Michigan W4 Form

What is the Michigan W4

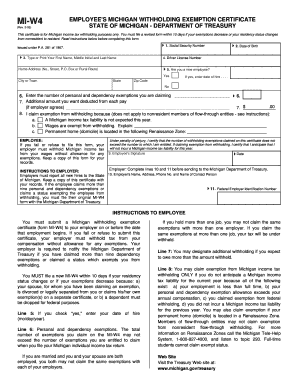

The Michigan W4 form, officially known as the Employee's Withholding Exemption Certificate, is a crucial document for employees in Michigan. It is used to determine the amount of state income tax to withhold from an employee's paycheck. By completing this form, employees can indicate their filing status, exemptions, and any additional withholding amounts they wish to apply. This ensures that the correct amount of tax is deducted, helping to avoid underpayment or overpayment of state taxes throughout the year.

How to use the Michigan W4

Using the Michigan W4 involves several straightforward steps. First, employees must obtain the form from their employer or download it from the Michigan Department of Treasury website. After acquiring the form, individuals fill it out by providing personal information such as their name, address, and Social Security number. Next, they select their filing status and claim any exemptions they qualify for. Finally, the completed form should be submitted to the employer, who will use the information to adjust the withholding from the employee's paychecks.

Steps to complete the Michigan W4

Completing the Michigan W4 requires careful attention to detail. Follow these steps:

- Obtain the Michigan W4 form from your employer or the Michigan Department of Treasury website.

- Fill in your personal information, including your name, address, and Social Security number.

- Select your filing status: single, married, or head of household.

- Claim any exemptions you may qualify for, which can reduce the amount withheld.

- Indicate any additional withholding amounts if desired.

- Review the form for accuracy and sign it.

- Submit the completed form to your employer.

Legal use of the Michigan W4

The Michigan W4 is legally recognized as a valid document for tax withholding purposes. It must be completed accurately to ensure compliance with state tax laws. Employers are required to maintain a copy of the W4 form on file for each employee, as it serves as a reference for the amount of state income tax to withhold. Inaccuracies or failure to submit this form can lead to penalties for both the employee and employer, making it essential to complete it correctly.

Key elements of the Michigan W4

Several key elements are essential to the Michigan W4 form. These include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household.

- Exemptions: Claiming exemptions can reduce withholding amounts.

- Additional Withholding: Employees can specify any extra amounts they wish to be withheld.

Form Submission Methods

Employees can submit the Michigan W4 form to their employer through various methods. The most common method is to hand in a physical copy directly to the payroll department. Alternatively, some employers may allow electronic submission through secure company portals. Regardless of the method chosen, it is important to ensure that the form is submitted promptly to avoid any delays in the correct withholding of state taxes.

Quick guide on how to complete michigan w4

Complete Michigan W4 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents since you can access the correct format and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Michigan W4 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and electronically sign Michigan W4 with ease

- Obtain Michigan W4 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method of sharing your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Michigan W4 and guarantee excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan w4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the michigan w4 form, and why is it important?

The michigan w4 form is a state tax withholding form that allows employees in Michigan to indicate their tax withholding preferences. Accurately filling out the michigan w4 is crucial for ensuring the correct amount of state taxes is withheld from your paycheck, helping you avoid surprises during tax season.

-

How can airSlate SignNow help with filling out the michigan w4?

airSlate SignNow simplifies the process of filling out the michigan w4 by offering an intuitive eSigning platform. Users can easily complete, sign, and send the michigan w4 form electronically, ensuring a streamlined and efficient process without the hassle of printing and mailing.

-

Is there a cost associated with using airSlate SignNow for the michigan w4?

airSlate SignNow provides cost-effective plans for businesses needing to manage forms like the michigan w4. With flexible pricing options, you can choose a plan that fits your budget while gaining access to features that facilitate document management and eSigning.

-

What features does airSlate SignNow offer for managing michigan w4 forms?

airSlate SignNow offers powerful features like customizable templates, automated workflows, and real-time tracking for managing michigan w4 forms. These tools help businesses streamline their HR processes while ensuring compliance with Michigan state tax laws.

-

Can I integrate airSlate SignNow with other software for michigan w4 management?

Yes, airSlate SignNow integrates seamlessly with various business tools, enhancing your ability to manage michigan w4 forms alongside other documentation. This compatibility allows you to incorporate eSigning into your existing workflows without interruption.

-

What benefits does eSigning the michigan w4 provide?

eSigning the michigan w4 through airSlate SignNow offers several benefits, including convenience and security. Users can sign documents from anywhere, and eSignatures are legally binding, thus improving efficiency and reducing paperwork.

-

How does airSlate SignNow ensure the security of my michigan w4 data?

airSlate SignNow prioritizes the security of your michigan w4 data by implementing industry-standard encryption and secure cloud storage. This ensures that all sensitive information remains safe and confidential throughout the signing process.

Get more for Michigan W4

- Wedding planning or consultant package new hampshire form

- Hunting forms package new hampshire

- Identity theft recovery package new hampshire form

- Durable power of attorney for health care and living will statutory new hampshire form

- Durable power attorney nh form

- Aging parent package new hampshire form

- Sale of a business package new hampshire form

- Legal documents for the guardian of a minor package new hampshire form

Find out other Michigan W4

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free