Individual W 2 Data Sheet Oklahoma Tax Commission State Tax Ok Form

What is the Individual W-2 Data Sheet?

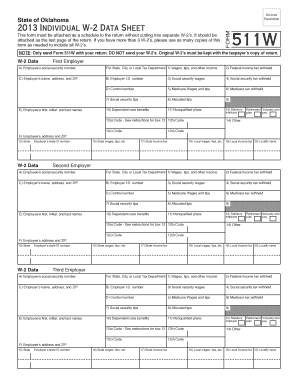

The Individual W-2 Data Sheet is a crucial form issued by the Oklahoma Tax Commission that reports an employee's annual wages and the taxes withheld from their paychecks. It is essential for both employees and employers, as it provides the necessary information for filing state income taxes. The form includes details such as the employee's name, Social Security number, and the total amount of wages earned during the tax year.

How to Use the Individual W-2 Data Sheet

To effectively use the Individual W-2 Data Sheet, employees should first ensure that all information is accurate and complete. This includes verifying personal details and ensuring that the wage amounts reflect the earnings for the year. Once verified, the form can be utilized to complete state tax returns. It is important to keep a copy of the W-2 for personal records and for any potential audits.

Steps to Complete the Individual W-2 Data Sheet

Completing the Individual W-2 Data Sheet involves several key steps:

- Gather necessary information, including your Social Security number and total wages for the year.

- Fill in personal details accurately, including your name and address.

- Report total earnings and any taxes withheld as indicated on your pay stubs.

- Review the completed form for accuracy before submission.

Key Elements of the Individual W-2 Data Sheet

The Individual W-2 Data Sheet contains several key elements that are vital for tax reporting:

- Employee Information: Name, address, and Social Security number.

- Employer Information: Employer's name, address, and Employer Identification Number (EIN).

- Wage Information: Total wages earned and federal/state taxes withheld.

- Tax Year: The specific year for which the wages are reported.

Legal Use of the Individual W-2 Data Sheet

The Individual W-2 Data Sheet is legally binding and must be filled out accurately to comply with state tax laws. Employers are required to provide this form to their employees by January 31 of each year. Failure to provide or accurately complete the W-2 can result in penalties for both the employer and the employee. It is essential to ensure that the form is submitted to the appropriate tax authorities as part of the annual tax filing process.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Individual W-2 Data Sheet is crucial for compliance. Employers must issue the W-2 forms to employees by January 31 each year. Employees should ensure that they have all necessary forms in hand by this date to accurately complete their state tax returns. The deadline for filing state income tax returns typically falls on April 15, but it is advisable to check for any extensions or changes to this date.

Quick guide on how to complete individual w 2 data sheet oklahoma tax commission state tax ok

Effortlessly Prepare Individual W 2 Data Sheet Oklahoma Tax Commission State Tax Ok on Any Device

Digital document management has gained popularity among organizations and individuals. It offers a superb eco-friendly substitute to traditional printed and signed papers, allowing you to locate the necessary form and store it securely online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents quickly and efficiently. Manage Individual W 2 Data Sheet Oklahoma Tax Commission State Tax Ok on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

Edit and eSign Individual W 2 Data Sheet Oklahoma Tax Commission State Tax Ok with Ease

- Locate Individual W 2 Data Sheet Oklahoma Tax Commission State Tax Ok and click Get Form to begin.

- Utilize the tools provided to submit your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign Individual W 2 Data Sheet Oklahoma Tax Commission State Tax Ok and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individual w 2 data sheet oklahoma tax commission state tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Individual W 2 Data Sheet from the Oklahoma Tax Commission?

The Individual W 2 Data Sheet is a crucial tax document provided by the Oklahoma Tax Commission. It summarizes an employee's earnings and the taxes withheld during the year. Businesses can easily generate this form using airSlate SignNow's platform, ensuring accurate and timely submissions to the State Tax Ok.

-

How can airSlate SignNow help with submitting the Individual W 2 Data Sheet to the Oklahoma Tax Commission?

airSlate SignNow simplifies the submission of the Individual W 2 Data Sheet to the Oklahoma Tax Commission by allowing users to eSign and send documents digitally. This streamlined process saves time and reduces errors, ensuring compliance with State Tax Ok regulations for businesses and employees alike.

-

What features does airSlate SignNow offer for managing Individual W 2 Data Sheets?

With airSlate SignNow, businesses can easily create, customize, and manage Individual W 2 Data Sheets. Features include electronic signatures, document tracking, and secure storage, which collectively enhance the efficiency of tax document management while adhering to the State Tax Ok requirements.

-

Is there a cost associated with using airSlate SignNow for Individual W 2 Data Sheets?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including those for generating Individual W 2 Data Sheets. These plans are cost-effective and designed to provide excellent value, ensuring that businesses can meet their tax obligations with ease under the State Tax Ok.

-

Can I integrate airSlate SignNow with other software for Individual W 2 Data Sheet management?

Absolutely, airSlate SignNow supports integrations with numerous accounting and HR software solutions. This allows businesses to efficiently manage and streamline their workflow for Individual W 2 Data Sheets, ensuring a cohesive experience for those handling State Tax Ok filings.

-

What benefits does airSlate SignNow provide for eSigning the Individual W 2 Data Sheet?

eSigning the Individual W 2 Data Sheet with airSlate SignNow enhances the signing experience, making it faster and more secure. Users can sign from anywhere, at any time, which not only expedites the process but also ensures compliance with the Oklahoma Tax Commission and State Tax Ok requirements.

-

How does airSlate SignNow ensure the security of my Individual W 2 Data Sheets?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your Individual W 2 Data Sheets. This ensures that sensitive tax information is safeguarded, adhering to the security standards required by the Oklahoma Tax Commission and State Tax Ok.

Get more for Individual W 2 Data Sheet Oklahoma Tax Commission State Tax Ok

- Carers certificate template form

- Canada ontario oesp consent form

- Llda application discharge form

- Model proforma for income certificate

- Application for accommodation in england and wales national form

- Equal opportunities monitoring form

- Masa renewal form middle atlantic skating

- Informed consent for neurotoxin injection

Find out other Individual W 2 Data Sheet Oklahoma Tax Commission State Tax Ok

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast