Form 199 General Instructions

What is the Form 199 General Instructions

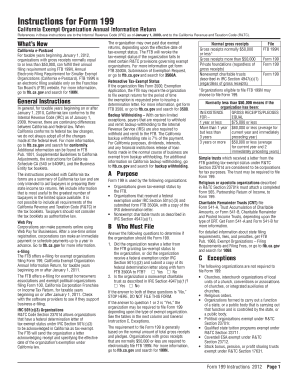

The Form 199 General Instructions provide essential guidance for completing the Form 199, which is used primarily for reporting certain tax information for businesses operating in the United States. This form is crucial for ensuring compliance with federal tax regulations and helps businesses accurately report their income and expenses. Understanding the specific requirements outlined in the general instructions is vital for successful completion and submission.

Steps to complete the Form 199 General Instructions

Completing the Form 199 requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including income statements and expense reports.

- Review the Form 199 General Instructions to understand the specific sections and requirements.

- Fill out each section of the form accurately, ensuring all figures are correct and supported by your documentation.

- Double-check your entries for any errors or omissions before finalizing the form.

- Submit the completed form according to the guidelines provided in the instructions, whether online, by mail, or in person.

Legal use of the Form 199 General Instructions

The legal use of the Form 199 is paramount for businesses to avoid penalties and ensure compliance with tax laws. The form must be filled out in accordance with the instructions provided to be considered valid. This includes adhering to deadlines and ensuring that all information is truthful and complete. Misrepresentation or failure to comply with the guidelines can lead to legal repercussions.

How to obtain the Form 199 General Instructions

The Form 199 General Instructions can typically be obtained through the official IRS website or directly from the relevant tax authority in your state. It is essential to ensure that you are using the most current version of the instructions, as updates may occur. Additionally, many tax preparation software solutions provide access to these instructions as part of their services.

Filing Deadlines / Important Dates

Filing deadlines for the Form 199 are crucial for maintaining compliance. Typically, the form must be submitted by a specific date each year, which aligns with the tax filing deadline for businesses. It is important to check the current year's deadlines, as they may vary. Missing these deadlines can result in penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form 199 can be done through various methods, depending on your preference and the guidelines provided in the general instructions. Options typically include:

- Online submission through the IRS e-file system or approved tax preparation software.

- Mailing a physical copy of the form to the designated IRS address.

- In-person submission at local IRS offices, where available.

Key elements of the Form 199 General Instructions

Understanding the key elements of the Form 199 General Instructions is essential for accurate completion. These elements include:

- Detailed explanations of each section of the form.

- Specific requirements for documentation and supporting materials.

- Guidelines for calculating taxable income and allowable deductions.

- Instructions for reporting any additional information required by the IRS.

Quick guide on how to complete form 199 general instructions

Easily Prepare Form 199 General Instructions on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Form 199 General Instructions on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to Edit and eSign Form 199 General Instructions Effortlessly

- Find Form 199 General Instructions and select Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or errors requiring new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 199 General Instructions to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 199 general instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Form 199 General Instructions?

Form 199 General Instructions provide essential guidelines for completing the California Nonprofit Corporation tax return. This document outlines the necessary information required and ensures compliance with state regulations, making it vital for nonprofit organizations.

-

How can airSlate SignNow assist with completing Form 199?

airSlate SignNow allows you to easily fill out and electronically sign Form 199 by providing a user-friendly platform that streamlines the document preparation process. With our solution, you can ensure all necessary fields are completed accurately, following the Form 199 General Instructions.

-

What features of airSlate SignNow support compliance with Form 199 General Instructions?

airSlate SignNow offers features such as customizable templates and automatic reminders to assist you in adhering to Form 199 General Instructions. These features help you stay organized and ensure timely submissions, reducing the risk of errors or compliance issues.

-

Is there a cost associated with using airSlate SignNow for Form 199?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs, making it a cost-effective solution for managing forms like Form 199. By leveraging our platform, you can save time and resources while ensuring compliance with Form 199 General Instructions.

-

Can airSlate SignNow integrate with other software to help with Form 199?

Absolutely! airSlate SignNow seamlessly integrates with various applications like CRM systems and cloud storage services, enhancing your workflow related to Form 199. These integrations allow for smooth document management and storage while following the Form 199 General Instructions.

-

What are the benefits of using airSlate SignNow for nonprofits?

Using airSlate SignNow helps nonprofits efficiently manage their documentation processes, including Form 199 compliance. With its easy eSigning features and compliance support, you can save time, reduce paperwork, and focus more on your mission while following Form 199 General Instructions.

-

How does airSlate SignNow ensure security when handling Form 199 documents?

airSlate SignNow prioritizes security with advanced encryption protocols and strict access controls, ensuring that your Form 199 and other sensitive documents are protected. Compliance with industry standards helps maintain the confidentiality and integrity of your data while complying with Form 199 General Instructions.

Get more for Form 199 General Instructions

Find out other Form 199 General Instructions

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy