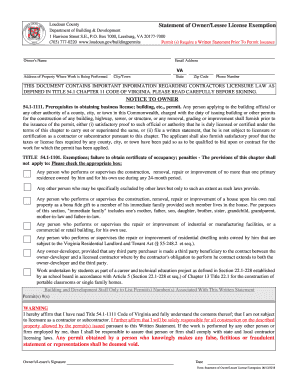

Loudoun County Statement of Owner Form

What is the Loudoun County Statement of Owner

The Loudoun County Statement of Owner is a legal document used by business owners in Loudoun County, Virginia, to declare ownership of a business entity. This form is essential for various purposes, including establishing the legal identity of the business and ensuring compliance with local regulations. It typically includes details such as the owner's name, business name, and address, as well as the nature of the business operations. The statement serves as a formal declaration that can be referenced in legal and financial contexts.

How to use the Loudoun County Statement of Owner

To effectively use the Loudoun County Statement of Owner, individuals must first ensure they have the correct version of the form. After obtaining the form, fill it out completely, providing accurate information about the business and its ownership. Once completed, the form must be submitted to the appropriate local authority, which may include the county clerk's office or a similar entity. This submission can help in obtaining necessary licenses and permits, as well as in establishing the business's legal standing.

Steps to complete the Loudoun County Statement of Owner

Completing the Loudoun County Statement of Owner involves several key steps:

- Obtain the latest version of the form from the appropriate local authority.

- Fill in the required information, including the owner's name, business name, and address.

- Provide a brief description of the business activities.

- Review the form for accuracy and completeness.

- Sign and date the form to certify the information provided.

- Submit the completed form to the designated office, either in person or online, if available.

Legal use of the Loudoun County Statement of Owner

The Loudoun County Statement of Owner is legally binding once it is properly completed and submitted. It is important for business owners to understand that this document may be required for various legal processes, including opening a business bank account, applying for loans, or entering contracts. Additionally, the statement can be used as evidence of ownership in disputes or legal proceedings, making its accurate completion crucial for protecting business interests.

Key elements of the Loudoun County Statement of Owner

Several key elements must be included in the Loudoun County Statement of Owner to ensure its validity:

- Owner's Name: The full legal name of the individual or entity that owns the business.

- Business Name: The registered name under which the business operates.

- Business Address: The physical location of the business.

- Description of Business: A brief overview of the services or products offered by the business.

- Signature: The owner's signature, affirming the accuracy of the information provided.

Who Issues the Form

The Loudoun County Statement of Owner is typically issued by the Loudoun County Clerk's Office or a similar local government agency responsible for business registrations. It is advisable for business owners to check with the specific office to ensure they are using the correct form and to obtain any additional instructions regarding submission and compliance.

Quick guide on how to complete loudoun county statement of owner

Complete Loudoun County Statement Of Owner effortlessly on any device

The management of online documents has become increasingly prevalent among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without any delays. Manage Loudoun County Statement Of Owner on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to edit and eSign Loudoun County Statement Of Owner seamlessly

- Find Loudoun County Statement Of Owner and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Underline essential sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, monotonous form searching, or errors that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Loudoun County Statement Of Owner and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loudoun county statement of owner

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Loudoun County statement of owner?

A Loudoun County statement of owner is a legal document that identifies the owner of a business operating in Loudoun County. It serves as a public record that ensures transparency regarding business ownership. This document is essential for compliance and can be easily processed using airSlate SignNow.

-

How can I obtain a Loudoun County statement of owner?

To obtain a Loudoun County statement of owner, you must fill out the application form available on the Loudoun County government’s website. Once completed, you can submit it online or in person. Using airSlate SignNow can simplify this process with eSignature options and document management features.

-

What features does airSlate SignNow offer for processing a Loudoun County statement of owner?

airSlate SignNow offers a range of features for processing a Loudoun County statement of owner, including customizable templates, secure eSignature capabilities, and status tracking for documents. These tools streamline the signing process, making it efficient and user-friendly for individuals and businesses alike.

-

Is airSlate SignNow cost-effective for managing Loudoun County statement of owner documents?

Yes, airSlate SignNow provides an affordable solution for managing Loudoun County statement of owner documents. With various pricing plans tailored for different business sizes, it allows you to choose a plan that fits your needs without sacrificing quality or functionality.

-

Are there any integrations available with airSlate SignNow for handling Loudoun County statement of owner forms?

Absolutely! airSlate SignNow integrates seamlessly with various software applications such as CRM and accounting tools. These integrations enable you to manage your Loudoun County statement of owner documents within your existing workflows, enhancing productivity and organization.

-

Can I customize my Loudoun County statement of owner template using airSlate SignNow?

Yes, airSlate SignNow allows for full customization of your Loudoun County statement of owner templates. You can modify fields, add logos, and adjust formatting to ensure that your document meets specific requirements or reflects your branding.

-

What are the benefits of using airSlate SignNow for a Loudoun County statement of owner?

Using airSlate SignNow for your Loudoun County statement of owner offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Additionally, the cloud-based platform ensures that your documents are accessible anytime, anywhere, facilitating a smoother business operation.

Get more for Loudoun County Statement Of Owner

Find out other Loudoun County Statement Of Owner

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure