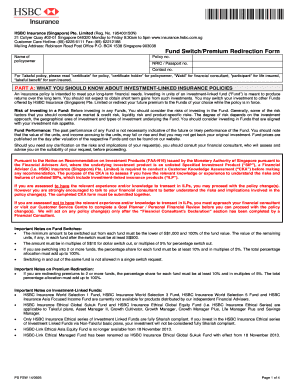

Hsbc Insurance Singapore Form

What is the Hsbc Insurance Singapore

The Hsbc Insurance Singapore refers to a range of insurance products offered by HSBC in Singapore. These products include life insurance, health insurance, travel insurance, and more, designed to meet various needs of individuals and families. Each policy typically provides coverage for specific risks, ensuring financial protection during unforeseen circumstances. Understanding the specifics of each insurance type is crucial for making informed decisions about personal and family financial security.

How to use the Hsbc Insurance Singapore

Using Hsbc Insurance Singapore involves several steps, starting with selecting the appropriate insurance product that aligns with your needs. After choosing a policy, you can apply online or through a financial advisor. Once your application is approved, you will receive your policy documents, which outline the coverage details, premium payments, and claims process. It is essential to review these documents carefully to understand your rights and responsibilities under the policy.

Steps to complete the Hsbc Insurance Singapore

Completing the Hsbc Insurance Singapore process typically includes the following steps:

- Identify your insurance needs and select the appropriate product.

- Gather necessary documents, such as identification and financial information.

- Fill out the application form accurately, providing all required details.

- Submit the application through the HSBC website or in person at a branch.

- Review the policy documents upon approval and make the first premium payment.

Legal use of the Hsbc Insurance Singapore

The legal use of Hsbc Insurance Singapore is governed by the terms and conditions outlined in the policy documents. These documents detail the rights and obligations of both the insurer and the insured. It is important to ensure compliance with all legal requirements, including timely premium payments and adherence to the claims process, to maintain coverage and avoid potential disputes.

Key elements of the Hsbc Insurance Singapore

Key elements of Hsbc Insurance Singapore include:

- Coverage Types: Different insurance products offer varying levels of coverage, such as life, health, and property insurance.

- Premiums: The amount paid for insurance coverage, which can vary based on the policy type and individual risk factors.

- Exclusions: Specific situations or conditions not covered by the policy, which are important to understand before purchasing.

- Claims Process: The procedure for filing a claim, including required documentation and timelines.

Eligibility Criteria

Eligibility criteria for Hsbc Insurance Singapore can vary by product but generally include factors such as age, residency status, and health conditions. Potential policyholders may need to provide personal information and undergo medical assessments, depending on the type of insurance selected. Understanding these criteria is essential to ensure that you qualify for the desired coverage.

Quick guide on how to complete hsbc insurance singapore

Set up Hsbc Insurance Singapore effortlessly on any gadget

Web-based document administration has become favored among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any hold-ups. Manage Hsbc Insurance Singapore on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to edit and electronically sign Hsbc Insurance Singapore without hassle

- Obtain Hsbc Insurance Singapore and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to apply your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign Hsbc Insurance Singapore for effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hsbc insurance singapore

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is HSBC Insurance Singapore?

HSBC Insurance Singapore offers a variety of insurance products tailored to meet your needs, including life, health, and general insurance. With a strong financial backing and a commitment to customer service, HSBC aims to provide comprehensive coverage options. Understanding these offerings can help you choose the right policy for your financial security.

-

How can I apply for HSBC Insurance Singapore?

To apply for HSBC Insurance Singapore, you can visit their website and fill out an online application or contact an HSBC insurance representative. It is advisable to have all necessary documents ready, such as identification and medical records if needed. Choosing the right insurance option is simple and facilitated by HSBC's customer service team.

-

What are the pricing options for HSBC Insurance Singapore policies?

HSBC Insurance Singapore provides a range of pricing options depending on the type and coverage of the insurance policy you select. Premiums can vary based on factors such as age, health, and desired coverage amount. It’s best to compare different plans and consult with an HSBC insurance advisor to find a plan that fits your budget.

-

What benefits does HSBC Insurance Singapore offer?

HSBC Insurance Singapore offers several key benefits, including comprehensive coverage, personalized service, and flexible payment plans. Their policies are designed to provide peace of mind by ensuring that you and your loved ones are financially protected in times of need. Additionally, there are options for riders that can enhance your coverage further.

-

Are there any discounts available for HSBC Insurance Singapore policies?

Yes, HSBC Insurance Singapore may offer various discounts for bundling policies, maintaining a claim-free record, or for purchasing online. It's important to inquire directly with HSBC representatives about current offers, as these can vary throughout the year. Getting the best rates is achievable through well-informed discussions with the insurance advisors.

-

How does HSBC Insurance Singapore integrate with online document signing?

HSBC Insurance Singapore supports digital processes, and customers can conveniently eSign necessary documents through platforms like airSlate SignNow. This integration simplifies the application and policy management process while ensuring that all transactions are secure and efficient. Using eSigning can save time and enhance the customer experience.

-

What types of insurance can I find with HSBC Insurance Singapore?

HSBC Insurance Singapore offers a diverse range of insurance types, including life insurance, health insurance, travel insurance, and home insurance. Each type provides various policies tailored to individual needs and circumstances. Understanding the differences between these options can help you make a more informed decision about which coverage is right for you.

Get more for Hsbc Insurance Singapore

- 2022 form 2350sp application for extension of time to file us income tax return spanish version

- 2022 form 4562 depreciation and amortization including information on listed property

- Form 5405 rev november 2022 repayment of the first time homebuyer credit

- Publication 5084 rev 12 2022 irs tax forms

- 2022 instructions for form 1099 misc internal revenue service fill

- About form 8801 credit for prior year minimum tax individuals

- 22 internal revenue service department of the treasury form

- Partners distributive share itemsinternational irs tax forms

Find out other Hsbc Insurance Singapore

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself