transmitting utility form

- Real estate records if applicable form

- Filed in connection with a manufactured home transaction effective 30 years form

- Use this form multiple copies if needed to continue adding additional debtor or secured party names as needed when filing a ucc

- Debtors name to be searched provide only one debtor name 1a or 1b use exact full name do not omit modify or abbreviate any part 490222879 form

Find out other About Form 8974, Qualified Small Business Payroll Tax IRS

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF