Ira Voucher Form

What is the Ira Voucher Form

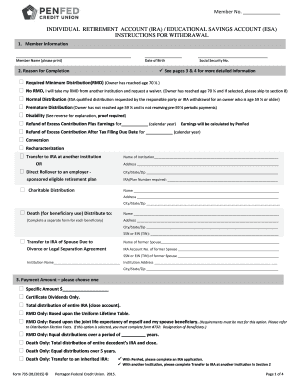

The Ira Voucher Form is a crucial document used in the context of Individual Retirement Accounts (IRAs) in the United States. This form typically serves as a request for the distribution or transfer of funds within an IRA. It is essential for individuals looking to manage their retirement savings effectively, ensuring compliance with IRS regulations. The form may include various sections that require specific information, such as account details, the amount to be withdrawn or transferred, and the reason for the transaction.

How to use the Ira Voucher Form

Using the Ira Voucher Form involves several straightforward steps. First, ensure you have the correct version of the form, as variations may exist depending on your financial institution. Next, carefully fill out the required fields, providing accurate information to avoid processing delays. After completing the form, you may need to sign it, either electronically or with a traditional signature, depending on your submission method. Finally, submit the form according to the instructions provided by your financial institution, which may include options for online submission, mailing, or in-person delivery.

Steps to complete the Ira Voucher Form

Completing the Ira Voucher Form requires attention to detail. Follow these steps to ensure accuracy:

- Gather necessary documents, such as your IRA account number and identification.

- Fill in your personal information, including your name, address, and Social Security number.

- Specify the type of transaction you are requesting, whether it is a withdrawal, transfer, or rollover.

- Indicate the amount you wish to withdraw or transfer.

- Review the form for any errors or omissions before signing.

- Submit the form according to your institution's guidelines.

Legal use of the Ira Voucher Form

The legal use of the Ira Voucher Form is governed by IRS regulations that dictate how funds can be distributed or transferred within IRAs. To ensure compliance, it is important to understand the rules surrounding withdrawals, rollovers, and transfers. For instance, there are specific tax implications associated with early withdrawals, and certain transactions may require additional documentation. Utilizing the form correctly helps maintain the tax-advantaged status of your retirement savings and avoids potential penalties.

Key elements of the Ira Voucher Form

Several key elements are essential to the Ira Voucher Form. These include:

- Account Information: Details about the IRA account from which funds will be withdrawn or transferred.

- Transaction Type: Clear indication of whether the request is for a withdrawal, transfer, or rollover.

- Amount: The specific dollar amount being requested.

- Signature: Required to authorize the transaction, confirming that the requestor understands the implications.

Filing Deadlines / Important Dates

Filing deadlines for the Ira Voucher Form can vary based on the type of transaction and the financial institution involved. Generally, it is advisable to submit the form well in advance of any tax deadlines or retirement account deadlines to ensure timely processing. For example, if you are requesting a distribution that may affect your tax obligations for the year, consider submitting the form at least a few weeks before the tax filing deadline. Always check with your financial institution for specific deadlines related to your transactions.

Quick guide on how to complete ira voucher form

Prepare Ira Voucher Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary template and securely store it online. airSlate SignNow provides all the features required to create, modify, and electronically sign your documents quickly without delays. Manage Ira Voucher Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Ira Voucher Form with ease

- Find Ira Voucher Form and click on Obtain Form to begin.

- Utilize the resources we offer to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes just moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Finish button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your preference. Edit and eSign Ira Voucher Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ira voucher form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Ira Voucher Form and how does it work?

The Ira Voucher Form is a document that facilitates the withdrawal of funds from an Individual Retirement Account (IRA) for various purposes. Using airSlate SignNow, you can easily create, send, and eSign your Ira Voucher Form, ensuring the process is quick and efficient. Our platform streamlines the entire workflow, making it user-friendly and accessible for everyone.

-

Is there a cost associated with using the Ira Voucher Form feature?

airSlate SignNow offers various pricing plans that include the ability to create and manage your Ira Voucher Form. Depending on the plan you choose, you can access different features that enhance your eSignature experience. We recommend reviewing our pricing page to select a plan that best suits your organization's needs.

-

What features does airSlate SignNow offer for managing the Ira Voucher Form?

Our platform includes features like customizable templates, automated workflows, and secure cloud storage specifically for managing the Ira Voucher Form. You can easily track the document's status, send reminders, and receive notifications once the form is signed. These features simplify the management of all your documentation.

-

Can I integrate other applications with my Ira Voucher Form in airSlate SignNow?

Yes, airSlate SignNow allows seamless integration with various applications to enhance your workflow when using the Ira Voucher Form. This includes popular CRM and storage solutions, making it easy to sync your data and manage documents efficiently. Our API also allows for custom integrations tailored to your specific business needs.

-

What are the benefits of using the Ira Voucher Form with airSlate SignNow?

By using the Ira Voucher Form with airSlate SignNow, you can signNowly reduce the time it takes to process documents. The eSigning process is secure and legally binding, ensuring compliance with regulations. Additionally, our platform is designed to enhance collaboration among team members and clients while maintaining data privacy.

-

Is it easy to eSign an Ira Voucher Form using airSlate SignNow?

Absolutely! airSlate SignNow offers a straightforward and intuitive interface for eSigning your Ira Voucher Form. Users can sign the document on any device, whether it's a desktop, tablet, or smartphone, ensuring that you can complete transactions anytime, anywhere.

-

How does airSlate SignNow ensure the security of my Ira Voucher Form?

Security is a top priority at airSlate SignNow. We use encryption protocols to protect your Ira Voucher Form and all sensitive data during transmission and storage. Additionally, access controls and audit trails help ensure that only authorized individuals can access important documents.

Get more for Ira Voucher Form

Find out other Ira Voucher Form

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online