RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR Form

What is the retail sales income and expense worksheet year

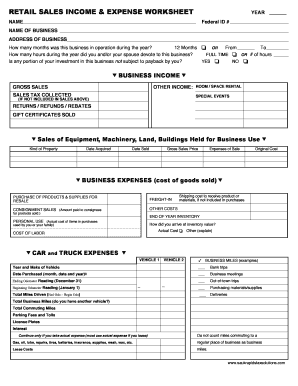

The retail sales income and expense worksheet year is a financial document designed for businesses to track their income and expenses related to retail activities over a specific year. This worksheet helps business owners maintain accurate financial records, which are essential for budgeting, tax preparation, and financial analysis. By organizing income and expenses, businesses can better understand their profitability and make informed decisions moving forward.

How to use the retail sales income and expense worksheet year

To effectively use the retail sales income and expense worksheet year, start by gathering all relevant financial documents, including sales receipts, invoices, and expense reports. Input your total sales income in the designated section, ensuring you account for all revenue streams. Next, list all expenses, such as inventory costs, rent, utilities, and payroll. By categorizing these expenses, you can gain insights into your spending patterns. Regularly updating this worksheet throughout the year can help you stay on top of your financial health.

Steps to complete the retail sales income and expense worksheet year

Completing the retail sales income and expense worksheet year involves several key steps:

- Gather all financial documents, including sales records and receipts.

- Enter your total sales income in the appropriate section of the worksheet.

- List all expenses related to your retail operations, categorizing them for clarity.

- Calculate the total expenses and subtract this amount from your total income to determine your net profit or loss.

- Review the completed worksheet for accuracy and make any necessary adjustments.

Key elements of the retail sales income and expense worksheet year

Several key elements are essential for the retail sales income and expense worksheet year:

- Total Sales Income: The overall revenue generated from retail sales.

- Expense Categories: Different types of expenses, such as cost of goods sold, operating expenses, and administrative costs.

- Net Profit or Loss: The difference between total income and total expenses, indicating the financial performance of the business.

- Time Period: The specific year for which the worksheet is prepared, providing a clear financial snapshot.

Legal use of the retail sales income and expense worksheet year

The retail sales income and expense worksheet year serves a legal purpose, especially during tax season. It provides a documented record of income and expenses, which can be essential for tax filings. Accurate completion of this worksheet ensures compliance with IRS regulations and can be used as evidence in case of audits. Maintaining this document helps businesses fulfill their legal obligations regarding financial reporting and tax payments.

Examples of using the retail sales income and expense worksheet year

Businesses can utilize the retail sales income and expense worksheet year in various scenarios. For instance, a small retail shop can track monthly sales and expenses to identify peak sales periods and manage inventory effectively. A seasonal business may use the worksheet to evaluate performance during different times of the year, allowing for better financial planning. Additionally, a startup can leverage this worksheet to monitor initial expenses against income, helping to establish a sustainable business model.

Quick guide on how to complete retail sales income amp expense worksheet year

Complete RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without interruptions. Manage RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR on any platform using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The simplest way to edit and eSign RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR effortlessly

- Obtain RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the retail sales income amp expense worksheet year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR?

A RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR is a structured tool designed to help businesses track their sales income and associated expenses over the course of a year. This worksheet allows retailers to monitor their financial performance, streamline budgeting, and improve their overall financial health.

-

How can the RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR benefit my business?

Utilizing the RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR can provide several benefits, including enhanced financial visibility and accurate cash flow management. It helps businesses identify trends, uncover potential cost savings, and make informed decisions that lead to better profitability.

-

Is the RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR easy to use?

Yes, the RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR is designed to be user-friendly, making it accessible for anyone, regardless of their accounting background. With clear sections for income and expenses, it simplifies the process of tracking your financials throughout the year.

-

What features are included in the RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR?

The RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR typically includes features such as customizable categories for income and expenses, monthly tracking templates, and summary sections for annual review. These features help ensure comprehensive financial management for retail businesses.

-

Can I integrate the RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR with other tools?

Absolutely! The RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR can be easily integrated with various accounting and financial management software. This allows for seamless data transfer and reduces the need for manual entry to streamline your accounting processes.

-

What is the pricing structure for the RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR?

Pricing for the RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR typically varies based on the software solution you choose. Many platforms offer subscription models that provide access to the worksheet along with additional tools and resources for a fixed monthly or annual fee.

-

How can I access the RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR?

You can access the RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR through various online platforms, including airSlate SignNow. Simply sign up for an account, and you can easily download or manage your worksheet within the platform.

Get more for RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR

Find out other RETAIL SALES INCOME Amp EXPENSE WORKSHEET YEAR

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document