2290v Form

What is the 2290v

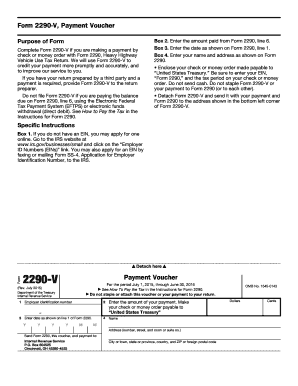

The 2290v form is a critical document used for reporting and paying the Heavy Highway Vehicle Use Tax (HVUT) in the United States. This form is specifically designed for businesses and individuals who operate heavy vehicles with a gross weight of 55,000 pounds or more on public highways. The 2290v serves as a declaration to the Internal Revenue Service (IRS) regarding the use of these vehicles, ensuring compliance with federal tax obligations. Understanding the purpose and requirements of the 2290v is essential for maintaining legal operations within the transportation industry.

How to use the 2290v

Using the 2290v form involves several straightforward steps. First, gather all necessary information, including the vehicle identification number (VIN), gross weight, and the business details of the owner. Next, accurately fill out the form, ensuring all sections are completed to avoid delays. Once completed, the form can be submitted electronically through approved e-filing services, which streamline the process and provide confirmation of submission. Alternatively, the form can be mailed to the IRS, though electronic submission is often faster and more efficient.

Steps to complete the 2290v

Completing the 2290v form requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, including the VIN and business information.

- Access the 2290v form through the IRS website or an authorized e-filing service.

- Fill in the required fields, ensuring accuracy in all entries.

- Calculate the total tax owed based on the vehicle's weight and usage.

- Review the form for any errors or omissions.

- Submit the form electronically or via mail, retaining a copy for your records.

Legal use of the 2290v

The legal use of the 2290v form is governed by IRS regulations, which stipulate that all heavy vehicle operators must file this form annually. To ensure the form is legally binding, it must be completed accurately and submitted within the designated filing period. Compliance with the Heavy Highway Vehicle Use Tax requirements is essential to avoid penalties and maintain good standing with the IRS. Utilizing a reliable e-signature solution can further enhance the legal validity of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the 2290v form are crucial for compliance. The form must be filed by the last day of the month following the end of the tax period. For example, if you are filing for the tax year that begins on July first, the deadline would typically be August 31st. It is important to stay informed about any changes to these deadlines, as late submissions can result in penalties and interest on unpaid taxes. Keeping a calendar of important dates can help ensure timely filing.

Required Documents

To complete the 2290v form, several documents and pieces of information are required. These include:

- Vehicle Identification Number (VIN) for each heavy vehicle.

- Gross weight of the vehicle.

- Business name, address, and Employer Identification Number (EIN).

- Details of any suspended vehicles, if applicable.

- Payment information for the tax owed, if filing by mail.

Having these documents ready will facilitate a smoother filing process and help avoid errors.

Penalties for Non-Compliance

Failure to file the 2290v form on time can result in significant penalties. The IRS imposes a penalty of up to $50 for each month the form is late, with a maximum penalty of up to five months. Additionally, interest may accrue on any unpaid tax amounts. To avoid these penalties, it is essential to file the form by the deadline and ensure that all information is accurate and complete. Regularly reviewing compliance requirements can help mitigate the risk of non-compliance.

Quick guide on how to complete 2290v

Effortlessly Complete 2290v on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a perfect environmentally-friendly alternative to conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Handle 2290v on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The Easiest Way to Edit and eSign 2290v with Ease

- Obtain 2290v and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal authority as a traditional wet signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Edit and eSign 2290v and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2290v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 2290v and how does it work?

The 2290v is a form used for reporting Heavy Highway Vehicle Use Tax to the IRS. With airSlate SignNow, you can easily fill out and eSign the 2290v, streamlining the submission process. This ensures compliance with tax regulations while saving you time and hassle.

-

How much does airSlate SignNow cost for 2290v eSignature services?

airSlate SignNow offers flexible pricing plans tailored to your business needs, including the ability to eSign 2290v forms. Pricing typically starts at an affordable monthly rate, allowing organizations to manage costs effectively. It’s a cost-effective solution for eSigning vital documents like the 2290v.

-

What features does airSlate SignNow offer for managing the 2290v form?

With airSlate SignNow, users benefit from features like templates for the 2290v, automated reminders, and secure cloud storage. These features enable you to manage your documents efficiently and ensure that your 2290v forms are always up-to-date and accessible. The platform also supports team collaboration on the 2290v.

-

Can I integrate airSlate SignNow with other applications for my 2290v forms?

Yes, airSlate SignNow supports integrations with various applications, enhancing your workflow for handling the 2290v. Integrate with tools like CRM systems or cloud storage solutions to streamline the management process. This makes it easier to access and eSign your 2290v alongside other business documents.

-

What are the benefits of using airSlate SignNow for the 2290v form?

By using airSlate SignNow for the 2290v form, you can ensure expedited processing and improved accuracy. The platform provides a user-friendly interface and robust security measures, protecting your important tax documents. Additionally, eSigning the 2290v saves time compared to traditional paper methods.

-

Is it safe to eSign my 2290v form through airSlate SignNow?

Absolutely. airSlate SignNow employs advanced encryption and security measures to ensure that your 2290v form is safe during transmission and storage. You can trust that your sensitive information will remain confidential and secure throughout the signing process.

-

How quickly can I complete my 2290v form using airSlate SignNow?

You can complete your 2290v form quickly with airSlate SignNow, often in just a few minutes. The platform simplifies the process with pre-formatted templates and guided steps for eSigning. This efficiency means you can submit your 2290v faster and reduce the risk of late fees.

Get more for 2290v

- Legal last will and testament form for a single person with minor children missouri

- Legal last will and testament form for single person with adult and minor children missouri

- Legal last will and testament form for single person with adult children missouri

- Legal last will and testament for married person with minor children from prior marriage missouri form

- Legal last will and testament form for married person with adult children from prior marriage missouri

- Legal last will and testament form for divorced person not remarried with adult children missouri

- Legal last will and testament form for divorced person not remarried with no children missouri

- Legal last will and testament form for divorced person not remarried with minor children missouri

Find out other 2290v

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure