Form FT 505 11111Government Entity Credit Card Refund or Credit Electionft505 1 State

What is the Form FT1 Government Entity Credit Card Refund Or Credit Election FT505 1 State

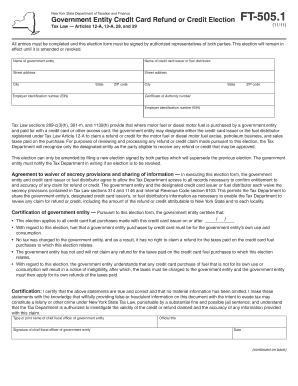

The Form FT1 Government Entity Credit Card Refund Or Credit Election FT505 1 State is a specific document used by government entities in the United States to request a refund or to elect a credit related to credit card transactions. This form is essential for maintaining accurate financial records and ensuring compliance with state regulations. It serves as a formal request to rectify any discrepancies in payments made via credit card, allowing government entities to manage their finances effectively.

Steps to Complete the Form FT1 Government Entity Credit Card Refund Or Credit Election FT505 1 State

Completing the Form FT1 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including transaction details and the reason for the refund or credit election.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy, as errors may delay processing.

- Sign the form electronically or manually, depending on the submission method.

- Submit the form through the appropriate channels, whether online, by mail, or in person.

How to Use the Form FT1 Government Entity Credit Card Refund Or Credit Election FT505 1 State

The form is utilized when a government entity needs to address issues related to credit card transactions. This may include situations where a refund is warranted or where a credit election is necessary to adjust the financial records. Users should ensure they understand the context of the transaction and provide all relevant details to facilitate a smooth process.

Legal Use of the Form FT1 Government Entity Credit Card Refund Or Credit Election FT505 1 State

The legal use of the Form FT1 is governed by state regulations regarding financial transactions and refunds. It is crucial for government entities to comply with these regulations to avoid legal complications. The form must be filled out correctly and submitted in accordance with the established protocols to ensure its validity.

Key Elements of the Form FT1 Government Entity Credit Card Refund Or Credit Election FT505 1 State

Key elements of the form include:

- Identification of the government entity making the request.

- Details of the credit card transaction in question.

- The specific refund amount or credit election being requested.

- Signature of the authorized representative.

Who Issues the Form FT1 Government Entity Credit Card Refund Or Credit Election FT505 1 State

The Form FT1 is typically issued by the state treasury or the financial department of the respective government entity. These authorities oversee the processing of refunds and credits, ensuring that all transactions are handled in compliance with state laws.

Quick guide on how to complete form ft 505 11111government entity credit card refund or credit electionft505 1 state

Effortlessly Prepare Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State on Any Device

The management of online documents has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and Electronically Sign Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State with Ease

- Locate Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive data using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ft 505 11111government entity credit card refund or credit electionft505 1 state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State?

Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State is a specific document required for government entities to request a credit or refund on credit card transactions. This form helps streamline the process of obtaining funds back for eligible transactions, ensuring compliance with state regulations.

-

How can airSlate SignNow assist with Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State?

airSlate SignNow provides an intuitive platform that allows users to easily fill out, sign, and send the Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State digitally. With our solution, you can save time, reduce paperwork, and ensure that your forms are processed quickly and efficiently.

-

What are the benefits of using airSlate SignNow for Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State?

Using airSlate SignNow for the Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State offers several benefits, including faster processing times, enhanced security with eSignature technology, and ease of access from any device. Our platform simplifies document management and helps you stay compliant with state requirements.

-

Is there a cost associated with using airSlate SignNow for Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of government entities, making it cost-effective for processing Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State. Each plan includes essential features designed to simplify document workflows while ensuring affordability.

-

Can I integrate airSlate SignNow with other tools for managing Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State?

Absolutely! airSlate SignNow integrates seamlessly with various systems, such as CRM and ERP platforms, enhancing the workflow around the Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State. This integration allows for efficient data sharing and document management across your organization's tools.

-

What features does airSlate SignNow offer to help with Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State?

airSlate SignNow provides features like customizable templates, automatic reminders, and secure storage, specifically designed to facilitate the completion and management of Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State. These features enhance user experience and ensure that important documents are easily accessible.

-

How does airSlate SignNow ensure security for Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State?

Security is a top priority for airSlate SignNow. When handling the Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State, we utilize encryption, secure data storage, and compliance with industry standards to protect sensitive information, providing peace of mind for our users.

Get more for Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State

Find out other Form FT 505 11111Government Entity Credit Card Refund Or Credit Electionft505 1 State

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure