Assets and Liabilities Format

Understanding the Assets and Liabilities Format

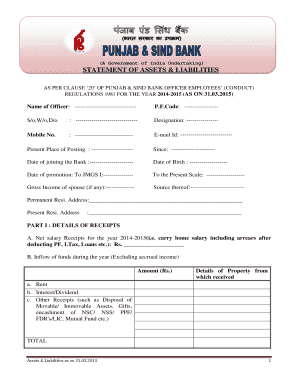

The assets and liabilities statement format is a structured document that provides a clear overview of an individual's or organization's financial position. This format typically includes two main sections: assets, which encompass everything of value owned, and liabilities, which represent obligations or debts owed. The statement is essential for various purposes, including financial analysis, loan applications, and tax assessments. By presenting a comprehensive view of financial standing, it aids in informed decision-making.

Steps to Complete the Assets and Liabilities Format

Filling out the assets and liabilities statement format involves several key steps:

- Gather Financial Information: Collect all relevant data regarding your assets and liabilities, including bank statements, property valuations, and outstanding debts.

- List Assets: Document all assets, categorizing them into current (cash, accounts receivable) and non-current (real estate, investments) assets.

- List Liabilities: Detail all liabilities, including short-term (credit card debts, loans) and long-term obligations (mortgages, bonds).

- Calculate Net Worth: Subtract total liabilities from total assets to determine your net worth, which provides insight into financial health.

- Review and Finalize: Ensure all information is accurate and complete before finalizing the document.

Key Elements of the Assets and Liabilities Format

Several critical components must be included in the assets and liabilities statement format to ensure its effectiveness:

- Asset Description: Clearly define each asset, including its value and date of acquisition.

- Liability Description: Specify each liability, including the amount owed and payment terms.

- Net Worth Calculation: Include a section that summarizes total assets and total liabilities, along with the resulting net worth.

- Signature Section: Provide space for signatures, indicating that the information presented is accurate and complete.

Legal Use of the Assets and Liabilities Format

The legal validity of the assets and liabilities statement format depends on compliance with relevant regulations. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, provided that certain conditions are met. This includes using a secure platform for signing, maintaining an audit trail, and ensuring that all parties have consented to electronic transactions. Utilizing a trusted electronic signature solution can help ensure that your document is legally binding.

Obtaining the Assets and Liabilities Format

The assets and liabilities statement format can be obtained through various means. Many financial institutions and accounting software provide templates that can be easily customized. Additionally, online resources offer downloadable formats that comply with standard practices. When selecting a template, ensure it aligns with your specific needs and adheres to any applicable legal requirements.

Examples of Using the Assets and Liabilities Format

There are numerous scenarios where the assets and liabilities statement format is beneficial:

- Loan Applications: Lenders often require this statement to assess the borrower's financial stability.

- Investment Analysis: Investors may request this information to evaluate potential risks and returns.

- Estate Planning: This format aids in understanding the total value of an estate, facilitating better planning for heirs.

Quick guide on how to complete assets and liabilities format

Easily Prepare Assets And Liabilities Format on Any Device

Online document management has gained increased popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly and effortlessly. Manage Assets And Liabilities Format on any platform using the airSlate SignNow apps for Android or iOS, streamlining any document-related workflow today.

The easiest way to edit and electronically sign Assets And Liabilities Format effortlessly

- Obtain Assets And Liabilities Format and then click Get Form to commence.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you would like to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Assets And Liabilities Format and maintain outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the assets and liabilities format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an asset liability statement format?

An asset liability statement format is a structured layout that showcases a company’s assets, liabilities, and equity at a specific point in time. This format helps businesses assess their financial position and make informed decisions. By using a clear asset liability statement, organizations can easily communicate their financial health to stakeholders.

-

How can airSlate SignNow help with asset liability statement format?

airSlate SignNow simplifies the creation and management of an asset liability statement format by providing easy-to-use templates. Our platform allows users to customize their documents quickly, ensuring that financial statements are accurate and professional. This not only saves time but also enhances compliance and reduces the risk of errors.

-

What features does airSlate SignNow offer for preparing an asset liability statement?

airSlate SignNow offers robust features for preparing an asset liability statement format, including drag-and-drop document assembly and real-time collaboration. Users can utilize electronic signatures to expedite approvals and ensure authenticity. Additionally, the platform provides audit trails to maintain a clear record of document interactions.

-

Is there a free trial available for using airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows new users to explore the platform and its features, including those for asset liability statement format. This trial enables prospective customers to experience the user-friendly interface and powerful tools before committing to a paid plan. Sign up today to create and manage your financial documents with ease.

-

Can I integrate airSlate SignNow with other applications for managing financial documents?

Absolutely! airSlate SignNow supports integration with a wide range of applications, making it easier to manage your asset liability statement format alongside other financial tools. Whether you're using accounting software or project management solutions, integrations ensure seamless workflows. This connectivity enhances efficiency and reduces the time spent on document processing.

-

What are the benefits of using airSlate SignNow for an asset liability statement format?

Using airSlate SignNow for your asset liability statement format provides several benefits, including reduced paperwork and faster document turnaround. The platform streamlines the signing process, allowing businesses to focus on strategic planning rather than administrative tasks. Enhanced security features also protect your sensitive financial data during document handling.

-

How does airSlate SignNow ensure the security of financial documents?

airSlate SignNow takes document security seriously, employing advanced encryption methods to safeguard your asset liability statement format. Users benefit from two-factor authentication and customizable access controls, ensuring that only authorized personnel can view or edit sensitive information. These measures help maintain trust and compliance with financial regulations.

Get more for Assets And Liabilities Format

Find out other Assets And Liabilities Format

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors