New Mexico Crs 1 Short Form

What is the New Mexico CRS 1 Short Form

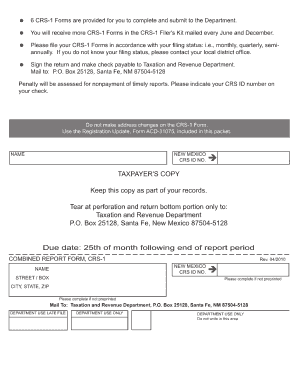

The New Mexico CRS 1 Short Form is a crucial document used for reporting gross receipts tax in the state of New Mexico. It is designed for businesses to report their gross receipts, compensating taxes, and any deductions or exemptions applicable. Understanding this form is essential for compliance with state tax regulations and ensuring that businesses accurately report their financial activities.

How to Obtain the New Mexico CRS 1 Short Form

To obtain the New Mexico CRS 1 Short Form, businesses can visit the New Mexico Taxation and Revenue Department's official website. The form is available for download in PDF format, allowing users to print and fill it out. Additionally, businesses can request a physical copy by contacting their local tax office. It is important to ensure that you have the most current version of the form to avoid any compliance issues.

Steps to Complete the New Mexico CRS 1 Short Form

Completing the New Mexico CRS 1 Short Form involves several key steps:

- Gather all necessary financial records, including sales receipts and any applicable deductions.

- Fill out the business information section, including the CRS identification number, business name, and address.

- Report total gross receipts for the reporting period, ensuring accuracy to avoid penalties.

- Calculate any deductions or exemptions and provide the total amounts.

- Sign and date the form to certify that the information provided is true and correct.

Legal Use of the New Mexico CRS 1 Short Form

The legal use of the New Mexico CRS 1 Short Form is governed by state tax laws. Businesses are required to file this form to report their gross receipts and pay the corresponding taxes. Failure to file accurately and on time can result in penalties and interest charges. It is essential for businesses to understand the legal implications of their filings and ensure compliance with all regulations.

Key Elements of the New Mexico CRS 1 Short Form

Key elements of the New Mexico CRS 1 Short Form include:

- Business Information: Details about the business, including name, address, and CRS identification number.

- Gross Receipts: Total gross receipts for the reporting period.

- Deductions: Any applicable deductions or exemptions that reduce the taxable amount.

- Signature: The signature of the business owner or authorized representative, certifying the accuracy of the information.

Form Submission Methods

The New Mexico CRS 1 Short Form can be submitted through various methods. Businesses have the option to file online through the New Mexico Taxation and Revenue Department's website, which offers a streamlined process for electronic submissions. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at local tax offices. Each method has specific guidelines and deadlines that must be adhered to for compliance.

Quick guide on how to complete new mexico crs 1 short form

Complete New Mexico Crs 1 Short Form effortlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely retain it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without delays. Manage New Mexico Crs 1 Short Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest way to alter and eSign New Mexico Crs 1 Short Form seamlessly

- Locate New Mexico Crs 1 Short Form and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or redact confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your updates.

- Select how you wish to share your form, via email, text message (SMS), or link invitation, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management requirements in just a few clicks from any device you choose. Modify and eSign New Mexico Crs 1 Short Form and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new mexico crs 1 short form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CRS number in New Mexico?

A CRS number in New Mexico, or Client Real-time System number, is a unique identifier assigned to businesses for tax and licensing purposes. This number is essential for filing state taxes and ensuring compliance with New Mexico's business regulations.

-

How do I obtain a CRS number in New Mexico?

To obtain a CRS number in New Mexico, you must register your business with the New Mexico Taxation and Revenue Department. This process involves providing essential business information and completing the required forms either online or in person.

-

What documents do I need to apply for a CRS number?

When applying for a CRS number in New Mexico, you typically need to provide identification information and details about your business structure, such as your business name, address, and type of business activities. It’s best to gather all necessary documentation before starting the application process.

-

Are there any fees associated with obtaining a CRS number in New Mexico?

No, there are no fees associated with getting a CRS number in New Mexico. The registration process is free, allowing you to easily comply with state tax requirements without incurring additional costs.

-

What is the importance of a CRS number for my business?

Having a CRS number is vital for your business as it allows you to collect and remit gross receipts taxes. Additionally, it is often required when applying for business permits, licenses, and when filing taxes in New Mexico.

-

How does airSlate SignNow help with documents requiring a CRS number?

airSlate SignNow simplifies the document signing process involving a CRS number by allowing you to electronically sign and send necessary forms securely. This ensures that all paperwork related to your CRS number is handled efficiently and can be tracked effectively.

-

Can I use my CRS number for online transactions?

Yes, your CRS number can be used for online transactions, especially when applying for licenses or filing taxes online. This number is important to validate your business and ensure compliance with state regulations.

Get more for New Mexico Crs 1 Short Form

- Legal last will and testament form for a widow or widower with adult children idaho

- Legal last will and testament form for widow or widower with minor children idaho

- Legal last will form for a widow or widower with no children idaho

- Legal last will and testament form for a widow or widower with adult and minor children idaho

- Legal last will and testament form for divorced and remarried person with mine yours and ours children idaho

- Legal last will and testament form with all property to trust called a pour over will idaho

- Written revocation of will idaho form

- Last will and testament for other persons idaho form

Find out other New Mexico Crs 1 Short Form

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure