Ca 3587 Form

What is the CA 3587?

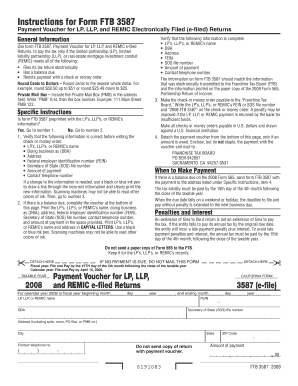

The CA 3587, also known as the California Form 3587, is a document used primarily for tax purposes within the state of California. This form is essential for taxpayers who need to report specific financial information to the California Franchise Tax Board (FTB). It is particularly relevant for individuals and businesses that are subject to California's income tax regulations. Understanding the purpose and requirements of the CA 3587 is crucial for ensuring compliance with state tax laws.

How to use the CA 3587

Using the CA 3587 requires a clear understanding of the information needed to complete the form accurately. Taxpayers should gather all necessary financial documents, such as income statements, deductions, and credits applicable to the tax year in question. Once all relevant information is compiled, the form can be filled out. It is important to follow the instructions provided on the form carefully to ensure that all sections are completed correctly, minimizing the risk of errors that could lead to penalties.

Steps to complete the CA 3587

Completing the CA 3587 involves several key steps:

- Gather all necessary financial documents, including income statements and any applicable deductions.

- Download the CA 3587 form from the California Franchise Tax Board website or obtain a physical copy.

- Fill out the form, ensuring that all required fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or via mail, following the submission guidelines provided by the FTB.

Legal use of the CA 3587

The CA 3587 is legally binding when completed and submitted in accordance with California tax laws. To ensure its legal standing, it is vital that taxpayers adhere to the requirements set forth by the California Franchise Tax Board. This includes providing accurate information and submitting the form by the designated deadlines. Failure to comply with these regulations may result in penalties or other legal consequences.

Key elements of the CA 3587

Several key elements are essential to the CA 3587, including:

- Taxpayer Information: This section requires personal details, such as name, address, and Social Security number or taxpayer identification number.

- Income Reporting: Taxpayers must report all sources of income, including wages, interest, and dividends.

- Deductions and Credits: This section allows taxpayers to claim any applicable deductions or credits that may reduce their tax liability.

- Signature: The form must be signed by the taxpayer to validate the information provided.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the CA 3587. Typically, the form must be submitted by April fifteenth of the tax year. However, extensions may be available under certain circumstances. Taxpayers should check the California Franchise Tax Board's website for any updates or changes to deadlines, as well as for specific guidance regarding extensions and late submissions.

Quick guide on how to complete ca 3587 16985731

Complete Ca 3587 effortlessly on any gadget

Managing documents online has gained popularity among organizations and individuals. It presents an ideal environmentally friendly option to traditional printed and signed documents, as you can obtain the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without hold-ups. Handle Ca 3587 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-centered procedure today.

How to modify and eSign Ca 3587 effortlessly

- Locate Ca 3587 and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text (SMS), an invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in a few clicks from any gadget of your choice. Modify and eSign Ca 3587 to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca 3587 16985731

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3587 and how can it be used in airSlate SignNow?

Form 3587 is an essential document used for various purposes within organizations, including compliance and data management. With airSlate SignNow, you can easily integrate form 3587 into your digital workflows, ensuring quick eSigning and efficient document handling.

-

Does airSlate SignNow offer templates for form 3587?

Yes, airSlate SignNow provides customizable templates for form 3587, allowing users to tailor the document to their specific needs. You can effortlessly create, edit, and manage these templates for streamlined operations.

-

What are the pricing options for using form 3587 with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to form 3587 functionalities. Depending on your business size and requirements, you can choose a plan that best fits your budget while optimizing your document management processes.

-

What features does airSlate SignNow provide for form 3587?

airSlate SignNow offers various features for form 3587, including real-time collaboration, secure eSigning, and automated workflows. These features help enhance productivity and ensure that your form 3587 is processed quickly and efficiently.

-

Can form 3587 be integrated with other applications via airSlate SignNow?

Absolutely! airSlate SignNow allows for seamless integration with popular applications, enabling users to connect form 3587 workflows with systems like Salesforce, Google Drive, and others. This integration capability enhances your overall document management strategy.

-

How secure is the data on form 3587 when using airSlate SignNow?

Security is paramount at airSlate SignNow. When using form 3587, your data is protected with advanced encryption, secure access controls, and regular security audits to ensure compliance with regulatory standards.

-

What benefits does airSlate SignNow provide for managing form 3587?

Using airSlate SignNow for managing form 3587 streamlines your document process, reduces turnaround time, and enhances accuracy. This cost-effective solution allows teams to focus on important tasks while ensuring that form 3587 is handled efficiently.

Get more for Ca 3587

Find out other Ca 3587

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online