1098 T Form 2017

What is the 1098-T Form

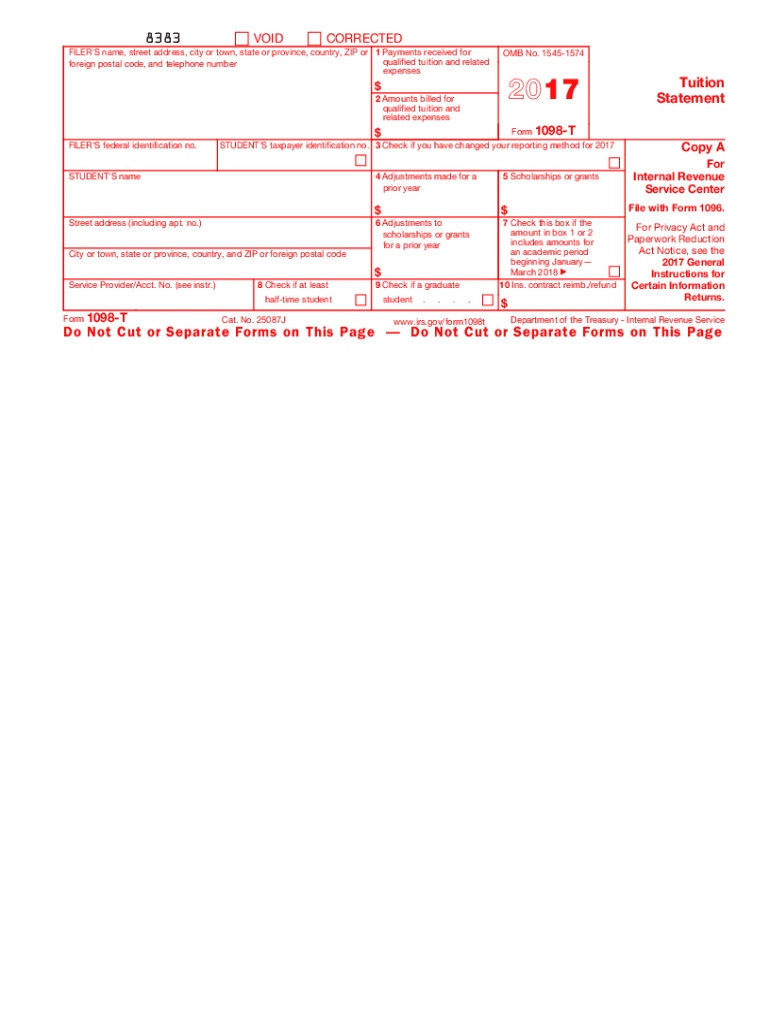

The 1098-T form, officially known as the Tuition Statement, is an essential document used by eligible educational institutions in the United States to report payments received for qualified tuition and related expenses. This form is primarily utilized by students to help determine their eligibility for education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. The 1098-T form includes vital information, including the amount billed for tuition, scholarships or grants received, and any adjustments made to prior year tuition amounts.

How to Obtain the 1098-T Form

Students can obtain their 1098-T form directly from their educational institution. Most colleges and universities provide the form electronically through their student portals or via mail. It is advisable for students to check with their school's financial aid or registrar's office for specific instructions on accessing their form. Institutions are required to send the 1098-T by January 31 of each year, ensuring that students have adequate time to prepare their tax returns.

Steps to Complete the 1098-T Form

Completing the 1098-T form involves several key steps. First, students should gather all relevant financial documents, including tuition payment receipts and any scholarships or grants received. Next, accurately fill out the form by entering the required information, such as the student’s personal details and the amounts related to tuition and fees. It is crucial to double-check all entries for accuracy before submission. Finally, ensure that the completed form is filed with the IRS along with your tax return by the designated deadline.

Key Elements of the 1098-T Form

The 1098-T form contains several key elements that are essential for tax reporting. These include:

- Box 1: Payments received for qualified tuition and related expenses during the calendar year.

- Box 2: Amounts billed for qualified tuition and related expenses (if applicable).

- Box 5: Scholarships or grants received by the student.

