Form 8903

What is the Form 8903

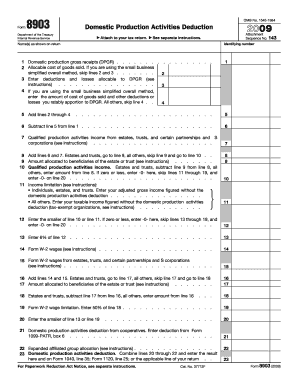

The Form 8903 is a tax form used by businesses to claim the Domestic Production Activities Deduction (DPAD). This deduction is available to eligible taxpayers who engage in qualified production activities within the United States. The form helps businesses calculate the amount of the deduction they can claim on their federal income tax returns. It is essential for companies involved in manufacturing, producing, growing, or extracting products in the U.S. to understand how to utilize this form effectively.

How to use the Form 8903

Using the Form 8903 involves several steps to ensure accurate completion and submission. First, gather all necessary financial records related to your production activities. This includes information about income, expenses, and any other relevant documentation. Next, carefully fill out the form by following the provided instructions, ensuring that all calculations are accurate. Once completed, the form should be attached to your federal income tax return, typically submitted by the annual filing deadline. It is advisable to keep a copy of the submitted form for your records.

Steps to complete the Form 8903

Completing the Form 8903 requires attention to detail and a clear understanding of your business activities. Follow these steps:

- Review the eligibility criteria for claiming the Domestic Production Activities Deduction.

- Gather all financial documents related to your production activities.

- Fill out the form, ensuring that each section is completed accurately.

- Calculate the deduction amount based on your qualified production activities.

- Attach the completed Form 8903 to your federal income tax return.

- Submit your tax return by the designated deadline.

Legal use of the Form 8903

The legal use of the Form 8903 is governed by IRS regulations regarding the Domestic Production Activities Deduction. To ensure compliance, businesses must accurately report their production activities and adhere to the guidelines set forth by the IRS. This includes maintaining proper documentation to support the claims made on the form. Failure to comply with these regulations may result in penalties or disallowance of the deduction, emphasizing the importance of understanding the legal implications of using this form.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 8903. These guidelines include detailed instructions on eligibility, required documentation, and calculation methods for the deduction. It is crucial for taxpayers to familiarize themselves with these guidelines to avoid errors that could lead to audits or penalties. The IRS website offers resources and publications that can assist in understanding the requirements associated with the Form 8903.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8903 align with the general tax return deadlines for businesses. Typically, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. For partnerships and sole proprietorships, the deadline is usually the fifteenth day of the third month after the end of their tax year. It is essential to be aware of these dates to ensure timely submission and avoid penalties.

Required Documents

When completing the Form 8903, several documents are necessary to support your claims. These may include:

- Income statements detailing revenue from qualified production activities.

- Expense records related to production costs.

- Documentation proving the nature of the production activities.

- Any additional forms or schedules that may be required by the IRS.

Having these documents readily available will facilitate a smoother completion process for the Form 8903.

Quick guide on how to complete form 8903

Effortlessly Prepare Form 8903 on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an excellent eco-conscious option to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, alter, and electronically sign your documents swiftly without delays. Manage Form 8903 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Alter and Electronically Sign Form 8903 with Ease

- Locate Form 8903 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Form 8903 while ensuring outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8903

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8903?

Form 8903 is a tax form used to claim the Domestic Production Activities Deduction (DPAD) for certain qualified activities. This form is especially important for businesses looking to maximize their tax benefits. Utilizing airSlate SignNow to eSign and send Form 8903 streamlines the submission process, making it efficient and secure.

-

How can airSlate SignNow help with Form 8903?

airSlate SignNow provides an easy-to-use platform that allows businesses to electronically sign and send Form 8903 quickly. With features like template creation and document tracking, users can efficiently manage their tax documents. This ensures that all necessary approvals and signatures are obtained hassle-free.

-

Is there a cost associated with using airSlate SignNow for Form 8903?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features that support the electronic signing and submission of documents, including Form 8903. Consider starting with a free trial to explore functionalities before committing to a subscription.

-

What features does airSlate SignNow offer for managing Form 8903?

AirSlate SignNow provides several features to enhance document management for Form 8903, including customizable templates, automated reminders, and real-time status tracking. These tools ensure that your Form 8903 is completed accurately and submitted on time, reducing the risk of delays or errors.

-

Can I integrate airSlate SignNow with other software for Form 8903?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your workflow when managing Form 8903. This means you can connect to popular tools for accounting or project management, allowing for streamlined processes. Integration can help simplify the preparation and submission of your Form 8903.

-

What are the benefits of using airSlate SignNow for eSigning Form 8903?

Using airSlate SignNow to eSign Form 8903 offers numerous benefits, including increased efficiency and reduced paper usage. The platform provides a secure way to collect signatures, ensuring compliance with legal standards. Additionally, it enables fast tracking of document status, allowing businesses to focus on their core operations.

-

Is airSlate SignNow secure for handling Form 8903?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your Form 8903 and other sensitive documents are protected. The platform employs advanced encryption and security protocols to safeguard data throughout the signing process. Users can confidently manage their Form 8903 without compromising their information.

Get more for Form 8903

Find out other Form 8903

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors