1098 T 2019-2026

What is the 1098-T?

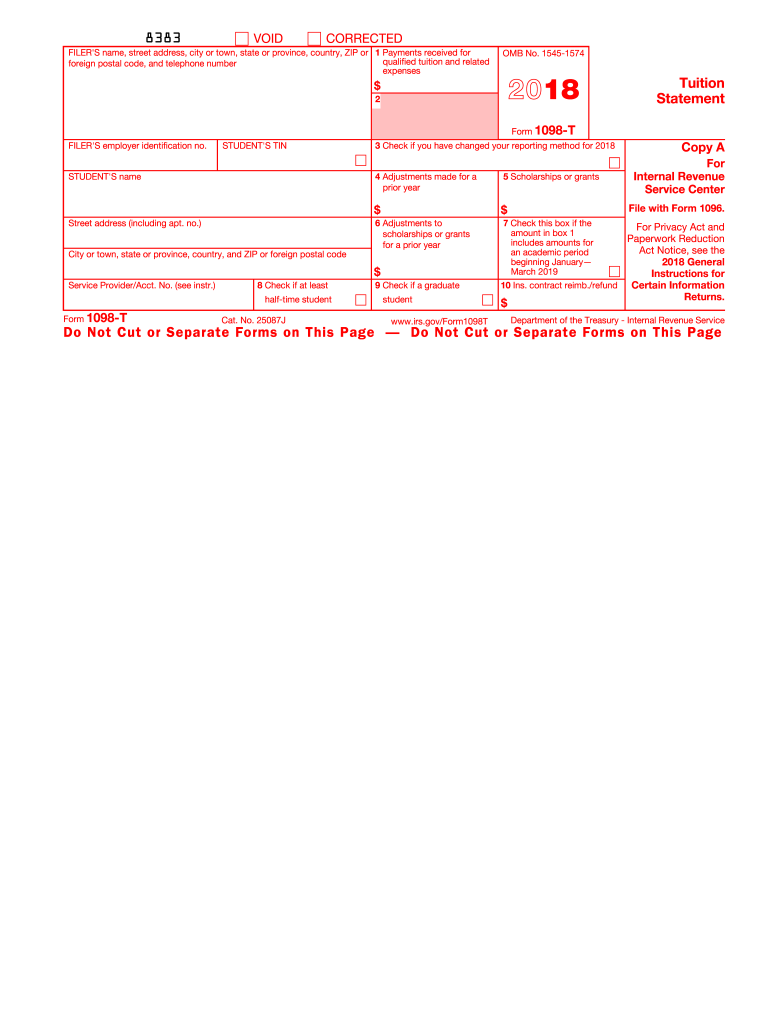

The 1098-T, also known as the Tuition Statement, is an important tax document used by eligible educational institutions to report qualified tuition and related expenses paid by students. This form helps students and their families determine eligibility for education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. The 1098-T includes information about the student, the institution, and the amounts billed for qualified tuition and fees during the tax year.

How to Obtain the 1098-T

Students can obtain the 1098-T form from their educational institution. Most colleges and universities provide this document electronically through their student portals or may send it via mail. It is advisable for students to check with their institution's registrar or financial aid office for specific instructions on how to access their 1098-T. Institutions are required to provide this form by January 31 of the following tax year, so students should ensure they have it before filing their taxes.

Steps to Complete the 1098-T

Completing the 1098-T involves several key steps. First, ensure that the form is the correct version for the tax year, as outdated forms will not be accepted. Next, carefully input all required information, including the student's name, Social Security number, and the amounts for qualified tuition and fees. It is crucial to review all entries for accuracy to avoid delays or issues with tax filing. Finally, submit the completed form to the IRS along with your tax return, either electronically or by mail, depending on your filing method.

Key Elements of the 1098-T

The 1098-T form contains several key elements that are essential for tax reporting. These include:

- Box 1: Amounts billed for qualified tuition and related expenses.

- Box 2: Amounts received for scholarships or grants.

- Box 3: Indicates whether the institution has changed its reporting method.

- Box 4: Adjustments made for prior year tuition amounts.

- Box 5: Total scholarships or grants received.

- Box 6: Adjustments to scholarships or grants for prior years.

IRS Guidelines

The IRS provides specific guidelines for the use of the 1098-T form. According to IRS regulations, educational institutions must report the amounts billed for qualified tuition and related expenses, as well as any scholarships or grants received by the student. It is important for students to understand these guidelines to accurately report their education expenses and claim any applicable tax credits. Failure to comply with IRS requirements can result in penalties and complications during tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the 1098-T form are crucial for students and educational institutions. The IRS requires that educational institutions provide the 1098-T to students by January 31 of the following tax year. Students should aim to file their tax returns by April 15 to avoid late penalties. It is advisable to keep track of these important dates to ensure compliance and timely submission of tax documents.

Quick guide on how to complete 1098 t 2018 form

Discover the simplest method to complete and sign your 1098 T

Are you still spending time preparing your official paperwork on paper instead of online? airSlate SignNow offers a superior way to finalize and endorse your 1098 T and other forms for public services. Our intelligent eSignature solution furnishes you with everything necessary to handle documents swiftly and according to official standards - robust PDF editing, management, protection, signing, and sharing tools all available within an user-friendly interface.

Only a few steps are needed to fill out and sign your 1098 T:

- Upload the editable template to the editor using the Get Form button.

- Review what details you need to fill in your 1098 T.

- Move between the fields with the Next button to avoid missing anything.

- Employ Text, Check, and Cross tools to fill in the sections with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Obscure areas that are no longer relevant.

- Click on Sign to create a legally binding eSignature using whichever method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed 1098 T in the Documents folder under your profile, download it, or transfer it to your preferred cloud storage. Our solution also offers flexible file sharing options. There’s no need to print your forms when you can submit them directly to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 1098 t 2018 form

FAQs

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

I am an international student who will need to file a tax return; would it be convenient for me to also fill a 1098-t form?

You do not complete a 1098T. If you paid qualifying tuition, then your school will send you a 1098-T. That will support your educational tax credits or deduction if you qualify to take them on a US tax return. You might check Am I Eligible to Claim an Education Credit?

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

Create this form in 5 minutes!

How to create an eSignature for the 1098 t 2018 form

How to make an electronic signature for your 1098 T 2018 Form in the online mode

How to make an eSignature for your 1098 T 2018 Form in Chrome

How to make an electronic signature for putting it on the 1098 T 2018 Form in Gmail

How to make an eSignature for the 1098 T 2018 Form from your smart phone

How to generate an eSignature for the 1098 T 2018 Form on iOS

How to generate an electronic signature for the 1098 T 2018 Form on Android devices

People also ask

-

What is a 1098 T form and why is it important?

The 1098 T form is a tax document used by educational institutions to report qualified tuition and related expenses. It's important because it helps students and their families claim education-related tax benefits, such as the American Opportunity Tax Credit. Understanding the 1098 T is essential for accurate tax filings.

-

How can airSlate SignNow help me with my 1098 T forms?

airSlate SignNow simplifies the process of sending and signing 1098 T forms electronically. With our user-friendly platform, you can easily prepare, send, and eSign these documents, ensuring they are completed efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for 1098 T forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for managing 1098 T forms. Our pricing structure is transparent, allowing you to choose the plan that fits your volume and feature requirements.

-

What features does airSlate SignNow offer for 1098 T document management?

airSlate SignNow provides features like template creation, real-time tracking, and secure eSignature options, specifically designed to streamline the management of 1098 T forms. These features enhance efficiency and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for 1098 T processing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage 1098 T forms alongside your existing systems. This integration enhances workflow efficiency and reduces manual data entry.

-

How secure is airSlate SignNow when handling sensitive 1098 T information?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure data storage to protect sensitive information contained in 1098 T forms, ensuring that your documents are safe and compliant with industry standards.

-

What benefits can I expect from using airSlate SignNow for my 1098 T forms?

Using airSlate SignNow for your 1098 T forms offers numerous benefits, including reduced processing time, improved accuracy, and enhanced collaboration. Our platform also provides a streamlined workflow that helps you manage multiple forms with ease.

Get more for 1098 T

Find out other 1098 T

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice