Nps 10 660 2016-2026

What is the NPS 10 660?

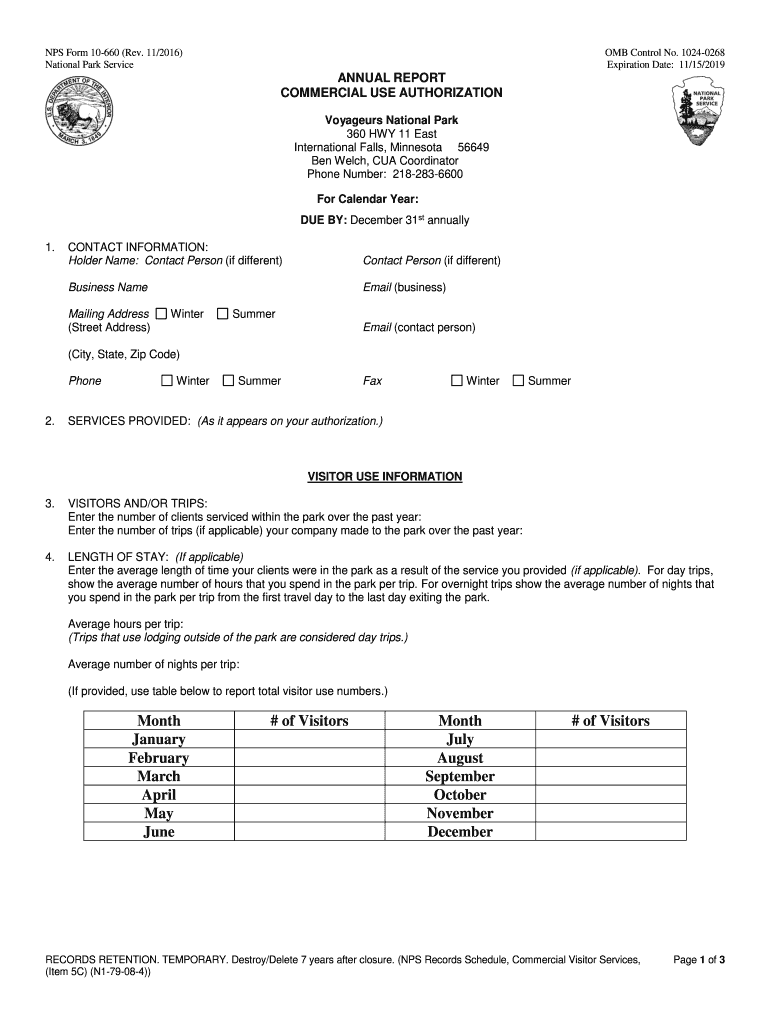

The NPS 10 660 form, commonly referred to as the 660 report form, is a document used by businesses and individuals to report specific information related to commercial activities on national park lands. This form is essential for obtaining authorization to conduct various activities, ensuring compliance with regulations set forth by the National Park Service (NPS). It serves as a formal request for permission to engage in activities that may impact park resources, thereby helping to protect the environment while allowing for responsible use of public lands.

How to Use the NPS 10 660

Using the NPS 10 660 form involves several key steps. First, gather all necessary information regarding the planned activity, including details about the location, duration, and nature of the commercial use. Next, accurately fill out the form with this information, ensuring that all sections are complete and clear. Once the form is filled out, it must be submitted to the appropriate NPS regional office for review. It is important to follow any specific instructions provided by the NPS regarding submission methods and additional documentation that may be required.

Steps to Complete the NPS 10 660

Completing the NPS 10 660 form involves a systematic approach:

- Identify the specific activity you plan to conduct within the national park.

- Gather supporting documents, such as maps, photographs, or plans that detail your proposed use.

- Fill out the form with accurate and comprehensive information, ensuring clarity in your descriptions.

- Review the completed form for any errors or omissions before submission.

- Submit the form along with any required attachments to the designated NPS office.

Legal Use of the NPS 10 660

The NPS 10 660 form is legally binding when completed and submitted according to the guidelines established by the National Park Service. This form ensures that all commercial activities comply with federal regulations, protecting both the park's natural resources and the integrity of the visitor experience. It is crucial for applicants to understand that failure to obtain the necessary authorization can result in penalties, including fines or restrictions on future activities within national parks.

Key Elements of the NPS 10 660

Several key elements are essential when filling out the NPS 10 660 form:

- Applicant Information: Include the name, address, and contact details of the individual or business applying for the permit.

- Activity Description: Clearly outline the nature of the proposed commercial use, including specific locations and dates.

- Impact Assessment: Provide an analysis of how the activity may affect park resources and visitor experiences.

- Insurance and Liability: Indicate any insurance coverage that will be in place to mitigate risks associated with the activity.

Form Submission Methods

The NPS 10 660 form can typically be submitted through various methods, including:

- Online Submission: Many NPS regions allow electronic submission of the form through their official websites.

- Mail: Applicants can send the completed form via postal service to the appropriate NPS office.

- In-Person: Some applicants may choose to deliver the form directly to the NPS office for immediate processing.

Quick guide on how to complete nps form 10 660 rev

Complete Nps 10 660 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents promptly without delays. Manage Nps 10 660 on any platform with the airSlate SignNow Android or iOS applications and simplify any document-centered process today.

The easiest way to modify and eSign Nps 10 660 without hassle

- Obtain Nps 10 660 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign Nps 10 660 while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

-

Need to fill out Form 10C and Form 19. Where can I get a 1 rupee revenue stamp in Bangalore?

I believe you are trying to withdraw PF. If that is correct, then I think its not a mandatory thing as I was able to submit these forms to my ex-employer without the stamp. I did receive the PF!

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the nps form 10 660 rev

How to make an eSignature for the Nps Form 10 660 Rev online

How to make an electronic signature for the Nps Form 10 660 Rev in Chrome

How to create an eSignature for signing the Nps Form 10 660 Rev in Gmail

How to create an eSignature for the Nps Form 10 660 Rev right from your mobile device

How to generate an eSignature for the Nps Form 10 660 Rev on iOS

How to generate an eSignature for the Nps Form 10 660 Rev on Android devices

People also ask

-

What is Nps 10 660 and how does it relate to airSlate SignNow?

Nps 10 660 refers to a specific document management protocol that enhances the eSigning process. With airSlate SignNow, you can utilize Nps 10 660 for efficient document workflows, ensuring that your business transactions are secure and compliant.

-

How much does airSlate SignNow cost for businesses using Nps 10 660?

The pricing for airSlate SignNow varies based on your business needs and the features you choose. Typically, plans start at a competitive rate that includes support for Nps 10 660, making it a cost-effective solution for all sizes of businesses.

-

What features does airSlate SignNow offer that support Nps 10 660?

airSlate SignNow offers features like customizable templates, automated workflows, and secure document storage, all of which support Nps 10 660. These features streamline the eSigning process, allowing for faster turnaround times and improved efficiency.

-

Can I integrate airSlate SignNow with other software while using Nps 10 660?

Yes, airSlate SignNow easily integrates with various software applications, enhancing your workflows while adhering to Nps 10 660. This means you can connect it to CRM systems, cloud storage, and more, ensuring seamless document management.

-

What are the benefits of using airSlate SignNow with Nps 10 660?

Using airSlate SignNow with Nps 10 660 provides your business with enhanced security, compliance, and efficiency in document management. This combination allows for faster eSigning processes and reduces the risk of errors, ultimately saving you time and resources.

-

Is airSlate SignNow user-friendly for those unfamiliar with Nps 10 660?

Absolutely! airSlate SignNow is designed to be user-friendly, even for those unfamiliar with Nps 10 660. The intuitive interface allows users to easily navigate the eSigning process, making it accessible for everyone in your organization.

-

How can I get support for Nps 10 660 with airSlate SignNow?

airSlate SignNow offers robust customer support for all users, including those utilizing Nps 10 660. You can access help through various channels, including live chat, email, and a comprehensive knowledge base to assist with any questions or issues.

Get more for Nps 10 660

Find out other Nps 10 660

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online