IRS Audit Letter 2604C Sample PDF Taxaudit Com Form

What is the IRS Audit Letter Sample?

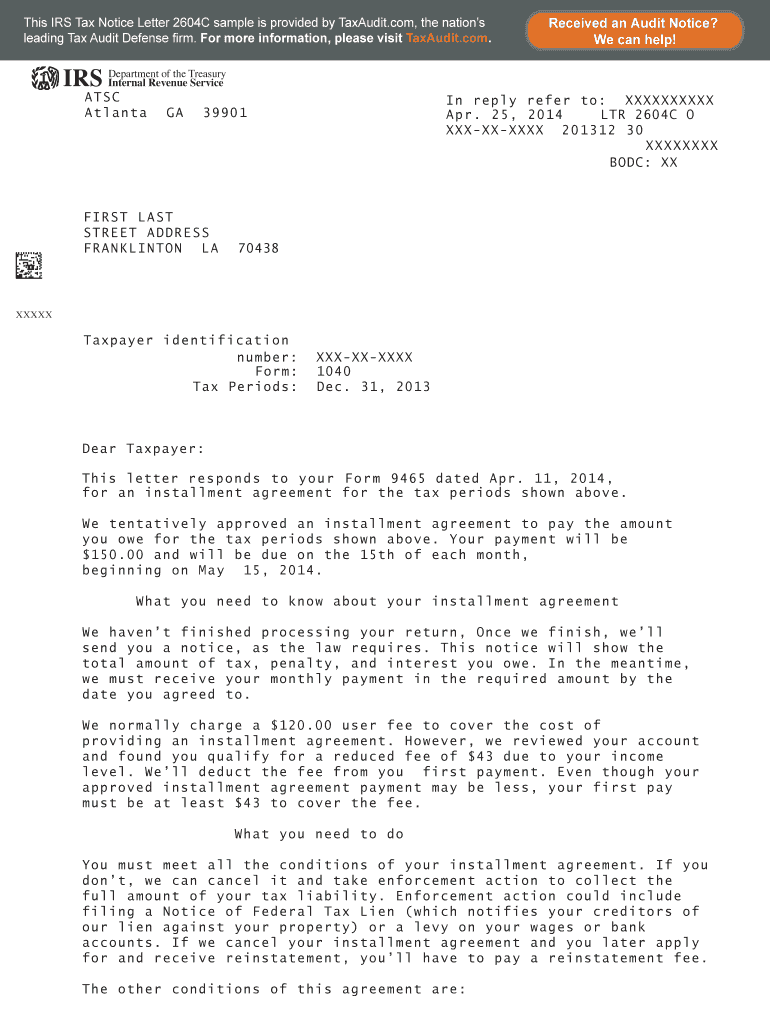

The IRS audit letter sample is a template used by the Internal Revenue Service to notify taxpayers that their tax return is being audited. This letter typically outlines the specific areas of concern regarding the taxpayer's return and requests additional documentation or information to verify the accuracy of the reported figures. Understanding this letter is crucial for taxpayers, as it can significantly impact their financial standing and tax obligations.

Key Elements of the IRS Audit Letter Sample

An IRS audit letter sample generally includes several important components:

- Taxpayer Information: This section contains the taxpayer's name, address, and Social Security number or Employer Identification Number.

- Audit Details: The letter specifies the tax year under review and the reasons for the audit, which may include discrepancies or unusual deductions.

- Documentation Request: The IRS will outline what specific documents or records are needed from the taxpayer to proceed with the audit.

- Response Instructions: This section provides guidance on how to respond to the audit request, including deadlines and submission methods.

Steps to Complete the IRS Audit Letter Sample

Completing the IRS audit letter sample involves several key steps to ensure compliance and accuracy:

- Review the Letter: Carefully read the audit letter to understand the specific requests and concerns raised by the IRS.

- Gather Documentation: Collect all requested documents, such as tax returns, receipts, and bank statements, that support your reported income and deductions.

- Prepare Your Response: Draft a response that addresses each point raised in the audit letter, providing clear explanations and supporting documents.

- Submit Your Response: Follow the instructions provided in the letter for submitting your response, ensuring that you meet any deadlines specified.

Legal Use of the IRS Audit Letter Sample

The IRS audit letter sample serves a legal purpose in the tax audit process. It is an official communication from the IRS, and the requests made in the letter must be taken seriously. Failing to respond appropriately can lead to penalties, additional taxes owed, or even legal action. It is important to maintain a record of all correspondence with the IRS and to ensure that responses are sent in a timely manner.

How to Obtain the IRS Audit Letter Sample

Taxpayers can obtain an IRS audit letter sample through various means:

- IRS Website: The IRS provides resources and sample letters on its official website, which can be helpful for understanding the audit process.

- Tax Professionals: Consulting with a tax professional or accountant can provide personalized guidance and access to relevant templates.

- Tax Preparation Software: Many tax preparation software programs include templates and resources related to IRS audits, helping users navigate the process.

IRS Guidelines for Audits

The IRS has established guidelines that govern the audit process. These guidelines include:

- Notification: Taxpayers must be notified in writing if their return is selected for audit.

- Right to Representation: Taxpayers have the right to have a representative, such as a tax attorney or accountant, present during the audit.

- Confidentiality: The IRS is required to keep taxpayer information confidential, and any disclosure must comply with privacy laws.

Quick guide on how to complete irs audit letter 2604c sample pdf taxaudit com

Complete IRS Audit Letter 2604C Sample PDF Taxaudit com effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly and without delays. Manage IRS Audit Letter 2604C Sample PDF Taxaudit com on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign IRS Audit Letter 2604C Sample PDF Taxaudit com with ease

- Obtain IRS Audit Letter 2604C Sample PDF Taxaudit com and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign IRS Audit Letter 2604C Sample PDF Taxaudit com to ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs audit letter 2604c sample pdf taxaudit com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS audit letter sample?

An IRS audit letter sample is a template or example of the communication sent by the IRS to inform taxpayers of an audit. These samples serve as a guideline for what to expect in terms of content and structure, helping individuals prepare for their audit.

-

How can airSlate SignNow help with IRS audit letters?

With airSlate SignNow, you can easily eSign documents and manage your IRS audit letters digitally. Our platform simplifies the signing process, ensuring that your responses and documentation are efficiently handled and securely stored.

-

Is there a cost associated with using airSlate SignNow for managing IRS audit letters?

airSlate SignNow offers various pricing plans to cater to your business needs. You can choose from different subscription options that provide features to efficiently manage IRS audit letters and other documents without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for IRS audit letters?

Yes, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and more. This allows you to easily access and manage your IRS audit letters alongside other essential documents.

-

What features does airSlate SignNow provide for handling IRS audit letters?

airSlate SignNow provides features such as eSigning, document management, templates, and secure storage. These features are designed to streamline the process of handling IRS audit letters, making it easier for businesses to respond efficiently.

-

How secure is the information shared via airSlate SignNow when dealing with IRS audit letters?

Security is a top priority at airSlate SignNow. We use bank-level encryption and robust security protocols to ensure that all information shared, including IRS audit letters, is kept confidential and secure.

-

Can I use airSlate SignNow to collaborate with a tax professional regarding my IRS audit letter?

Absolutely! airSlate SignNow allows for easy collaboration with tax professionals. You can share your IRS audit letter and other related documents securely, enabling your tax advisor to review and provide necessary guidance.

Get more for IRS Audit Letter 2604C Sample PDF Taxaudit com

Find out other IRS Audit Letter 2604C Sample PDF Taxaudit com

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online