- Box 4: Adjustments made for prior years.

- Student Information: Personal details of the student, including name, address, and taxpayer identification number.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the 1098-T form. Educational institutions must provide the form to students by January 31 each year. Students should ensure that they include the information from the 1098-T form when filing their federal tax returns, typically due by April 15. If additional time is needed, students can file for an extension, but they should still estimate and pay any taxes owed by the original deadline to avoid penalties.

IRS Guidelines

The IRS has established specific guidelines for the use and reporting of the 1098-T form. Students should refer to IRS Publication 970, which provides detailed information on education tax benefits, including how to use the 1098-T form for claiming tax credits. It is important for students to familiarize themselves with these guidelines to ensure compliance and maximize potential tax benefits. Additionally, keeping accurate records of educational expenses will support any claims made on tax returns.

Quick guide on how to complete 1098 t 2017 2018 form

Discover the most efficient method to complete and sign your 1098 T Form

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow provides a superior way to fill out and sign your 1098 T Form and comparable forms for public services. Our intelligent electronic signature platform equips you with everything necessary to handle documents swiftly and in accordance with standard regulations - robust PDF editing, managing, securing, signing, and sharing features all available within a user-friendly interface.

Only a few simple steps are needed to complete and sign your 1098 T Form:

- Upload the editable template to the editor using the Get Form button.

- Review what information you need to enter in your 1098 T Form.

- Navigate between the fields using the Next button to ensure you don’t miss anything.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Erase sections that are no longer relevant.

- Click on Sign to generate a legally binding electronic signature using any method that suits you.

- Add the Date next to your signature and finish your task with the Done button.

Store your finished 1098 T Form in the Documents folder of your profile, download it, or export it to your chosen cloud storage. Our service also provides adaptable file sharing options. There's no need to print your templates when you can submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 1098 t 2017 2018 form

Create this form in 5 minutes!

How to create an eSignature for the 1098 t 2017 2018 form

How to generate an eSignature for your 1098 T 2017 2018 Form in the online mode

How to generate an electronic signature for the 1098 T 2017 2018 Form in Google Chrome

How to make an electronic signature for putting it on the 1098 T 2017 2018 Form in Gmail

How to create an eSignature for the 1098 T 2017 2018 Form right from your mobile device

How to make an electronic signature for the 1098 T 2017 2018 Form on iOS devices

How to make an eSignature for the 1098 T 2017 2018 Form on Android OS

People also ask

-

What is a 1098 T Form and why is it important?

The 1098 T Form is a tax document used by educational institutions to report qualified tuition and related expenses to the IRS. It’s essential for students and parents as it can help with tax deductions or credits for education costs. Understanding the 1098 T Form is crucial for maximizing potential tax benefits.

-

How can airSlate SignNow help with the 1098 T Form process?

airSlate SignNow simplifies the process of sending and eSigning the 1098 T Form, ensuring that all parties can complete it securely and efficiently. With our user-friendly platform, you can easily manage your documents and track their status, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the 1098 T Form?

Yes, airSlate SignNow offers a variety of pricing plans to fit different business needs, including options for handling documents like the 1098 T Form. Our cost-effective solution ensures you get the best value for your document management needs without compromising on features.

-

What features does airSlate SignNow offer for managing the 1098 T Form?

airSlate SignNow includes features like customizable templates, real-time tracking, and secure eSigning, specifically designed to streamline the handling of documents such as the 1098 T Form. These tools enhance efficiency and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software to manage the 1098 T Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage the 1098 T Form alongside your existing systems. This ensures a smooth workflow and enhances your overall document management process.

-

Is airSlate SignNow secure for handling sensitive documents like the 1098 T Form?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards, making it safe for handling sensitive documents such as the 1098 T Form. You can trust our platform to protect your personal and financial information.

-

How does eSigning the 1098 T Form with airSlate SignNow work?

eSigning the 1098 T Form with airSlate SignNow is straightforward. Users simply upload the form, add the necessary signers, and send it out for signatures. Once all parties have eSigned, the completed document is securely stored and easily accessible.

Get more for 1098 T Form

Find out other 1098 T Form

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later