25 104 Annual Insurance Tax Report Surplus Lines 2015

What is the 25 104 Annual Insurance Tax Report Surplus Lines

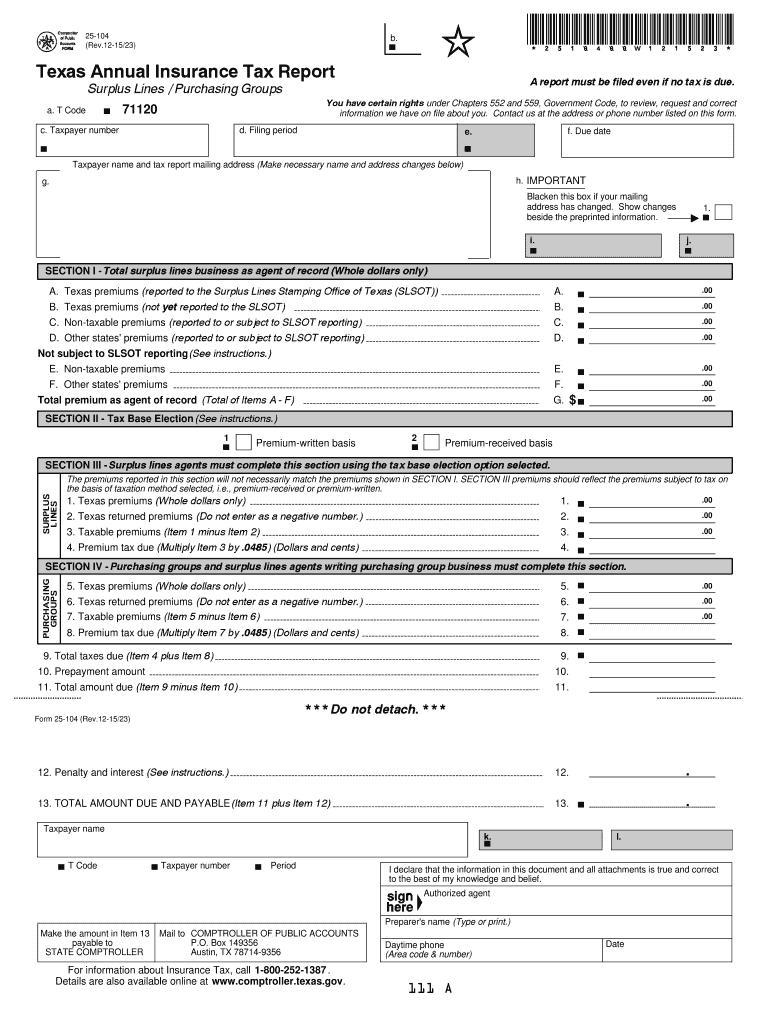

The 25 104 Annual Insurance Tax Report Surplus Lines is a crucial document for businesses engaged in surplus lines insurance. This form is used to report the premium taxes owed to state governments on surplus lines policies. Surplus lines insurance refers to coverage provided by non-admitted insurers, which are not licensed in the state where the policyholder resides. The report ensures that these businesses comply with state tax regulations and provides a comprehensive overview of their surplus lines transactions for the year.

Steps to complete the 25 104 Annual Insurance Tax Report Surplus Lines

Completing the 25 104 Annual Insurance Tax Report Surplus Lines involves several key steps:

- Gather necessary financial records, including total premiums written and any applicable deductions.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total tax owed based on the premiums reported.

- Review the completed form for accuracy and compliance with state regulations.

- Submit the form electronically or via mail, depending on state requirements.

How to obtain the 25 104 Annual Insurance Tax Report Surplus Lines

The 25 104 Annual Insurance Tax Report Surplus Lines can typically be obtained from the state’s insurance department website or office. Many states provide downloadable forms in PDF format, which can be filled out electronically or printed for manual completion. It is important to ensure that you are using the most current version of the form, as requirements may change annually.

Filing Deadlines / Important Dates

Filing deadlines for the 25 104 Annual Insurance Tax Report Surplus Lines vary by state but generally fall on the last day of the month following the end of the tax year. For example, if your tax year ends on December 31, the report is typically due by January 31 of the following year. It is essential to check with your state’s insurance department for specific deadlines to avoid penalties.

Key elements of the 25 104 Annual Insurance Tax Report Surplus Lines

Key elements of the 25 104 Annual Insurance Tax Report Surplus Lines include:

- Identification information for the reporting entity, including name and address.

- Total premiums written for the reporting period.

- Details of any deductions or exemptions applicable.

- Calculation of the total tax liability based on reported premiums.

- Signature of the authorized representative certifying the accuracy of the information.

Legal use of the 25 104 Annual Insurance Tax Report Surplus Lines

The legal use of the 25 104 Annual Insurance Tax Report Surplus Lines is essential for compliance with state insurance regulations. Filing this report accurately and on time helps businesses avoid penalties and ensures that they meet their tax obligations. Additionally, the form serves as a record of the premiums collected and taxes paid, which can be important for audits and financial reporting.

Quick guide on how to complete 25 104 annual insurance tax report surplus lines

Your assistance manual on how to prepare your 25 104 Annual Insurance Tax Report Surplus Lines

If you’re interested in understanding how to create and submit your 25 104 Annual Insurance Tax Report Surplus Lines, below are some brief guidelines on making tax filing signNowly simpler.

To begin, you just need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document tool that enables you to modify, draft, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to modify details whenever necessary. Optimize your tax administration with advanced PDF editing, eSigning, and easy sharing options.

Follow the instructions below to complete your 25 104 Annual Insurance Tax Report Surplus Lines in no time:

- Create your account and start working on PDFs within minutes.

- Utilize our catalog to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your 25 104 Annual Insurance Tax Report Surplus Lines in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any inaccuracies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that paper filing can lead to increased errors and delayed refunds. Importantly, before e-filing your taxes, verify the IRS website for submission rules specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct 25 104 annual insurance tax report surplus lines

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the 25 104 annual insurance tax report surplus lines

How to make an eSignature for the 25 104 Annual Insurance Tax Report Surplus Lines online

How to make an electronic signature for the 25 104 Annual Insurance Tax Report Surplus Lines in Google Chrome

How to create an electronic signature for signing the 25 104 Annual Insurance Tax Report Surplus Lines in Gmail

How to generate an electronic signature for the 25 104 Annual Insurance Tax Report Surplus Lines from your mobile device

How to create an eSignature for the 25 104 Annual Insurance Tax Report Surplus Lines on iOS devices

How to generate an eSignature for the 25 104 Annual Insurance Tax Report Surplus Lines on Android

People also ask

-

What is the 25 104 Annual Insurance Tax Report Surplus Lines?

The 25 104 Annual Insurance Tax Report Surplus Lines is a crucial document for insurance professionals that outlines the surplus lines business conducted in a given year. This report ensures compliance with state regulations and helps businesses accurately report their tax obligations. Understanding this report is essential for maintaining your company’s good standing with state authorities.

-

How can airSlate SignNow assist with the 25 104 Annual Insurance Tax Report Surplus Lines?

airSlate SignNow simplifies the process of preparing and submitting the 25 104 Annual Insurance Tax Report Surplus Lines by providing a user-friendly platform for document management and eSigning. With our solution, you can easily collect signatures, track document status, and ensure that all necessary information is accurately included in your report. This saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 25 104 Annual Insurance Tax Report Surplus Lines?

Yes, airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. Our pricing is competitive and designed to provide a cost-effective solution for managing documents, including the 25 104 Annual Insurance Tax Report Surplus Lines. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer that are beneficial for the 25 104 Annual Insurance Tax Report Surplus Lines?

airSlate SignNow includes features such as customizable templates, secure document storage, and automated reminders, all of which are particularly beneficial for preparing the 25 104 Annual Insurance Tax Report Surplus Lines. Additionally, our platform supports multi-party signing, ensuring that all relevant stakeholders can easily review and sign off on documents without hassle.

-

Can airSlate SignNow integrate with other software for managing the 25 104 Annual Insurance Tax Report Surplus Lines?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, making it easier to manage all aspects of the 25 104 Annual Insurance Tax Report Surplus Lines. Whether you use accounting software or CRM systems, our integrations ensure that your data flows smoothly between tools, enhancing your workflow efficiency.

-

How does airSlate SignNow ensure the security of the 25 104 Annual Insurance Tax Report Surplus Lines?

Security is a top priority at airSlate SignNow. We implement industry-leading encryption protocols and secure cloud storage to protect your documents, including the 25 104 Annual Insurance Tax Report Surplus Lines. Additionally, our platform complies with various regulations, ensuring that your sensitive information remains safe and confidential.

-

What are the benefits of using airSlate SignNow for the 25 104 Annual Insurance Tax Report Surplus Lines?

Using airSlate SignNow for the 25 104 Annual Insurance Tax Report Surplus Lines streamlines your document management process, reduces turnaround times, and minimizes the risk of errors. Our platform enhances collaboration among team members and clients, allowing for a more efficient filing process. With airSlate SignNow, you can focus on your business while we handle the complexities of document management.

Get more for 25 104 Annual Insurance Tax Report Surplus Lines

- Stylist pull request form

- Completing an airplane certificate of insurancer form

- Preliminary application nyc gov home nyc form

- Single song publishing agreement form

- Personal savings account application form first citizens bank

- Animal data transfer form

- Lock out agreement template form

- Lockout agreement template form

Find out other 25 104 Annual Insurance Tax Report Surplus Lines

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe