Collegeamerica 529 Application Form

What is the Collegeamerica 529 Application

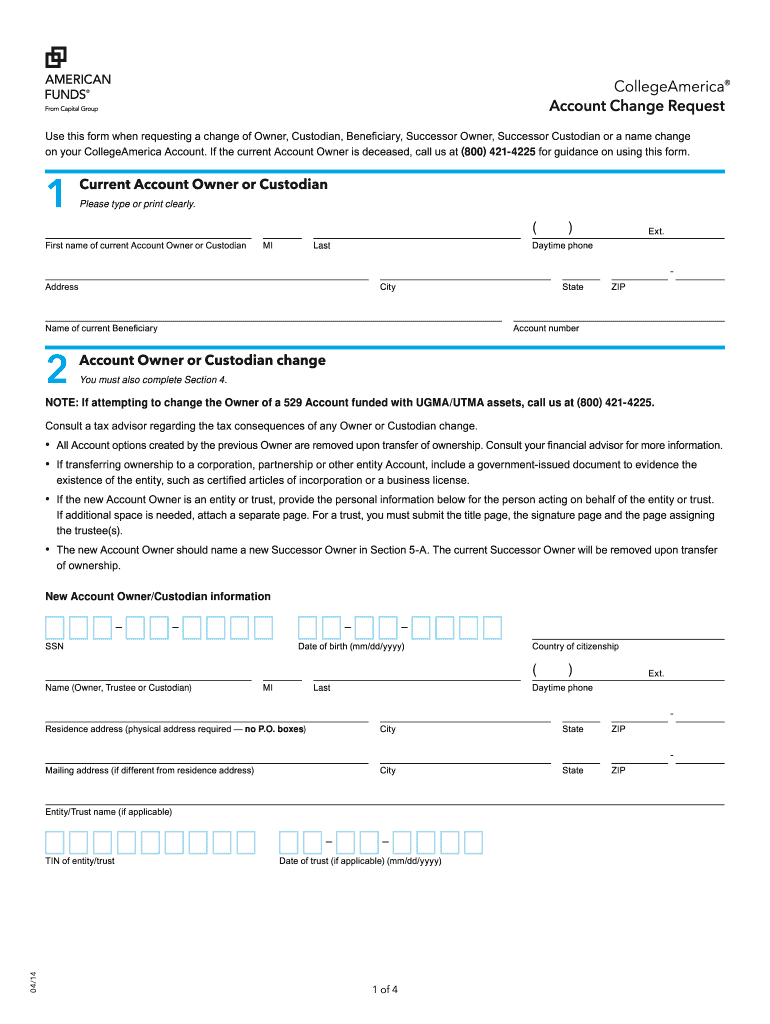

The Collegeamerica 529 application is a formal request to open a tax-advantaged savings account specifically designed for education expenses. This account allows families to save for future college costs while benefiting from tax-free growth on investments. The funds can be used for qualified higher education expenses, including tuition, fees, and room and board. The application process is straightforward and can typically be completed online, making it accessible for families across the United States.

Steps to complete the Collegeamerica 529 Application

Completing the Collegeamerica 529 application involves several key steps:

- Gather necessary information: Collect personal details such as Social Security numbers, addresses, and financial information for both the account owner and the beneficiary.

- Choose your investment options: Review and select from various investment portfolios offered by Collegeamerica that align with your financial goals.

- Fill out the application form: Complete the online application form, ensuring all required fields are accurately filled out.

- Review and submit: Double-check your information for accuracy before submitting the application electronically.

- Confirmation: After submission, you will receive a confirmation of your application, which may include further instructions or information on account funding.

Legal use of the Collegeamerica 529 Application

The Collegeamerica 529 application is legally binding, provided it meets specific requirements set forth by federal and state laws. To ensure compliance, it is essential to follow the guidelines established by the Internal Revenue Service (IRS) and state education agencies. The application must include valid signatures and, when completed electronically, should utilize a secure eSignature solution that complies with the ESIGN Act and UETA. This ensures that the application is recognized as legitimate and enforceable in a court of law.

Required Documents

When applying for a Collegeamerica 529 account, certain documents are typically required to verify identity and eligibility:

- Social Security numbers for the account owner and beneficiary.

- Proof of identity, which may include a driver's license or passport.

- Financial information, such as income details, if applicable.

- Any previous 529 plan account statements, if transferring funds.

Eligibility Criteria

To be eligible for the Collegeamerica 529 application, applicants must meet specific criteria:

- The account owner must be a U.S. citizen or legal resident.

- The beneficiary must be a qualified individual, typically a child or dependent under the age of 30.

- There are no income restrictions for opening a 529 account, making it accessible to a wide range of families.

Form Submission Methods

The Collegeamerica 529 application can be submitted through various methods, providing flexibility for applicants:

- Online: The most common method, allowing for quick completion and submission.

- Mail: Applicants can print the completed form and send it to the designated address.

- In-Person: Some financial institutions may allow for in-person submissions at their branches.

Quick guide on how to complete collegeamerica 529 application

Complete Collegeamerica 529 Application effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Collegeamerica 529 Application on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Collegeamerica 529 Application with ease

- Find Collegeamerica 529 Application and select Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically designed for that purpose, offered by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Adjust and electronically sign Collegeamerica 529 Application and ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the collegeamerica 529 application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the American Funds 529 application?

The American Funds 529 application is a college savings plan designed to help families save for education expenses. It offers various investment options and tax advantages to maximize savings over time. This application is a key step for individuals looking to secure their children's future education funding.

-

How do I start the American Funds 529 application process?

To begin the American Funds 529 application process, visit the official website and create an account. Once registered, you can fill out the application form online, select your investment options, and review the details before submitting. The process is straightforward and user-friendly.

-

What are the benefits of using the American Funds 529 application?

Using the American Funds 529 application provides several benefits, including tax-free growth on investments and tax-free withdrawals for qualified education expenses. Additionally, the plan offers flexible contributions and various investment options tailored to different risk tolerances. This makes it an efficient tool for families saving for college.

-

Are there any fees associated with the American Funds 529 application?

Yes, there are fees associated with the American Funds 529 application, including management fees for the investment options selected. It's important to review the fee structure during the application process to understand the costs involved. Overall, these fees contribute to the management of your investment portfolio.

-

Can I integrate the American Funds 529 application with other financial tools?

Yes, the American Funds 529 application can be integrated with various financial planning tools and services. Many users choose to link their 529 accounts with budgeting apps or investment platforms for better management and oversight. This integration can make planning for educational expenses more streamlined.

-

What age should I start the American Funds 529 application for my child?

It's recommended to start the American Funds 529 application as early as possible, ideally when your child is born or even before. The sooner you begin saving, the more time your investments have to grow, leveraging the power of compound interest. Early planning can signNowly increase the funds available for education.

-

Are there any withdrawal restrictions with the American Funds 529 application?

Yes, withdrawals from the American Funds 529 application must be used for qualified education expenses to avoid penalties and taxes. These expenses include tuition, room and board, and other associated costs. It's important to keep track of these qualified expenses to maximize your savings effectively.

Get more for Collegeamerica 529 Application

- Petition restoration form

- Ga probate with form

- Declaring no administration form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497303967 form

- Annual minutes 497303968 form

- Notices resolutions simple stock ledger and certificate georgia form

- Minutes organizational form

- Ga secretary form

Find out other Collegeamerica 529 Application

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now