St 28m Form

What is the St 28m

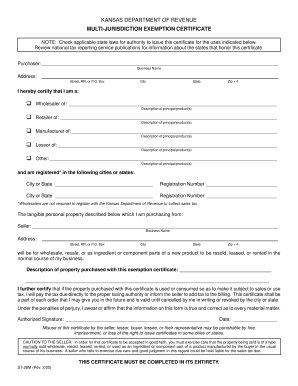

The St 28m form is a specific document used within various administrative and legal contexts in the United States. It serves as a formal request or declaration, often required for compliance with state regulations or federal guidelines. Understanding its purpose is essential for individuals and businesses alike, as it may relate to tax, legal, or regulatory requirements. The St 28m is designed to streamline processes by providing a standardized method for submitting necessary information to relevant authorities.

How to use the St 28m

Using the St 28m form effectively involves several key steps. First, ensure that you have the correct version of the form, which can typically be obtained from the relevant state or federal agency. Next, carefully read the instructions provided with the form to understand the specific requirements and information needed. Fill out the form completely, ensuring that all fields are accurately completed to avoid delays or rejections. Once filled, the form can be submitted electronically or via traditional mail, depending on the guidelines associated with the specific St 28m form you are using.

Steps to complete the St 28m

Completing the St 28m form requires attention to detail. Start by gathering all necessary information, such as personal identification details, business information, and any supporting documentation that may be required. Follow these steps:

- Download the St 28m form from the appropriate source.

- Read the instructions thoroughly to understand what is required.

- Fill in your information accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Sign the form electronically or by hand, as required.

- Submit the form through the designated method, whether online or by mail.

Legal use of the St 28m

The legal validity of the St 28m form hinges on compliance with relevant regulations governing electronic signatures and document submissions. To ensure that the form is legally binding, it is essential to use a trusted eSignature solution that adheres to the ESIGN Act and UETA guidelines. By doing so, signers can be confident that their submissions will be accepted by authorities and hold up in legal contexts. Maintaining proper records and following submission protocols also contributes to the form's legal standing.

Who Issues the Form

The St 28m form is typically issued by state or federal agencies, depending on its specific purpose. Each agency may have different guidelines regarding the issuance and use of the form. It is important to identify the correct issuing authority to ensure compliance with all applicable regulations. This may include state tax departments, licensing boards, or other governmental entities that require the St 28m for processing applications or compliance documentation.

Required Documents

When completing the St 28m form, certain documents may be required to support your submission. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Business registration documents, if applicable.

- Tax identification numbers, including Social Security numbers or Employer Identification Numbers.

- Any additional documentation specified in the form instructions.

Gathering these documents in advance can facilitate a smoother completion process and help avoid delays in processing your St 28m form.

Quick guide on how to complete st 28m

Complete St 28m effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without interruptions. Manage St 28m on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign St 28m with ease

- Obtain St 28m and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign St 28m and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 28m

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is st 28m in relation to airSlate SignNow?

st 28m refers to a specific pricing tier or plan available within airSlate SignNow. This plan is designed to provide users with advanced features for eSigning and document management, making it cost-effective for businesses of all sizes looking to streamline their operations.

-

How can st 28m enhance my document signing process?

The st 28m plan includes features such as customizable templates, bulk sending, and in-person signing, which signNowly enhance the document signing process. With these tools, businesses can save time and improve efficiency, ultimately leading to a smoother workflow.

-

Is st 28m suitable for small businesses?

Yes, the st 28m plan is particularly well-suited for small businesses. Its cost-effective pricing and robust features allow smaller organizations to leverage professional eSigning capabilities without breaking the bank.

-

What are the key features included in the st 28m plan?

The st 28m plan includes essential features such as unlimited templates, advanced security options, and real-time tracking of document statuses. These features empower businesses to manage their document workflows more efficiently and securely.

-

Are there any integrations available with the st 28m plan?

Absolutely, the st 28m plan offers a variety of integrations with popular business applications like CRM, HR software, and accounting tools. This interoperability helps streamline operations and enhances overall productivity.

-

What kind of customer support can I expect with st 28m?

With the st 28m plan, users receive dedicated customer support through multiple channels, including live chat, email, and phone. This ensures that your queries are addressed promptly and efficiently, contributing to a hassle-free experience.

-

Can I upgrade from a lower plan to st 28m easily?

Yes, upgrading to the st 28m plan is a seamless process. Users can easily transition between plans, allowing businesses to scale their eSigning capabilities as their needs evolve.

Get more for St 28m

- Phs inclusion enrollment report fillable form

- B4 form canada

- Fire alarm testing notice form

- Quitclaim deed nevada form

- Download form uac ms word

- Grit test online form

- Highly structured parenting plan florida form

- Dh1096 housing statement housing statement made by applicant or tenant housing pathways form

Find out other St 28m

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure