Vat431c Form

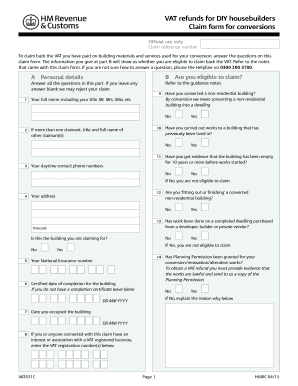

What is the Vat431c Form

The Vat431c form is a specific document used for reporting value-added tax (VAT) in certain business transactions. It is essential for businesses to accurately report their VAT obligations to ensure compliance with tax regulations. This form is particularly relevant for entities engaged in taxable activities and helps them track their VAT liabilities and entitlements. Understanding the purpose of the Vat431c form is crucial for maintaining proper financial records and fulfilling legal obligations.

How to use the Vat431c Form

To effectively use the Vat431c form, businesses should first ensure they have all necessary information at hand, including transaction details and VAT rates applicable to their operations. The form typically requires the following steps:

- Gather all relevant transaction records that include VAT amounts.

- Fill out the form accurately, ensuring that all fields are completed as required.

- Review the information for accuracy and completeness before submission.

Using the Vat431c form correctly can help businesses avoid penalties and ensure they are in good standing with tax authorities.

Steps to complete the Vat431c Form

Completing the Vat431c form involves several essential steps to ensure accuracy and compliance. Here is a straightforward process:

- Start with your business information, including name, address, and tax identification number.

- Detail the transactions that occurred during the reporting period, including sales and purchases.

- Calculate the total VAT charged on sales and the total VAT incurred on purchases.

- Submit the completed form by the designated deadline, either electronically or by mail.

Following these steps will help ensure that the Vat431c form is completed correctly and submitted on time.

Legal use of the Vat431c Form

The legal use of the Vat431c form is grounded in its compliance with federal and state tax regulations. Properly completing and submitting this form is crucial for businesses to avoid legal repercussions, such as fines or audits. The form serves as an official record of VAT transactions and must be retained for a specified period as mandated by tax authorities. Understanding the legal implications of using the Vat431c form helps businesses maintain compliance and protect their interests.

Filing Deadlines / Important Dates

Filing deadlines for the Vat431c form vary based on the reporting period and the specific regulations of the state in which the business operates. Generally, businesses must submit the form quarterly or annually, depending on their VAT obligations. It is important for businesses to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important dates related to VAT filing can help ensure timely submissions.

Required Documents

To complete the Vat431c form, several documents are typically required. These may include:

- Transaction records that detail sales and purchases.

- Invoices that indicate VAT amounts charged and paid.

- Previous VAT returns for reference.

Having these documents readily available can facilitate a smoother completion process for the Vat431c form.

Who Issues the Form

The Vat431c form is usually issued by the relevant state tax authority or revenue department responsible for VAT collection and enforcement. Each state may have its own version of the form, tailored to its specific VAT regulations. Businesses should ensure they are using the correct version of the Vat431c form as issued by their state to ensure compliance with local laws.

Quick guide on how to complete vat431c form 100539231

Easily Prepare Vat431c Form on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed documents by allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, alter, and electronically sign your documents swiftly without delays. Manage Vat431c Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to Alter and Electronically Sign Vat431c Form with Ease

- Locate Vat431c Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, the tedious task of searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Edit and electronically sign Vat431c Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat431c form 100539231

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the vat431c form, and how does it relate to airSlate SignNow?

The vat431c form is essential for businesses to claim VAT refunds on exported goods. Using airSlate SignNow, you can easily eSign and send the vat431c form electronically, simplifying the process and ensuring compliance with tax regulations.

-

How does airSlate SignNow help in managing vat431c documents?

AirSlate SignNow provides a user-friendly platform to manage vat431c documents efficiently. You can create, edit, and eSign these forms quickly, streamlining your workflow and reducing paperwork errors.

-

What are the pricing options for using airSlate SignNow for vat431c processing?

AirSlate SignNow offers flexible pricing plans tailored to your needs, starting with a free trial to explore features for vat431c processing. For businesses, options include monthly or annual subscriptions that provide full access to document management tools.

-

Can I integrate airSlate SignNow with other software for vat431c management?

Yes, airSlate SignNow integrates seamlessly with various software solutions, enhancing your vat431c management process. Whether you use CRM systems or accounting software, integrations can help streamline your workflow and reduce manual data entry.

-

What features does airSlate SignNow offer for eSigning vat431c forms?

AirSlate SignNow offers advanced eSigning features for vat431c forms, including customizable templates, in-person signing, and automated reminders. These features enhance efficiency and ensure timely submissions of your VAT refunds.

-

Is airSlate SignNow secure for processing sensitive vat431c information?

Absolutely, airSlate SignNow prioritizes security with encrypted data transmission and storage for all documents, including vat431c. Your sensitive information is protected, complying with industry standards to safeguard your business data.

-

What are the benefits of using airSlate SignNow for VAT refund submissions?

Using airSlate SignNow for VAT refund submissions through forms like vat431c offers numerous benefits, including time savings, reduced errors, and improved tracking. The electronic process minimizes delays and helps ensure you receive your refunds more efficiently.

Get more for Vat431c Form

Find out other Vat431c Form

- Sign Tennessee Joint Venture Agreement Template Free

- How Can I Sign South Dakota Budget Proposal Template

- Can I Sign West Virginia Budget Proposal Template

- Sign Alaska Debt Settlement Agreement Template Free

- Help Me With Sign Alaska Debt Settlement Agreement Template

- How Do I Sign Colorado Debt Settlement Agreement Template

- Can I Sign Connecticut Stock Purchase Agreement Template

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template