Indiana Forms 103 Short 104

What is the Indiana Forms 103 Short 104

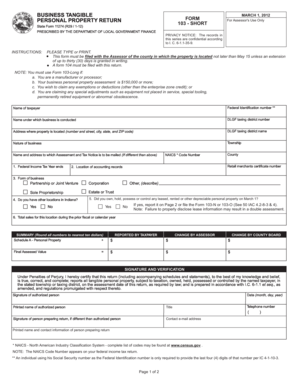

The Indiana Forms 103 Short 104 is a tax-related document used primarily for property tax deductions in the state of Indiana. This form is specifically designed for individuals who qualify for certain exemptions, including the homestead exemption. By completing this form, taxpayers can ensure they receive the appropriate tax benefits associated with their property ownership. The form requires information about the property, the owner, and the specific exemption being claimed.

How to use the Indiana Forms 103 Short 104

Using the Indiana Forms 103 Short 104 involves several key steps. First, obtain the form from the Indiana Department of Local Government Finance or other authorized sources. Next, fill out the required sections, providing accurate information regarding your property and the exemption you are claiming. After completing the form, review it for accuracy to avoid any potential delays or issues. Finally, submit the form to your local county assessor's office by the specified deadline to ensure your exemption is processed.

Steps to complete the Indiana Forms 103 Short 104

Completing the Indiana Forms 103 Short 104 requires careful attention to detail. Follow these steps:

- Download or request a physical copy of the form.

- Provide your name, address, and contact information in the designated fields.

- Indicate the type of exemption you are applying for, such as the homestead exemption.

- Include property details, including the parcel number and property description.

- Sign and date the form to certify that the information is accurate.

Key elements of the Indiana Forms 103 Short 104

Several key elements are essential for the Indiana Forms 103 Short 104 to be valid. These include:

- Property Information: Accurate details about the property, including its location and parcel number.

- Owner Information: The name and contact information of the property owner.

- Exemption Type: Clear identification of the exemption being claimed, such as the homestead exemption.

- Signature: The form must be signed by the property owner to validate the information provided.

Legal use of the Indiana Forms 103 Short 104

The Indiana Forms 103 Short 104 is legally recognized as a valid document for claiming property tax exemptions in Indiana. It complies with state regulations and must be submitted to the appropriate local authority to be considered for exemption. Failure to submit this form correctly may result in the denial of the exemption, leading to higher property tax liabilities.

Form Submission Methods (Online / Mail / In-Person)

The Indiana Forms 103 Short 104 can typically be submitted through various methods, depending on local county regulations. Common submission methods include:

- Online: Some counties may offer online submission through their official websites.

- Mail: You can mail the completed form to your local county assessor's office.

- In-Person: Submitting the form in person at the county assessor's office is also an option.

Quick guide on how to complete indiana forms 103 short 104

Complete Indiana Forms 103 Short 104 easily on any device

Online document management has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Handle Indiana Forms 103 Short 104 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign Indiana Forms 103 Short 104 with ease

- Locate Indiana Forms 103 Short 104 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing fresh copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Alter and eSign Indiana Forms 103 Short 104 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana forms 103 short 104

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Indiana forms 103 short 104?

Indiana forms 103 short 104 are specific tax forms used by businesses and individuals in Indiana for reporting income and calculating tax liabilities. These forms are essential for ensuring compliance with state tax requirements and are designed to simplify the filing process. By utilizing airSlate SignNow, you can easily create and eSign these forms securely.

-

How can airSlate SignNow help with Indiana forms 103 short 104?

airSlate SignNow streamlines the process of filling out and signing Indiana forms 103 short 104. With its user-friendly interface, you can efficiently complete these forms and eSign them from anywhere. This not only saves time but also reduces the risk of errors typical in manual processes.

-

Is there a cost associated with using airSlate SignNow for Indiana forms 103 short 104?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is designed to be cost-effective, especially considering the time saved when eSigning Indiana forms 103 short 104 compared to traditional methods. You can choose a plan that fits your volume of document management.

-

Can I integrate airSlate SignNow with other software for managing Indiana forms 103 short 104?

Absolutely! airSlate SignNow integrates seamlessly with popular software applications, helping you manage Indiana forms 103 short 104 efficiently. This integration allows you to connect your data and workflows, making it easier to track form completion and store documents securely.

-

What are the benefits of using airSlate SignNow for Indiana forms 103 short 104?

Using airSlate SignNow for Indiana forms 103 short 104 provides numerous benefits, including enhanced security, speed of processing, and ease of use. With its eSignature capabilities, you can quickly get approvals, which accelerates your workflow and ensures compliance with state regulations.

-

Are there templates available for Indiana forms 103 short 104 on airSlate SignNow?

Yes, airSlate SignNow offers templates specifically designed for Indiana forms 103 short 104. These templates simplify the documentation process, allowing you to quickly fill out the necessary information and ensure that all required sections are completed accurately before eSigning.

-

What support is available for users managing Indiana forms 103 short 104 with airSlate SignNow?

airSlate SignNow provides robust customer support to assist users with managing Indiana forms 103 short 104. You can access FAQs, live chat, and email support for any questions or issues. This ensures that you receive timely assistance to maximize your experience with the platform.

Get more for Indiana Forms 103 Short 104

- Final notice of forfeiture and request to vacate property under contract for deed district of columbia form

- Buyers request for accounting from seller under contract for deed district of columbia form

- District columbia property form

- General notice of default for contract for deed district of columbia form

- Sellers disclosure of forfeiture rights for contract for deed district of columbia form

- District of columbia form

- Contract for deed sellers annual accounting statement district of columbia form

- Notice of default for past due payments in connection with contract for deed district of columbia form

Find out other Indiana Forms 103 Short 104

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT