PTAX 343 R Annual Verification of Eligibility for St Clair County Co St Clair Il 2013

What is the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair Il

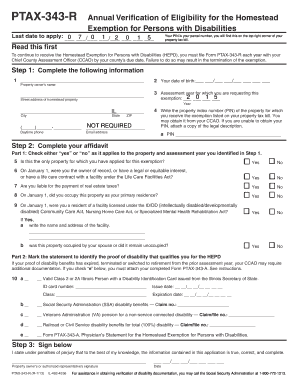

The PTAX 343 R Annual Verification of Eligibility is a crucial form used in St. Clair County, Illinois, to confirm the eligibility of property owners for various tax exemptions. This form is particularly important for those seeking to maintain their eligibility for exemptions such as the General Homestead Exemption or the Senior Citizens Homestead Exemption. Completing this form accurately ensures that property owners can benefit from potential tax savings, making it essential for financial planning and compliance with local tax laws.

Steps to complete the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair Il

Completing the PTAX 343 R form involves several key steps:

- Gather necessary documentation, including proof of residency and any previous exemption approvals.

- Fill out the form with accurate personal and property information, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate county office by the specified deadline, either online or via mail.

By following these steps, property owners can ensure their eligibility is verified efficiently and correctly.

Legal use of the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair Il

The PTAX 343 R form is legally binding when completed and submitted according to the guidelines set forth by the Illinois Department of Revenue. To be considered valid, the form must include accurate information and be signed by the property owner. Compliance with state regulations is essential, as any discrepancies could lead to the loss of tax exemptions or penalties. Understanding the legal implications of this form helps property owners navigate the tax exemption process confidently.

Required Documents for the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair Il

When preparing to complete the PTAX 343 R form, property owners should gather the following documents:

- Proof of residency, such as a utility bill or lease agreement.

- Previous year’s property tax bill or exemption approval letter.

- Identification documents, such as a driver’s license or state ID.

Having these documents ready will streamline the process and ensure that all necessary information is provided.

How to obtain the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair Il

The PTAX 343 R form can be obtained through the St. Clair County Assessor's Office or downloaded from the Illinois Department of Revenue website. It is advisable to check for the most current version of the form to ensure compliance with any updates or changes in regulations. Additionally, local government offices may offer assistance in filling out the form, providing resources for residents who need help.

Eligibility Criteria for the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair Il

To qualify for the exemptions verified by the PTAX 343 R form, property owners must meet specific eligibility criteria. Generally, these criteria include:

- Ownership of the property for which the exemption is requested.

- Use of the property as the primary residence.

- Meeting income limits for certain exemptions, such as the Senior Citizens Homestead Exemption.

Understanding these criteria is essential for property owners to ensure they qualify for any applicable tax benefits.

Quick guide on how to complete ptax 343 r annual verification of eligibility for st clair county co st clair il

Complete PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St clair Il effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St clair Il on any device with airSlate SignNow's Android or iOS applications and enhance your document-centric operations today.

The easiest way to edit and electronically sign PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St clair Il with ease

- Obtain PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St clair Il and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Modify and electronically sign PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St clair Il to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ptax 343 r annual verification of eligibility for st clair county co st clair il

Create this form in 5 minutes!

How to create an eSignature for the ptax 343 r annual verification of eligibility for st clair county co st clair il

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL?

The PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL is a crucial document that verifies eligibility for property tax exemptions. It is essential for residents claiming exemptions, ensuring they remain compliant with local tax regulations. Submitting this document accurately can help you benefit from tax savings.

-

How can airSlate SignNow assist with the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL?

airSlate SignNow provides a seamless way to eSign and send the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL. Our platform simplistically streamlines the signing process, ensuring that your documents are completed quickly and securely. This way, you can focus on other important tasks while staying compliant.

-

What features does airSlate SignNow offer for handling the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL?

With airSlate SignNow, you can enjoy features like cloud storage, templates for the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL, and real-time collaboration. These features work together to streamline your document management process and ensure that all necessary paperwork is handled efficiently. Our user-friendly interface makes it easy to navigate.

-

Is there a cost associated with using airSlate SignNow for the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL?

Yes, there is a cost associated with using airSlate SignNow; however, it is designed to be cost-effective for individuals and businesses. We offer flexible pricing plans tailored to fit various needs, ensuring you only pay for the features you utilize. Investing in our solution can save you time and increase productivity as you manage documents like the PTAX 343 R.

-

Can airSlate SignNow integrate with other software for submitting the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL?

Absolutely! airSlate SignNow integrates seamlessly with various software tools, allowing you to manage your PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL alongside your existing systems. This integration facilitates easier data transfer and minimizes the hassle of switching between applications. Connect with systems like CRM and accounting software for a smoother workflow.

-

What benefits does airSlate SignNow provide for the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL?

Using airSlate SignNow for the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL offers various benefits, including enhanced speed, security, and convenience. Electronic signing reduces turnaround times and eliminates the need for physical paperwork, while our encryption and compliance measures keep your information safe. Ultimately, our solution saves you both time and money.

-

How secure is the airSlate SignNow platform when handling the PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL?

Security is a top priority at airSlate SignNow. We utilize industry-standard encryption, secure access controls, and compliance with regulations to protect your PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St Clair IL. Our commitment to data security ensures that your sensitive information remains private and secure throughout the entire signing process.

Get more for PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St clair Il

Find out other PTAX 343 R Annual Verification Of Eligibility For St Clair County Co St clair Il

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile