BE 008 PDF 2022-2026

What is the BE 008 pdf

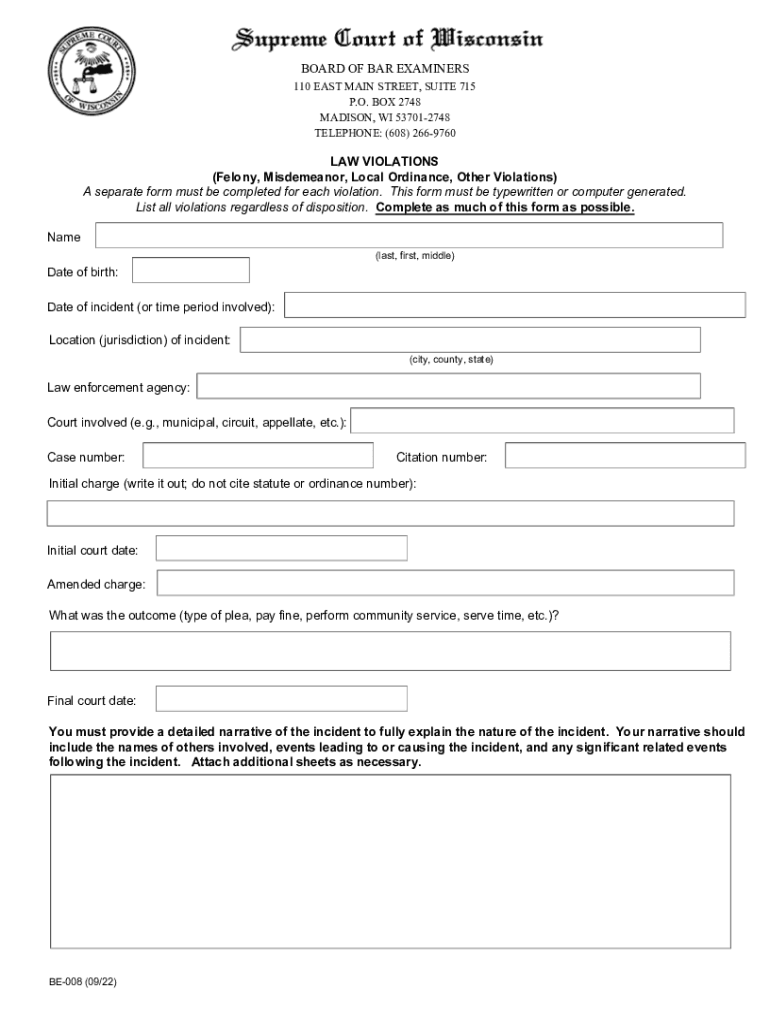

The BE 008 pdf is a specific form used in various administrative and legal contexts. It serves as an official document that individuals or businesses may need to complete for regulatory compliance or to fulfill certain requirements. Understanding its purpose is essential for anyone who needs to navigate the associated processes effectively.

How to use the BE 008 pdf

Using the BE 008 pdf involves several steps to ensure that the form is filled out correctly. First, download the form from a reliable source. Next, review the instructions carefully to understand the required information. Fill in the necessary fields accurately, ensuring that all details are complete. Once filled, you can either print and sign the document or use a digital signature solution for submission, depending on the requirements.

Steps to complete the BE 008 pdf

Completing the BE 008 pdf requires a systematic approach:

- Download the form: Obtain the latest version of the BE 008 pdf from a trusted source.

- Review the guidelines: Familiarize yourself with the instructions provided with the form.

- Fill in the details: Carefully enter all required information, ensuring accuracy.

- Sign the document: Depending on your choice, either print the form for a handwritten signature or use an eSignature solution.

- Submit the form: Follow the specified submission method, whether online, by mail, or in person.

Legal use of the BE 008 pdf

The legal use of the BE 008 pdf is contingent upon compliance with relevant regulations and guidelines. To ensure that the form is legally binding, it is important to follow all instructions accurately and provide the necessary signatures. Utilizing a reliable eSignature solution can enhance the legal validity of the document, as it often includes features such as digital certificates and compliance with eSignature laws.

Key elements of the BE 008 pdf

Understanding the key elements of the BE 008 pdf is crucial for proper completion. These elements typically include:

- Personal or business information: Details about the individual or entity completing the form.

- Signature fields: Areas designated for signatures, which may require additional verification.

- Submission instructions: Guidelines on how and where to submit the completed form.

- Contact information: Sections for providing contact details in case of follow-up or clarification.

Who Issues the Form

The BE 008 pdf is typically issued by a governmental or regulatory body, depending on its intended use. This may include state or federal agencies that require the form for compliance with specific regulations. Identifying the issuing authority is important for ensuring that you are using the correct version of the form and following the appropriate guidelines.

Quick guide on how to complete be 008 pdf

Prepare BE 008 pdf easily on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without any holdups. Manage BE 008 pdf on any platform using airSlate SignNow Android or iOS apps and enhance any document-related process today.

The simplest way to modify and eSign BE 008 pdf effortlessly

- Obtain BE 008 pdf and click on Get Form to get started.

- Utilize the tools we provide to complete your form.

- Highlight essential sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from your chosen device. Edit and eSign BE 008 pdf and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct be 008 pdf

Create this form in 5 minutes!

How to create an eSignature for the be 008 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BE 008 pdf and how does it relate to airSlate SignNow?

The BE 008 pdf is a specific documentation format utilized for business processes. With airSlate SignNow, users can easily fill, sign, and send BE 008 pdf documents electronically, streamlining workflows and ensuring document security.

-

How can I upload a BE 008 pdf into airSlate SignNow?

Uploading a BE 008 pdf into airSlate SignNow is straightforward. Users can simply drag and drop the file into the platform or use the upload button. Once uploaded, the document becomes easily accessible for editing and signing.

-

Is there a cost associated with using airSlate SignNow for BE 008 pdf documents?

airSlate SignNow offers various pricing plans tailored to suit different business needs, including those involving BE 008 pdf documents. You can choose a plan that fits your budget while gaining access to essential features for managing and signing your documents.

-

What features does airSlate SignNow offer for managing BE 008 pdf documents?

AirSlate SignNow provides multiple features for BE 008 pdf management, including document editing, customizable templates, and electronic signatures. These tools enhance efficiency and ensure that your documents are processed seamlessly.

-

Can I integrate airSlate SignNow with other applications when handling BE 008 pdf?

Yes, airSlate SignNow integrates with various applications such as CRM software, cloud storage services, and project management tools. This capability allows for smooth handling of BE 008 pdf documents within your existing workflows.

-

What are the benefits of using airSlate SignNow for BE 008 pdf signing?

Using airSlate SignNow for signing BE 008 pdf documents offers numerous benefits, including faster turnaround times, improved tracking and management, and enhanced security. This simplifies your document processes while ensuring compliance.

-

Is it easy to eSign a BE 008 pdf using airSlate SignNow?

Absolutely! airSlate SignNow offers a user-friendly interface that makes eSigning BE 008 pdf documents quick and hassle-free. Simply upload your document, place your signature, and send it—everything can be done in just a few clicks.

Get more for BE 008 pdf

- Bill of sale with warranty by individual seller wisconsin form

- Bill of sale with warranty for corporate seller wisconsin form

- Bill of sale without warranty by individual seller wisconsin form

- Bill of sale without warranty by corporate seller wisconsin form

- Creditors matrix 497430750 form

- Verification of creditors matrix wisconsin form

- Correction statement and agreement wisconsin form

- Manufactured home closing documents wisconsin form

Find out other BE 008 pdf

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form