EFT 001 Alabama Department of Revenue Revenue Alabama Form

What is the EFT 001 Alabama Department Of Revenue Revenue Alabama

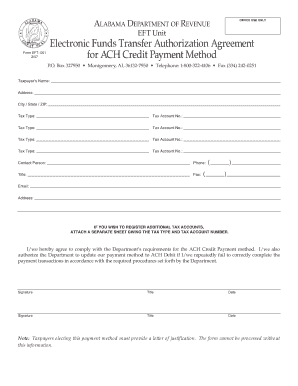

The EFT 001 form is a crucial document issued by the Alabama Department of Revenue. It is primarily used for electronic funds transfer (EFT) of tax payments. This form facilitates the payment process for various taxes, ensuring that businesses and individuals can meet their tax obligations efficiently and securely. By utilizing this form, taxpayers can authorize the direct withdrawal of funds from their bank accounts, streamlining the payment procedure and reducing the likelihood of late payments.

How to use the EFT 001 Alabama Department Of Revenue Revenue Alabama

Using the EFT 001 form involves several straightforward steps. First, taxpayers must complete the form accurately, providing all required information such as taxpayer identification details and banking information. Once the form is filled out, it can be submitted electronically or via mail, depending on the taxpayer's preference. It is essential to ensure that all details are correct to avoid any delays in processing. After submission, taxpayers should monitor their bank accounts to confirm that the payment has been processed successfully.

Steps to complete the EFT 001 Alabama Department Of Revenue Revenue Alabama

Completing the EFT 001 form requires careful attention to detail. Here are the key steps:

- Gather necessary information, including your tax identification number and bank account details.

- Fill out the EFT 001 form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form electronically through the Alabama Department of Revenue's designated platform or mail it to the appropriate address.

- Keep a copy of the submitted form for your records.

Legal use of the EFT 001 Alabama Department Of Revenue Revenue Alabama

The EFT 001 form is legally binding when completed and submitted according to the Alabama Department of Revenue's guidelines. To ensure its legal validity, it must comply with relevant eSignature laws and regulations, such as the ESIGN Act and UETA. This means that electronic submissions are recognized as legally enforceable, provided that the necessary authentication measures are in place. Taxpayers should be aware of these legal frameworks to ensure their submissions are accepted without issues.

Filing Deadlines / Important Dates

Filing deadlines for the EFT 001 form are critical for compliance with tax obligations. Taxpayers should be aware of specific dates related to their tax payments, as late submissions can result in penalties. Generally, the Alabama Department of Revenue provides a calendar of important dates that includes deadlines for quarterly and annual tax payments. It is advisable to review this calendar regularly to stay informed and avoid any potential issues.

Form Submission Methods (Online / Mail / In-Person)

The EFT 001 form can be submitted through various methods, offering flexibility to taxpayers. The primary submission methods include:

- Online: Taxpayers can submit the form electronically through the Alabama Department of Revenue's online portal, ensuring quick processing.

- Mail: The completed form can be sent via postal service to the designated address provided by the Department of Revenue.

- In-Person: Some taxpayers may prefer to submit the form in person at local Department of Revenue offices, where assistance is available.

Quick guide on how to complete eft 001 alabama department of revenue revenue alabama

Effortlessly Prepare EFT 001 Alabama Department Of Revenue Revenue Alabama on Any Device

Digital document management has gained traction among both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle EFT 001 Alabama Department Of Revenue Revenue Alabama on any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest method to modify and eSign EFT 001 Alabama Department Of Revenue Revenue Alabama with minimal effort

- Locate EFT 001 Alabama Department Of Revenue Revenue Alabama and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign function, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management demands with just a few clicks from any device you prefer. Alter and eSign EFT 001 Alabama Department Of Revenue Revenue Alabama to ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eft 001 alabama department of revenue revenue alabama

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EFT 001 Alabama Department Of Revenue Revenue Alabama?

EFT 001 Alabama Department Of Revenue Revenue Alabama is a specific electronic funds transfer form used for submitting tax payments. This form simplifies the payment process for businesses and ensures timely and accurate tax submissions to the Alabama Department of Revenue.

-

How can I use airSlate SignNow for the EFT 001 Alabama Department Of Revenue Revenue Alabama?

You can utilize airSlate SignNow to digitally fill out and eSign the EFT 001 Alabama Department Of Revenue Revenue Alabama. Our platform streamlines the document workflow, making it easier to manage and submit your tax forms securely.

-

Is airSlate SignNow cost-effective for submitting the EFT 001 Alabama Department Of Revenue Revenue Alabama?

Yes, airSlate SignNow offers competitive pricing plans, making it a cost-effective solution for businesses that need to submit the EFT 001 Alabama Department Of Revenue Revenue Alabama. Our service reduces the costs associated with paper, printing, and postage.

-

What features does airSlate SignNow provide for handling EFT 001 submissions?

airSlate SignNow includes features like document templates, automated workflows, and secure cloud storage tailored for managing EFT 001 Alabama Department Of Revenue Revenue Alabama submissions. These tools help ensure compliance and efficiency in your tax process.

-

Can I integrate airSlate SignNow with accounting software for the EFT 001 form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software platforms, enabling you to manage your EFT 001 Alabama Department Of Revenue Revenue Alabama submissions alongside your financials. This integration streamlines your processes and minimizes errors.

-

What are the benefits of using airSlate SignNow for the EFT 001 Alabama Department Of Revenue Revenue Alabama?

Using airSlate SignNow for your EFT 001 Alabama Department Of Revenue Revenue Alabama submissions offers numerous benefits, including improved efficiency, enhanced accuracy, and faster processing times. Our platform also ensures your documents are securely stored and easily accessible.

-

How secure is airSlate SignNow when submitting the EFT 001 form?

airSlate SignNow prioritizes security, using advanced encryption protocols to protect your data during the submission of the EFT 001 Alabama Department Of Revenue Revenue Alabama. You can trust that your sensitive tax information is handled safely.

Get more for EFT 001 Alabama Department Of Revenue Revenue Alabama

- Petition to open an estate under foreign will vermont form

- Vermont foreign form

- Petition open estate form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497428617 form

- Interested persons probate form

- Vt probate court form

- Vt agreement form

- Vt corporation form

Find out other EFT 001 Alabama Department Of Revenue Revenue Alabama

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding