AUTHORIZATION for the RELEASE NEW2015FINAL042715 DOCX Biggert Waters Flood Insurance Reform Act of and Homeowner Flood Insurance

Understanding the Authorization for the Release

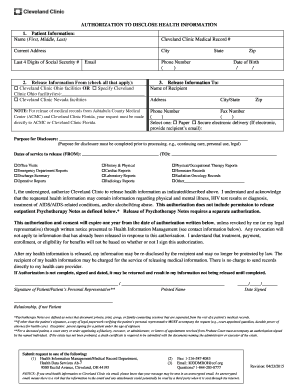

The Authorization for the Release NEW2015FINAL042715 is a crucial document associated with the Biggert-Waters Flood Insurance Reform Act and the Homeowner Flood Insurance Affordability Act. This form allows individuals to authorize the release of their flood insurance information to designated entities, ensuring compliance with federal regulations. It is essential for homeowners seeking to manage their flood insurance policies effectively and to navigate the complexities of the insurance landscape.

Steps to Complete the Authorization Form

Completing the Authorization for the Release involves several straightforward steps. Start by downloading the form from a reliable source. Fill in your personal details accurately, including your name, address, and policy number. Next, indicate the specific information you wish to authorize for release. Review the completed form for accuracy before signing. It's important to ensure that all fields are filled out correctly to avoid delays in processing.

Legal Use of the Authorization Form

This authorization form is legally binding when completed correctly. It adheres to the requirements set forth by the ESIGN Act, UETA, and other relevant regulations. To ensure its legality, the form must be signed by the individual granting the authorization. Additionally, using a secure electronic signature platform can enhance the validity of the document, providing a digital certificate that confirms the signing process.

Key Elements of the Authorization Form

Several key elements must be included in the Authorization for the Release. These include the name and contact information of the individual granting the authorization, the specific information being released, and the name of the entity receiving the information. Additionally, the form should include a clear statement of consent and the signature of the individual. These components are vital for ensuring that the authorization is recognized and accepted by the relevant parties.

Examples of Using the Authorization Form

Homeowners may utilize the Authorization for the Release in various scenarios. For instance, if a homeowner is applying for a new flood insurance policy, they may need to authorize the release of prior claims history. Similarly, if they are disputing a claim or seeking assistance from a financial advisor, this form can facilitate the sharing of necessary information. Understanding these practical applications can help homeowners navigate their insurance needs more effectively.

Obtaining the Authorization Form

The Authorization for the Release can typically be obtained from your insurance provider or through official government websites related to flood insurance. It is advisable to ensure that you are using the most current version of the form, as updates may occur in response to changes in legislation or policy requirements. Always verify that you are accessing the document from a reliable source to avoid issues with outdated forms.

Quick guide on how to complete authorization for the release new2015final042715 docx biggert waters flood insurance reform act of and homeowner flood

Complete AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of And Homeowner Flood Insurance effortlessly on any device

Digital document management has become widely embraced by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents swiftly and without delays. Manage AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of And Homeowner Flood Insurance on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of And Homeowner Flood Insurance seamlessly

- Obtain AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of And Homeowner Flood Insurance and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow satisfies all your document management needs with just a few clicks from any chosen device. Modify and electronically sign AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of And Homeowner Flood Insurance and ensure outstanding communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the authorization for the release new2015final042715 docx biggert waters flood insurance reform act of and homeowner flood

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of And Homeowner Flood Insurance Affordability Act Of My Clevelandclinic?

The AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of And Homeowner Flood Insurance Affordability Act Of My Clevelandclinic is a document that facilitates the release of information related to flood insurance policies. It ensures compliance with regulations while streamlining the process for homeowners seeking insurance under the outlined acts.

-

How does airSlate SignNow streamline the process for using the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715?

AirSlate SignNow simplifies the signing and management of important documents like the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of and Homeowner Flood Insurance Affordability Act Of My Clevelandclinic through its user-friendly interface. Users can send, sign, and store documents securely, saving time and reducing manual labor.

-

What are the benefits of using airSlate SignNow for the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715?

Using airSlate SignNow for the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 provides several benefits, including enhanced security, remote access, and integration with popular software. The platform's cost-effective pricing model ensures businesses can efficiently manage documents without extensive resources.

-

Is airSlate SignNow affordable for small businesses needing the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715?

Yes, airSlate SignNow is designed to be budget-friendly, making it an excellent choice for small businesses that need the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of and Homeowner Flood Insurance Affordability Act Of My Clevelandclinic. The flexible pricing plans allow you to choose one that meets your needs without overspending.

-

Can the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 be customized in airSlate SignNow?

Absolutely! With airSlate SignNow, you can customize the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of and Homeowner Flood Insurance Affordability Act Of My Clevelandclinic to fit your specific requirements. The platform supports various templates and workflows, ensuring your documents meet organizational standards.

-

What integrations does airSlate SignNow offer for seamless management of the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715?

AirSlate SignNow offers various integrations with popular applications such as Google Drive, Dropbox, and Microsoft Office, ensuring seamless management of the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of and Homeowner Flood Insurance Affordability Act Of My Clevelandclinic. These integrations streamline your workflow and enhance productivity.

-

How secure is the signing process for the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 in airSlate SignNow?

The signing process for the AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of and Homeowner Flood Insurance Affordability Act Of My Clevelandclinic in airSlate SignNow is highly secure. The platform employs advanced encryption techniques and complies with compliance standards to ensure that your documents are protected at all times.

Get more for AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of And Homeowner Flood Insurance

- Michigan release form

- Partial release of property from mortgage for corporation michigan form

- Michigan partial form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy michigan form

- Warranty deed for parents to child with reservation of life estate michigan form

- Warranty deed for separate or joint property to joint tenancy michigan form

- Warranty deed to separate property of one spouse to both spouses as joint tenants michigan form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries michigan form

Find out other AUTHORIZATION FOR THE RELEASE NEW2015FINAL042715 docx Biggert Waters Flood Insurance Reform Act Of And Homeowner Flood Insurance

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe