Non Employee Invoice UH Form NE INV Hawaii

What is the Non Employee Invoice UH Form NE INV Hawaii

The Non Employee Invoice UH Form NE INV Hawaii is a specific document used primarily by individuals or entities that provide services without being classified as employees. This form is essential for reporting income for tax purposes and ensuring that payments made to non-employees are documented accurately. It is particularly relevant for freelancers, contractors, and consultants who work with organizations in Hawaii.

How to use the Non Employee Invoice UH Form NE INV Hawaii

Using the Non Employee Invoice UH Form NE INV Hawaii involves several straightforward steps. First, ensure that you have all necessary information, including your name, address, and the details of the services provided. Fill out the form accurately, detailing the services rendered, the payment amount, and any applicable tax information. Once completed, submit the form to the appropriate entity for processing. This ensures that your income is reported correctly and that you receive timely payment.

Steps to complete the Non Employee Invoice UH Form NE INV Hawaii

Completing the Non Employee Invoice UH Form NE INV Hawaii requires attention to detail. Follow these steps:

- Gather your personal and business information, including your tax identification number.

- Clearly describe the services provided, including dates and hours worked.

- Specify the total amount due for the services rendered.

- Add any applicable taxes or deductions, if required.

- Review the form for accuracy before submission.

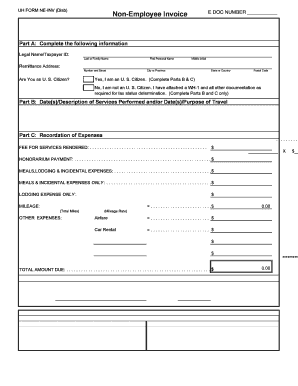

Key elements of the Non Employee Invoice UH Form NE INV Hawaii

The Non Employee Invoice UH Form NE INV Hawaii contains several key elements that are crucial for proper documentation. These include:

- Service Provider Information: Name, address, and contact details of the individual or business providing the service.

- Service Description: A detailed account of the services performed, including dates and duration.

- Payment Details: The total amount owed, including any applicable taxes.

- Signature: A signature line for both the service provider and the client to confirm agreement.

Legal use of the Non Employee Invoice UH Form NE INV Hawaii

The Non Employee Invoice UH Form NE INV Hawaii is legally recognized when filled out correctly and submitted in accordance with applicable laws. This form serves as a formal record of services provided and payments made, which can be important for tax reporting and compliance. It is essential to retain a copy of the completed form for your records, as it may be requested by tax authorities or for verification purposes.

Form Submission Methods

The Non Employee Invoice UH Form NE INV Hawaii can be submitted through various methods, depending on the requirements of the entity requesting the invoice. Common submission methods include:

- Online Submission: Many organizations allow for electronic submission through their platforms.

- Mail: You can print the completed form and send it via postal service.

- In-Person: Some entities may require you to deliver the form in person, especially for urgent matters.

Quick guide on how to complete non employee invoice uh form ne inv hawaii

Effortlessly Prepare Non Employee Invoice UH Form NE INV Hawaii on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly solution to conventional printed and signed paperwork, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Handle Non Employee Invoice UH Form NE INV Hawaii on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Non Employee Invoice UH Form NE INV Hawaii with Ease

- Locate Non Employee Invoice UH Form NE INV Hawaii and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Non Employee Invoice UH Form NE INV Hawaii and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the non employee invoice uh form ne inv hawaii

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Non Employee Invoice UH Form NE INV Hawaii?

The Non Employee Invoice UH Form NE INV Hawaii is a specific document required for processing payments to non-employee individuals or entities for services rendered. This form ensures that transactions comply with state regulations, making it essential for businesses in Hawaii.

-

How can airSlate SignNow help with the Non Employee Invoice UH Form NE INV Hawaii?

airSlate SignNow streamlines the processing of the Non Employee Invoice UH Form NE INV Hawaii by allowing users to easily create, send, and eSign documents electronically. This results in signNow time savings and ensures that your workflows remain compliant and efficient.

-

Is there a cost associated with using airSlate SignNow for the Non Employee Invoice UH Form NE INV Hawaii?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Pricing details are available on our website, and we offer various plans to suit different needs, ensuring you benefit from handling your Non Employee Invoice UH Form NE INV Hawaii efficiently.

-

What features does airSlate SignNow offer for the Non Employee Invoice UH Form NE INV Hawaii?

airSlate SignNow offers features like customizable templates, an easy-to-use eSignature tool, document tracking, and secure cloud storage. These features collectively enhance the process of managing the Non Employee Invoice UH Form NE INV Hawaii, providing users with a seamless experience.

-

Can I integrate airSlate SignNow with other software for my Non Employee Invoice UH Form NE INV Hawaii?

Absolutely! airSlate SignNow allows integration with various popular business applications, which means you can efficiently manage the Non Employee Invoice UH Form NE INV Hawaii alongside your existing tools. Integrations help automate workflows and reduce manual entry.

-

Are there benefits to using airSlate SignNow for my Non Employee Invoice UH Form NE INV Hawaii?

Using airSlate SignNow for your Non Employee Invoice UH Form NE INV Hawaii provides numerous benefits, including improved turnaround times and enhanced accuracy. With quick document processing and secure eSigning, your billing practices will become more efficient and reliable.

-

How secured is the Non Employee Invoice UH Form NE INV Hawaii documentation with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Non Employee Invoice UH Form NE INV Hawaii. We use advanced encryption protocols and comply with industry standards to ensure that your sensitive information is always protected.

Get more for Non Employee Invoice UH Form NE INV Hawaii

Find out other Non Employee Invoice UH Form NE INV Hawaii

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy