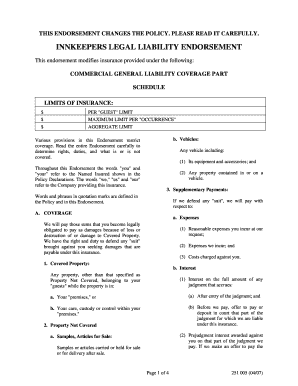

INNKEEPERS LEGAL LIABILITY ENDORSEMENT Form

What is the innkeepers legal liability endorsement?

The innkeepers legal liability endorsement is a specialized form of insurance designed to protect lodging establishments, such as hotels, motels, and bed-and-breakfasts, from legal claims arising from property damage or loss of guests' belongings. This endorsement extends the coverage of a standard innkeepers insurance policy, ensuring that innkeepers are financially safeguarded against potential lawsuits related to the loss or damage of personal property entrusted to them by guests. It is crucial for innkeepers to understand the specifics of this endorsement, as it outlines the responsibilities and liabilities they hold in the hospitality industry.

Key elements of the innkeepers legal liability endorsement

Several key elements define the innkeepers legal liability endorsement, making it essential for lodging operators. These include:

- Coverage Limits: The endorsement specifies the maximum amount the insurer will pay for claims related to guests' property.

- Types of Property Covered: It typically covers personal belongings, such as luggage, electronics, and valuables, but may exclude certain items like cash or jewelry unless specified.

- Negligence Requirements: The endorsement often requires that the innkeeper's negligence directly causes the loss or damage for a claim to be valid.

- Exclusions: Common exclusions may include damages from natural disasters or acts of God, which are not covered under standard policies.

Steps to complete the innkeepers legal liability endorsement

Completing the innkeepers legal liability endorsement involves several important steps to ensure compliance and proper coverage. These steps include:

- Review Policy Requirements: Understand the specific requirements of your insurance policy and the endorsement.

- Gather Necessary Information: Collect information about your property, including its value and any previous claims.

- Fill Out the Endorsement Form: Complete the endorsement form accurately, ensuring all details are correct.

- Submit the Form: Send the completed form to your insurance provider, either digitally or via traditional mail.

- Keep Records: Maintain a copy of the endorsement and any correspondence with your insurer for future reference.

Legal use of the innkeepers legal liability endorsement

The legal use of the innkeepers legal liability endorsement requires adherence to specific guidelines and regulations. It is important for innkeepers to ensure that:

- Compliance with State Laws: Different states may have varying requirements for insurance coverage, so it is essential to comply with local regulations.

- Proper Documentation: Maintain accurate records of all guest property entrusted to your establishment, as this can support claims if disputes arise.

- Clear Communication: Inform guests about the coverage limits and exclusions of the endorsement to manage expectations and reduce liability.

How to obtain the innkeepers legal liability endorsement

Obtaining the innkeepers legal liability endorsement typically involves a straightforward process. Innkeepers can follow these steps:

- Contact Your Insurance Provider: Reach out to your current insurance agent or company to discuss adding the endorsement to your existing policy.

- Evaluate Coverage Options: Assess different coverage options and limits to determine what best fits your business needs.

- Complete Required Documentation: Fill out any necessary forms or applications required by your insurer to initiate the endorsement.

- Review and Sign: Carefully review the terms of the endorsement before signing to ensure full understanding of the coverage.

Examples of using the innkeepers legal liability endorsement

Understanding practical applications of the innkeepers legal liability endorsement can help innkeepers appreciate its importance. Here are a few examples:

- Lost Luggage: If a guest's luggage goes missing during their stay, the endorsement may cover the cost of replacing the lost items, provided the innkeeper is found negligent.

- Damaged Property: If a guest's valuable item is accidentally damaged by hotel staff, the endorsement can help cover the repair or replacement costs.

- Legal Claims: In the event of a lawsuit filed by a guest regarding lost or damaged property, the endorsement can cover legal fees and settlements, protecting the innkeeper's financial interests.

Quick guide on how to complete innkeepers legal liability endorsement

Complete INNKEEPERS LEGAL LIABILITY ENDORSEMENT effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage INNKEEPERS LEGAL LIABILITY ENDORSEMENT on any device with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign INNKEEPERS LEGAL LIABILITY ENDORSEMENT without any hassle

- Obtain INNKEEPERS LEGAL LIABILITY ENDORSEMENT and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form—by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign INNKEEPERS LEGAL LIABILITY ENDORSEMENT and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the innkeepers legal liability endorsement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is innkeepers insurance and why do I need it?

Innkeepers insurance is a specialized insurance policy designed to protect property owners from risks associated with operating hospitality businesses like bed and breakfasts or hotels. It covers various liabilities, including guest injuries, property damage, and loss of income due to business interruptions. Securing innkeepers insurance is essential for safeguarding your investment and ensuring peace of mind.

-

How much does innkeepers insurance typically cost?

The cost of innkeepers insurance can vary based on factors such as the size of your property, the number of guests you accommodate, and the specific coverage options you choose. Generally, premiums can range from a few hundred to several thousand dollars annually. It's advisable to get quotes from multiple providers to find the best coverage that fits your budget.

-

What types of coverage does innkeepers insurance include?

Innkeepers insurance typically includes liability coverage, property damage, and business interruption insurance. Additional options such as personal property coverage and loss of rental income may also be available. Evaluating your unique needs can help you select the coverage types that provide the best protection for your hospitality business.

-

Can innkeepers insurance cover loss of business due to natural disasters?

Yes, innkeepers insurance can include coverage for losses resulting from natural disasters, but this may vary depending on the policy and provider. It’s essential to review your policy carefully and consider adding riders or endorsements for specific events like floods or earthquakes. This way, you can ensure comprehensive protection for your business in the event of unexpected disasters.

-

What are the benefits of having innkeepers insurance?

Having innkeepers insurance provides crucial financial protection for your property against lawsuits, guest injuries, and unforeseen events that could disrupt your business. It also enhances customer trust, as guests are more likely to feel safe when they know you are insured. Ultimately, innkeepers insurance helps you manage risks effectively and maintains the operational stability of your business.

-

How do I choose the right innkeepers insurance policy?

Choosing the right innkeepers insurance policy involves assessing your specific business needs and risks. Start by comparing quotes from multiple insurance providers, considering the coverage limits, deductibles, and exclusions. Consulting with an insurance broker who specializes in hospitality can also be beneficial in finding a policy tailored to your requirements.

-

Are there any discounts available for innkeepers insurance?

Many insurance providers offer discounts for innkeepers insurance, especially if you bundle it with other insurance types or maintain a good claims history. Additional discounts may be available for property improvements, safety certifications, or membership in professional associations. It’s a good idea to inquire about all potential discounts when obtaining quotes.

Get more for INNKEEPERS LEGAL LIABILITY ENDORSEMENT

- Salary verification form for potential lease wisconsin

- Landlord agreement to allow tenant alterations to premises wisconsin form

- Notice of default on residential lease wisconsin form

- Landlord tenant lease co signer agreement wisconsin form

- Application for sublease wisconsin form

- Inventory and condition of leased premises for pre lease and post lease wisconsin form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out wisconsin form

- Property manager agreement wisconsin form

Find out other INNKEEPERS LEGAL LIABILITY ENDORSEMENT

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast