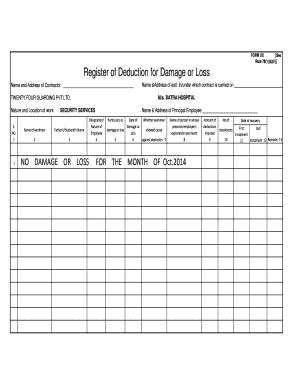

Register of Deduction for Damage or Loss Form

What is the Register Of Deduction For Damage Or Loss

The Register Of Deduction For Damage Or Loss is a formal document used to record any deductions related to damages or losses incurred by a business or individual. This register serves as a crucial tool for tracking financial impacts and ensuring compliance with relevant regulations. It is particularly important for businesses that need to substantiate their financial statements and tax filings. By maintaining an accurate register, entities can provide evidence of losses, which may be necessary for insurance claims or tax deductions.

How to use the Register Of Deduction For Damage Or Loss

Using the Register Of Deduction For Damage Or Loss involves several straightforward steps. First, gather all relevant documentation that supports your claim of damage or loss. This may include invoices, receipts, and photographs. Next, accurately fill out the register by detailing each instance of damage or loss, including dates, descriptions, and amounts. Ensure that the information is clear and precise to avoid any discrepancies. Once completed, the register should be securely stored and easily accessible for future reference or audits.

Steps to complete the Register Of Deduction For Damage Or Loss

Completing the Register Of Deduction For Damage Or Loss requires careful attention to detail. Follow these steps for effective completion:

- Collect supporting documents related to each deduction.

- Clearly list each item of damage or loss in the register.

- Include the date of the incident and a brief description.

- Record the financial impact of each loss, including any related expenses.

- Review the register for accuracy and completeness.

- Store the completed register in a secure location.

Legal use of the Register Of Deduction For Damage Or Loss

The Register Of Deduction For Damage Or Loss is legally recognized when it meets specific criteria. To ensure its legal validity, the register must be accurately completed and supported by appropriate documentation. This includes maintaining records that comply with federal and state regulations. Additionally, the register may be subject to review by tax authorities, making it essential to keep it organized and up-to-date. Proper use of this register can protect businesses from legal disputes and ensure compliance with tax laws.

Key elements of the Register Of Deduction For Damage Or Loss

Several key elements are essential for the effective use of the Register Of Deduction For Damage Or Loss. These include:

- Date: The date when the damage or loss occurred.

- Description: A detailed account of the incident or loss.

- Amount: The financial impact of the damage or loss.

- Supporting Documentation: Any receipts, invoices, or photos that corroborate the loss.

- Signatures: Signatures of individuals responsible for the entries may enhance credibility.

Examples of using the Register Of Deduction For Damage Or Loss

There are various scenarios where the Register Of Deduction For Damage Or Loss may be utilized. For instance, a business may record losses due to theft, property damage from a natural disaster, or equipment failure. Each entry should detail the specific circumstances surrounding the loss, along with the financial implications. By documenting these instances, businesses can provide evidence for insurance claims or tax deductions, demonstrating the necessity of maintaining an accurate register.

Quick guide on how to complete register of deduction for damage or loss

Effortlessly Prepare Register Of Deduction For Damage Or Loss on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Register Of Deduction For Damage Or Loss on any device with airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

How to Modify and eSign Register Of Deduction For Damage Or Loss Effortlessly

- Locate Register Of Deduction For Damage Or Loss and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or conceal sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow effectively manages all your document management needs in just a few clicks from your preferred device. Adjust and eSign Register Of Deduction For Damage Or Loss and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the register of deduction for damage or loss

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Register Of Deduction For Damage Or Loss?

The Register Of Deduction For Damage Or Loss is a crucial document that enables businesses to formally track and report any deductions related to damage or loss of assets. This ensures compliance with financial regulations and helps maintain accurate accounting records.

-

How does airSlate SignNow assist with the Register Of Deduction For Damage Or Loss?

airSlate SignNow streamlines the process of creating and managing the Register Of Deduction For Damage Or Loss by providing customizable templates and easy document sharing options. This allows businesses to quickly complete and digitally sign essential documents, saving time and reducing errors.

-

What are the pricing plans for using airSlate SignNow for the Register Of Deduction For Damage Or Loss?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it a cost-effective solution for managing the Register Of Deduction For Damage Or Loss. You can choose a plan that suits your team's size and requirements, with no hidden costs.

-

Can I integrate airSlate SignNow with other software for managing the Register Of Deduction For Damage Or Loss?

Yes, airSlate SignNow provides integrations with popular software platforms, allowing you to seamlessly manage the Register Of Deduction For Damage Or Loss alongside your existing tools. This enhances productivity by centralizing your document management processes.

-

What benefits does using airSlate SignNow bring when managing the Register Of Deduction For Damage Or Loss?

Using airSlate SignNow to manage the Register Of Deduction For Damage Or Loss offers several benefits, including faster document turnaround times, enhanced security with electronic signatures, and easy access to completed reports from anywhere. This improves overall efficiency and helps ensure compliance.

-

Is it easy to collaborate with team members on the Register Of Deduction For Damage Or Loss using airSlate SignNow?

Absolutely! airSlate SignNow supports real-time collaboration, allowing multiple team members to work together on the Register Of Deduction For Damage Or Loss. You can easily share documents, provide comments, and track changes, ensuring everyone stays in sync.

-

Are electronic signatures legally binding for the Register Of Deduction For Damage Or Loss?

Yes, electronic signatures provided by airSlate SignNow are legally binding and compliant with relevant regulations, making them a secure option for signing the Register Of Deduction For Damage Or Loss. This ensures that your documents hold up in court if necessary.

Get more for Register Of Deduction For Damage Or Loss

Find out other Register Of Deduction For Damage Or Loss

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later