Form W 4vt

What is the Form W-4VT

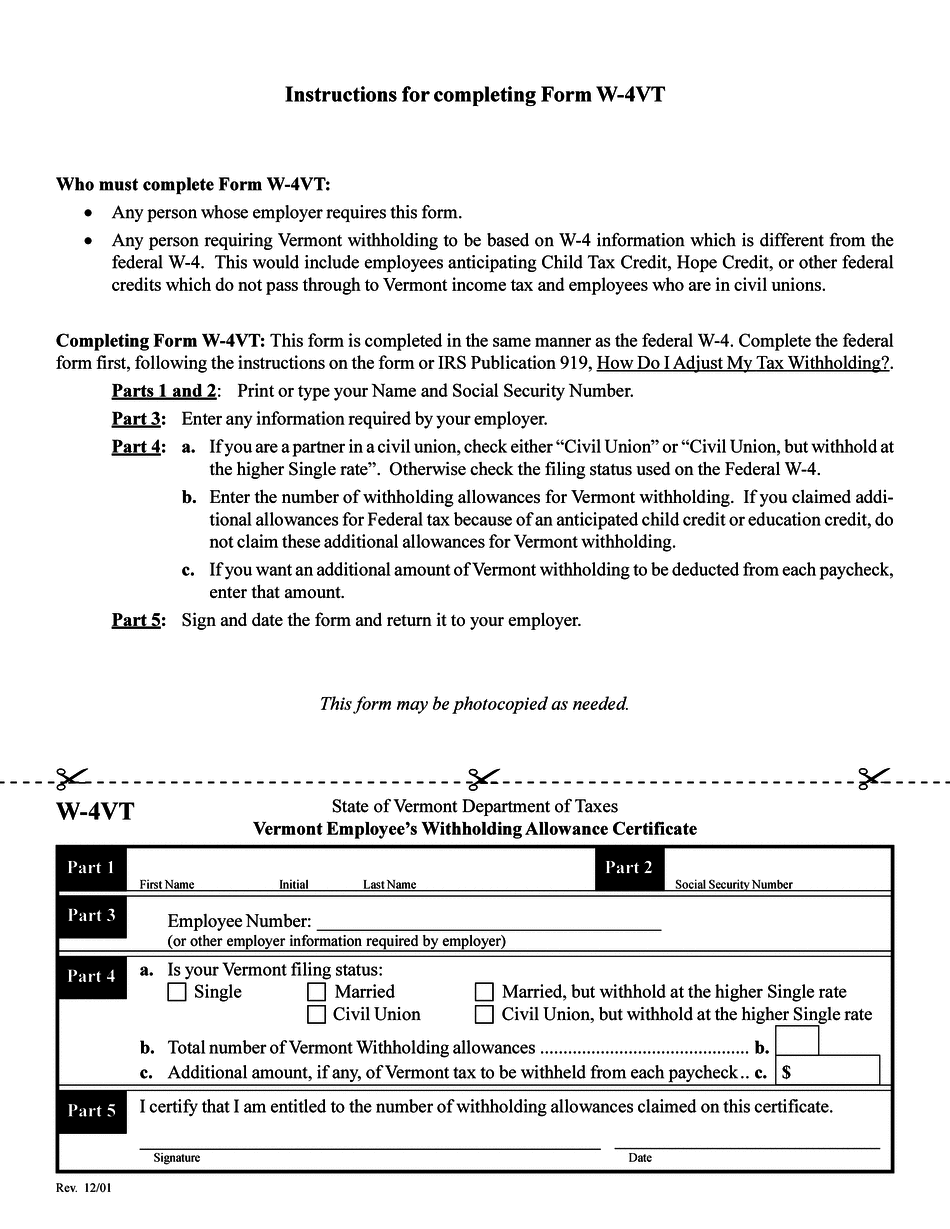

The Form W-4VT is a state-specific tax form used in Vermont for employees to indicate their withholding allowances. This form helps employers determine the correct amount of state income tax to withhold from an employee's paycheck. It is essential for ensuring that employees meet their tax obligations while avoiding over-withholding, which can lead to a larger tax refund at the end of the year.

How to use the Form W-4VT

Using the Form W-4VT involves completing the form accurately and submitting it to your employer. Employees should fill out the form based on their personal tax situation, including marital status and number of dependents. Once completed, the form should be given to the employer, who will use the information to calculate the appropriate withholding amount from each paycheck. It is advisable to review and update the form whenever there are significant life changes, such as marriage, divorce, or the birth of a child.

Steps to complete the Form W-4VT

Completing the Form W-4VT requires careful attention to detail. Here are the steps to follow:

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Calculate your withholding allowances based on your situation, including any dependents.

- Sign and date the form to certify that the information provided is accurate.

Once completed, submit the form to your employer for processing.

Legal use of the Form W-4VT

The Form W-4VT is legally recognized for tax withholding purposes in Vermont. Employers are required to use this form to ensure compliance with state tax laws. It is important for employees to provide accurate information to avoid penalties or issues with the Vermont Department of Taxes. The form must be filled out truthfully, as any discrepancies may lead to audits or additional tax liabilities.

Filing Deadlines / Important Dates

While the Form W-4VT does not have a specific filing deadline, it is crucial to submit it to your employer as soon as you start a new job or experience a significant life change. Employers typically need the form on file before the first paycheck is issued to ensure correct withholding. Additionally, reviewing and updating the form annually or after any major changes can help maintain accurate withholding throughout the year.

Who Issues the Form

The Form W-4VT is issued by the Vermont Department of Taxes. It is available for download from their official website or can be obtained from employers. Employees should ensure they are using the most current version of the form to comply with any updates in tax regulations or withholding requirements.

Quick guide on how to complete form w 4vt

Effortlessly Prepare Form W 4vt on Any Device

The management of online documents has gained traction among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed materials, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly and seamlessly. Manage Form W 4vt on any platform using the airSlate SignNow apps for Android or iOS, and enhance any document-centric process today.

Easily Modify and eSign Form W 4vt

- Obtain Form W 4vt and click Get Form to initiate the process.

- Utilize the features we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

No more worries about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form W 4vt and ensure clear communication at every stage of the document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4vt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w 4vt, and how does it work with airSlate SignNow?

The w 4vt is a specialized form used for tax purposes, and airSlate SignNow simplifies the process of completing and signing this document. Users can fill out the w 4vt online, ensuring accuracy and speeding up the submission process. With airSlate SignNow's eSigning capabilities, you can easily send and receive the completed w 4vt securely.

-

How much does it cost to use airSlate SignNow for managing w 4vt forms?

airSlate SignNow offers various pricing plans that cater to different business needs. When it comes to managing w 4vt forms specifically, the affordable plans allow you to handle unlimited documents and eSignatures. You can choose a subscription that aligns with your expected volume of w 4vt forms.

-

What features does airSlate SignNow provide for w 4vt document management?

airSlate SignNow offers robust features such as customizable templates, real-time tracking, and automated reminders specifically for w 4vt documents. Additionally, its user-friendly interface ensures that your team can efficiently manage, sign, and store these documents. The solution streamlines the entire workflow related to w 4vt forms.

-

Is airSlate SignNow compliant with tax regulations regarding w 4vt?

Yes, airSlate SignNow ensures compliance with tax regulations when managing w 4vt forms. The platform adheres to industry standards for data security and eSignature legality. This compliance guarantees that your completed w 4vt documents are legally binding and secure.

-

Can I integrate airSlate SignNow with other tools for handling w 4vt forms?

Absolutely! airSlate SignNow offers integrations with various popular business applications, which can enhance your management of w 4vt forms. Whether you are using CRM software or cloud storage solutions, integration helps to streamline workflows and improve overall productivity.

-

What are the benefits of using airSlate SignNow for w 4vt?

The primary benefits of using airSlate SignNow for w 4vt include time efficiency, ease of use, and enhanced security. With electronic signatures, you can process w 4vt forms faster without the hassles of paper documents. Furthermore, the platform keeps your data safe and organized, allowing for easy access when needed.

-

How can I get started with airSlate SignNow for my w 4vt documents?

Getting started with airSlate SignNow for your w 4vt documents is straightforward. Simply sign up for an account, and you can begin using templates for w 4vt forms right away. Additionally, the platform provides tutorials and customer support to help you navigate the features effectively.

Get more for Form W 4vt

Find out other Form W 4vt

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe