Texas Annual Insurance Tax Report 25 104 2018-2026

What is the Texas Annual Insurance Tax Report 25-104

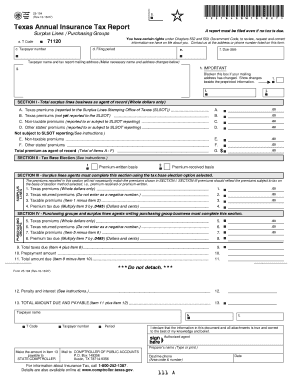

The Texas Annual Insurance Tax Report, commonly referred to as the 25-104 form, is a mandatory filing for insurance companies operating in Texas. This report is essential for documenting the surplus lines taxes owed to the state. It provides a comprehensive overview of the insurer's financial performance and compliance with state regulations. The form must be completed accurately to ensure that all tax obligations are met and to avoid penalties.

Key Elements of the Texas Annual Insurance Tax Report 25-104

The 25-104 form includes several key components that must be filled out correctly. These elements typically cover:

- Company Information: Name, address, and contact details of the insurance provider.

- Tax Calculation: Detailed breakdown of the surplus lines taxes owed based on the company's gross premiums.

- Financial Data: Information regarding the company's financial performance over the reporting period.

- Signature Section: Required signatures from authorized representatives to validate the report.

Steps to Complete the Texas Annual Insurance Tax Report 25-104

Completing the Texas Annual Insurance Tax Report involves several systematic steps:

- Gather all necessary financial documents and data related to surplus lines premiums.

- Access the official 25-104 form, either online or in a physical format.

- Fill out the form with accurate company information and tax calculations.

- Review the completed form for any errors or omissions.

- Obtain the required signatures from authorized personnel.

- Submit the form by the specified filing deadline, either electronically or via mail.

Filing Deadlines / Important Dates

Adhering to filing deadlines is crucial for compliance. The Texas Annual Insurance Tax Report must typically be submitted by the end of March each year. It is important to stay updated on any changes to these deadlines, as late submissions may incur penalties. Companies should mark their calendars and prepare their documents ahead of time to ensure timely filing.

Required Documents

To complete the Texas Annual Insurance Tax Report, certain documents are necessary. These may include:

- Financial statements for the reporting period.

- Records of all surplus lines premiums written.

- Previous tax filings for reference.

- Any additional documentation required by the Texas Department of Insurance.

Penalties for Non-Compliance

Failure to file the Texas Annual Insurance Tax Report on time or inaccuracies in the report can lead to significant penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest charges on late payments.

- Potential legal action for continued non-compliance.

Quick guide on how to complete 25 104 annual insurance tax report surplus lines purchasing groups

Your assistance manual on how to prepare your Texas Annual Insurance Tax Report 25 104

If you’re curious about how to generate and send your Texas Annual Insurance Tax Report 25 104, here are some concise guidelines on how to simplify tax declaration.

To initiate, simply register your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, create, and finalize your tax forms with ease. With its editor, you can alternate between text, checkboxes, and eSignatures and return to amend responses as necessary. Streamline your tax organization with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to finalize your Texas Annual Insurance Tax Report 25 104 in just a few minutes:

- Establish your account and start working on PDFs in moments.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Texas Annual Insurance Tax Report 25 104 in our editor.

- Complete the mandatory fillable areas with your information (text, numbers, check marks).

- Utilize the Sign Tool to append your legally-recognized eSignature (if required).

- Examine your document and correct any errors.

- Preserve changes, print your copy, send it to your recipient, and download it onto your device.

Utilize this manual to submit your taxes online with airSlate SignNow. Please remember that filing on paper can increase errors and postpone refunds. Before e-filing your taxes, ensure you review the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 25 104 annual insurance tax report surplus lines purchasing groups

Create this form in 5 minutes!

How to create an eSignature for the 25 104 annual insurance tax report surplus lines purchasing groups

How to make an eSignature for your 25 104 Annual Insurance Tax Report Surplus Lines Purchasing Groups online

How to generate an eSignature for your 25 104 Annual Insurance Tax Report Surplus Lines Purchasing Groups in Google Chrome

How to make an electronic signature for putting it on the 25 104 Annual Insurance Tax Report Surplus Lines Purchasing Groups in Gmail

How to generate an eSignature for the 25 104 Annual Insurance Tax Report Surplus Lines Purchasing Groups from your mobile device

How to make an electronic signature for the 25 104 Annual Insurance Tax Report Surplus Lines Purchasing Groups on iOS devices

How to generate an eSignature for the 25 104 Annual Insurance Tax Report Surplus Lines Purchasing Groups on Android devices

People also ask

-

What is a Texas insurance tax report?

A Texas insurance tax report is a document required by the state for insurance companies to report taxable activities and ensure compliance with Texas tax regulations. This report details premiums collected and helps in calculating the appropriate tax owed. Businesses must file this report accurately to avoid penalties.

-

How can airSlate SignNow help with preparing the Texas insurance tax report?

AirSlate SignNow simplifies the process of preparing the Texas insurance tax report by allowing users to easily send and eSign documents online. With our intuitive interface, you can gather necessary signatures and ensure that all information is compiled efficiently. This streamlines the workflow and reduces the chance of errors.

-

Is there a specific pricing model for businesses using airSlate SignNow for Texas insurance tax reports?

Yes, airSlate SignNow offers a flexible pricing model that caters to businesses of all sizes. Our plans are designed to be cost-effective, ensuring that you get the best value while preparing documents such as the Texas insurance tax report. You can choose from various subscription options tailored to your needs.

-

What features does airSlate SignNow offer for managing Texas insurance tax reports?

AirSlate SignNow provides essential features such as document templates, automated workflows, and secure eSigning which are beneficial for managing Texas insurance tax reports. These features enhance document tracking and collaboration, making it easier to gather the necessary information for your report.

-

Can I integrate airSlate SignNow with other accounting software for Texas insurance tax report management?

Absolutely! AirSlate SignNow supports integrations with a variety of popular accounting and tax software, enabling seamless management of your Texas insurance tax report data. This connectivity allows you to streamline your reporting process and ensure that all information is accurately reflected in your filings.

-

What benefits can I expect from using airSlate SignNow for my Texas insurance tax report?

Using airSlate SignNow for your Texas insurance tax report can signNowly enhance efficiency and accuracy. Our platform minimizes paperwork, speeds up document approval processes, and ensures secure transactions, which can result in timely and correct submissions to state authorities. This can ultimately help protect your business from compliance issues.

-

Is airSlate SignNow user-friendly for newcomers to Texas insurance tax reporting?

Yes, airSlate SignNow is designed to be user-friendly, even for those new to Texas insurance tax reporting. The platform features a simple interface and easy navigation, making it accessible for all users regardless of their technical expertise. Additionally, our customer support is available to assist with any questions.

Get more for Texas Annual Insurance Tax Report 25 104

- Tenancy application form single property applying for

- Attending dentist s statement macalester college macalester form

- Fmcsa dot forms

- Middle school reading literary terms form

- State bar of wisconsin form 3 quit claim deed land title

- Algebra 2 topics form

- Secured personal loan agreement template form

- Securities purchase agreement template form

Find out other Texas Annual Insurance Tax Report 25 104

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement