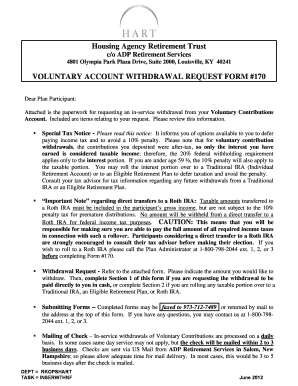

Hart Retirement Form

What is the Hart Retirement?

The Hart Retirement refers to a structured retirement plan designed for employees within housing agencies. This plan typically includes contributions from both the employee and the employer, aimed at providing financial security during retirement. Understanding the Hart Retirement is crucial for employees to ensure they maximize their benefits and comply with necessary regulations.

How to use the Hart Retirement

Utilizing the Hart Retirement involves several steps. First, employees should familiarize themselves with the specific guidelines and options available under the plan. This includes understanding contribution limits, investment choices, and withdrawal rules. Employees can manage their accounts online, allowing for easy tracking of contributions and growth over time. Regularly reviewing account statements and adjusting investment strategies can enhance retirement savings.

Steps to complete the Hart Retirement

Completing the Hart Retirement involves a straightforward process:

- Review eligibility criteria to ensure participation in the plan.

- Select contribution amounts based on personal financial goals.

- Choose investment options that align with risk tolerance and retirement timeline.

- Submit necessary forms electronically or via mail, ensuring all required information is included.

- Monitor account performance regularly and make adjustments as needed.

Legal use of the Hart Retirement

The Hart Retirement must comply with federal and state regulations to ensure its legality. This includes adherence to the Employee Retirement Income Security Act (ERISA), which sets minimum standards for retirement plans. Proper documentation and record-keeping are essential to demonstrate compliance and protect the rights of participants. Engaging with a legal or financial advisor can provide additional assurance regarding the plan's legal standing.

Eligibility Criteria

Eligibility for the Hart Retirement typically depends on employment status within a housing agency. Common criteria include:

- Full-time employment status.

- Minimum length of service, often ranging from six months to one year.

- Age restrictions, usually requiring participants to be at least 21 years old.

Employees should consult their agency's human resources department for specific eligibility requirements.

Required Documents

To enroll in the Hart Retirement, employees must prepare several documents, including:

- Proof of employment, such as an employment verification letter.

- Completed enrollment forms, which may include personal information and beneficiary designations.

- Tax identification information for reporting purposes.

Having these documents ready can streamline the enrollment process and ensure compliance with all requirements.

Quick guide on how to complete hart retire

Complete hart retire effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage housing agency retirement trust on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign hart retire effortlessly

- Obtain hart retirement and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all information carefully and click on the Done button to save your modifications.

- Choose how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow accommodates all your document management needs in just a few clicks from any device you prefer. Edit and eSign housing agency retirement trust and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to hart retirement

Create this form in 5 minutes!

How to create an eSignature for the housing agency retirement trust

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask hart retirement

-

What is a housing agency retirement trust?

A housing agency retirement trust is a specialized fund designed to help housing agencies manage retirement benefits for their employees. It ensures that the funds are allocated effectively to meet the future financial obligations of the agency. By leveraging airSlate SignNow, housing agencies can streamline document workflows related to these trusts.

-

How can airSlate SignNow assist with managing a housing agency retirement trust?

airSlate SignNow simplifies the management of housing agency retirement trusts by allowing agencies to effortlessly send and sign documents electronically. Its user-friendly interface ensures that all necessary forms and agreements are executed promptly, helping to maintain compliance and financial integrity. This optimizes the retirement trust management process.

-

What are the pricing options for using airSlate SignNow for housing agency retirement trust documentation?

airSlate SignNow offers flexible pricing plans that cater to various organizational needs, including those managing housing agency retirement trusts. Pricing is based on the number of users and specific features required. Agencies can choose a plan that best fits their budget while ensuring effective management of retirement trust documents.

-

What features of airSlate SignNow are particularly beneficial for housing agency retirement trusts?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning, which are all beneficial for housing agency retirement trusts. These features enable agencies to quickly generate and manage trust-related documents efficiently. Additionally, robust security measures protect sensitive information throughout the process.

-

How does airSlate SignNow enhance collaboration on housing agency retirement trust documents?

With airSlate SignNow, collaboration on housing agency retirement trust documents is made seamless. Multiple stakeholders can review, comment, and eSign documents in real time, ensuring transparency and quick resolution of any issues. This streamlined collaboration enhances the efficiency of fund management and decision-making.

-

Is airSlate SignNow integration-friendly for housing agency retirement trust software?

Yes, airSlate SignNow is designed to seamlessly integrate with various software solutions commonly used by housing agencies. This includes platforms for financial management and HR, making it easier to synchronize data related to retirement trusts. Such integrations further enhance operational efficiency and data accuracy.

-

What are the key benefits of using airSlate SignNow for housing agency retirement trusts?

Utilizing airSlate SignNow for housing agency retirement trusts offers several benefits, including improved efficiency, reduced paperwork, and increased compliance. By streamlining document management processes, housing agencies can focus on their core mission of supporting community housing while ensuring that retirement fund obligations are met. This leads to better service and satisfaction for employees.

Get more for housing agency retirement trust

Find out other hart retire

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe