Schedule C Organizer Ambassador's Business & Tax Services Form

What is the Schedule C Organizer Ambassador's Business & Tax Services

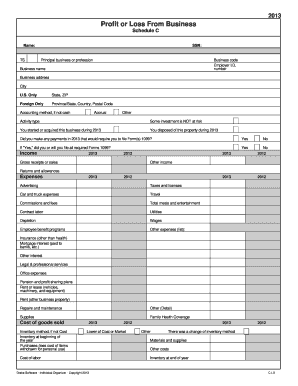

The Schedule C Organizer Ambassador's Business & Tax Services is a vital document used by self-employed individuals and sole proprietors to report income and expenses from their business activities. This form is essential for accurately calculating net profit or loss, which directly affects tax obligations. It provides a structured way to detail various aspects of a business, including revenue, costs of goods sold, and other deductible expenses.

How to use the Schedule C Organizer Ambassador's Business & Tax Services

Using the Schedule C Organizer involves gathering relevant financial information and filling out the form systematically. Start by collecting all income statements, receipts, and records of business expenses. The form is divided into sections that guide you through reporting your income, costs, and deductions. It is important to ensure that all entries are accurate and supported by documentation to facilitate a smooth filing process.

Steps to complete the Schedule C Organizer Ambassador's Business & Tax Services

Completing the Schedule C Organizer requires several key steps:

- Gather Documentation: Collect all necessary documents, including income statements, receipts, and invoices.

- Fill Out Business Information: Enter your business name, address, and type of business entity.

- Report Income: Document all sources of income generated by your business.

- List Expenses: Itemize all business-related expenses, ensuring you categorize them correctly.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine your net profit or loss.

- Review and Sign: Double-check all entries for accuracy before signing the form.

Legal use of the Schedule C Organizer Ambassador's Business & Tax Services

The Schedule C Organizer is legally recognized as a valid document for tax reporting purposes. To be considered legally binding, it must be completed accurately and filed with the IRS by the designated deadlines. Compliance with federal tax laws ensures that the information provided is accepted by tax authorities, minimizing the risk of audits or penalties.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule C Organizer. These guidelines outline what constitutes allowable expenses, how to report income accurately, and the importance of maintaining proper documentation. Familiarizing yourself with these guidelines can help ensure compliance and optimize your tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C Organizer typically align with the annual tax return deadlines. For most taxpayers, this means the form must be submitted by April 15 of each year. If you require additional time, you may file for an extension, but it is crucial to understand that any taxes owed must still be paid by the original deadline to avoid penalties.

Quick guide on how to complete schedule c organizer ambassadoramp39s business amp tax services

Effortlessly prepare Schedule C Organizer Ambassador's Business & Tax Services on any device

Digital document management is now widely adopted by both businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to easily find the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and eSign your documents without any delays. Handle Schedule C Organizer Ambassador's Business & Tax Services on any device using the airSlate SignNow apps available for Android or iOS and enhance any document-related task today.

How to modify and eSign Schedule C Organizer Ambassador's Business & Tax Services effortlessly

- Find Schedule C Organizer Ambassador's Business & Tax Services and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form hunting, or errors that require new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Schedule C Organizer Ambassador's Business & Tax Services to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c organizer ambassadoramp39s business amp tax services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule C Organizer Ambassador's Business & Tax Services?

The Schedule C Organizer Ambassador's Business & Tax Services is designed to help small business owners streamline their tax preparation process. This service provides users with an organized structure to compile necessary income and expense information for their Schedule C tax filings. Utilizing this organizer can signNowly reduce the stress associated with tax season.

-

How can the Schedule C Organizer help me save time during tax season?

The Schedule C Organizer Ambassador's Business & Tax Services simplifies the data-gathering process. By categorizing income and expenses, it can help you compile your documents quickly and efficiently, thus minimizing the time spent on your tax return. This organized approach ensures that no item is overlooked.

-

Are there any costs associated with using the Schedule C Organizer Ambassador's Business & Tax Services?

Yes, there is a cost for utilizing the Schedule C Organizer Ambassador's Business & Tax Services; however, the fees are competitive and offer tremendous value. This service is priced to provide signNow savings in time and potential tax deductions that could outweigh the initial investment. It's essential to consider the overall benefits when evaluating cost.

-

What features does the Schedule C Organizer provide?

The Schedule C Organizer Ambassador's Business & Tax Services offers several key features, including customizable templates for income and expenses, easy document uploads, and automatic calculations. These features ensure that you can effectively prepare your Schedule C with accuracy and ease. Additionally, the service supports electronic filing, streamlining the entire tax preparation process.

-

Does the Schedule C Organizer integrate with other financial software?

Yes, the Schedule C Organizer Ambassador's Business & Tax Services is designed to integrate seamlessly with various accounting and tax software solutions. This means you can easily transfer your organized data to your preferred platform for filing. Such integrations enhance usability, allowing for a smoother experience overall.

-

What are the benefits of using the Schedule C Organizer for my business taxes?

Utilizing the Schedule C Organizer Ambassador's Business & Tax Services comes with several benefits, including improved accuracy and reduced time spent on tax preparation. It helps you stay organized, maximizing deductions you can claim. Overall, this service empowers small business owners to take control of their tax obligations confidently.

-

Is the Schedule C Organizer suitable for all types of businesses?

The Schedule C Organizer Ambassador's Business & Tax Services is specifically designed for sole proprietors and single-member LLCs, making it ideal for various small businesses. If your business structure requires a different tax form, we recommend consulting with a tax professional. However, its primary focus remains beneficial for those who qualify for Schedule C.

Get more for Schedule C Organizer Ambassador's Business & Tax Services

- Letter from landlord to tenant as notice to remove unauthorized inhabitants minnesota form

- Mortgage deed assignment of rent clause individual to individual ucbc form 44 m minnesota

- Utility shut off notice template 497312079 form

- Minnesota mortgage form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat minnesota form

- Mn 20 1 form

- Change name m online form

- Assignment of mortgage by business entity ucbc form 2032 minnesota

Find out other Schedule C Organizer Ambassador's Business & Tax Services

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP