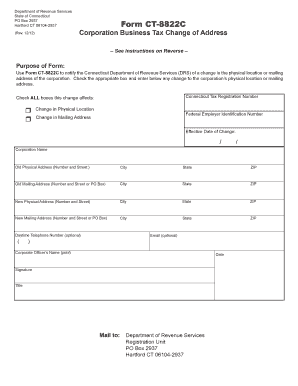

Ct Form 8822c

What is the Ct Form 8822c

The Ct Form 8822c is a tax form used by businesses and individuals in Connecticut to notify the Internal Revenue Service (IRS) of a change in their address. This form is essential for ensuring that all tax-related correspondence and documentation are sent to the correct location. It is particularly important for maintaining accurate records with the IRS and avoiding potential issues related to missed communications or deadlines.

How to use the Ct Form 8822c

Using the Ct Form 8822c involves a straightforward process. First, you need to download the form from the IRS website or obtain it through authorized sources. After acquiring the form, fill in the required information, including your old address, new address, and taxpayer identification number. Ensure that all details are accurate to prevent any complications. Once completed, you can submit the form electronically or via mail, depending on your preference and the guidelines provided by the IRS.

Steps to complete the Ct Form 8822c

Completing the Ct Form 8822c requires careful attention to detail. Follow these steps for a smooth process:

- Download the Ct Form 8822c from the IRS website.

- Provide your old address in the designated section.

- Enter your new address accurately, ensuring it matches your current residence.

- Include your taxpayer identification number, which may be your Social Security number or Employer Identification Number.

- Review the form for any errors or omissions.

- Sign and date the form to validate your submission.

- Submit the completed form electronically or mail it to the appropriate IRS address.

Legal use of the Ct Form 8822c

The legal use of the Ct Form 8822c is crucial for compliance with IRS regulations. By notifying the IRS of your address change, you help ensure that all tax-related documents are sent to the correct location. This form is legally binding, meaning that any inaccuracies or failure to submit it could lead to complications, such as missed tax notifications or penalties. It is important to keep a copy of the submitted form for your records as proof of your address change.

Filing Deadlines / Important Dates

Filing deadlines for the Ct Form 8822c are essential to consider to avoid any penalties. Generally, it is advisable to submit the form as soon as you change your address. While there is no specific deadline for filing the form, timely submission ensures that the IRS has your updated information before important tax deadlines, such as filing your annual tax return. Keeping track of these dates helps maintain compliance and avoid potential issues with your tax filings.

Form Submission Methods (Online / Mail / In-Person)

The Ct Form 8822c can be submitted through various methods to accommodate different preferences. You can file the form online using the IRS e-File system, which provides a quick and efficient way to notify the IRS of your address change. Alternatively, you can print the completed form and mail it to the appropriate IRS address. In some cases, individuals may prefer to deliver the form in person at their local IRS office, although this is less common. Each method has its advantages, so choose the one that best fits your needs.

Quick guide on how to complete ct form 8822c

Complete Ct Form 8822c seamlessly on any device

Managing documents online has gained popularity among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage Ct Form 8822c on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Ct Form 8822c effortlessly

- Acquire Ct Form 8822c and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight key sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ct Form 8822c and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct form 8822c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Ct Form 8822c?

Ct Form 8822c is a form used by businesses in Connecticut to notify the Department of Revenue Services (DRS) of a change in their business address. This form is essential for ensuring that correspondence and tax documents signNow your updated location. Completing the Ct Form 8822c promptly helps avoid delays or complications with your tax filings.

-

How can airSlate SignNow help with filing Ct Form 8822c?

airSlate SignNow provides a user-friendly platform to easily complete and eSign your Ct Form 8822c. Our solution allows you to fill out the form electronically, ensuring accuracy and saving time. You can also securely share the completed form with relevant parties or submit it directly to the DRS.

-

What are the benefits of using airSlate SignNow for Ct Form 8822c?

Using airSlate SignNow to manage your Ct Form 8822c helps streamline the process of filing important documents. Our platform enhances efficiency through electronic signatures and templates, which reduce paperwork and facilitate faster submissions. Additionally, it ensures that your documents remain secure and accessible from any device.

-

Is there a cost associated with using airSlate SignNow for Ct Form 8822c?

Yes, there are various pricing plans available for using airSlate SignNow, including options suitable for businesses of all sizes. Our pricing is transparent and designed to provide cost-effective solutions for efficiently managing forms like Ct Form 8822c. You can find a plan that fits your business needs without compromising on essential features.

-

Can I use airSlate SignNow to create other tax-related documents like Ct Form 8822c?

Absolutely! airSlate SignNow allows you to create, manage, and eSign a variety of tax-related documents, not just the Ct Form 8822c. Our platform supports multiple document types, making it a versatile tool for all your business documentation needs. You can efficiently handle everything from tax forms to contracts with ease.

-

Does airSlate SignNow integrate with other software for handling Ct Form 8822c?

Yes, airSlate SignNow offers integrations with a wide range of software applications that can assist with the management of your Ct Form 8822c and other business processes. These integrations can help connect your document workflow with accounting, CRM, and productivity tools, creating a seamless experience. Explore our integrations to find the best fit for your business.

-

What security measures does airSlate SignNow implement for Ct Form 8822c?

airSlate SignNow prioritizes the security of your documents, including the Ct Form 8822c. Our platform uses encryption and secure access protocols to protect sensitive information. You can confidently sign, send, and store your forms knowing that they are safeguarded against unauthorized access.

Get more for Ct Form 8822c

- Greeley pet license form

- Sample birth affidavit by relative form

- Reinforcement worksheet answer key form

- Service record for private school teachers form

- Application form for life saving drugs cghs pdf

- Informal language assessment pdf

- Jv 365 termination of juvenile court jurisdictionnonminor form

- Name tag services tate student center uga form

Find out other Ct Form 8822c

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History