City of Salida Lodging Occupation Tax Form

What is the City of Salida Lodging Occupation Tax Form

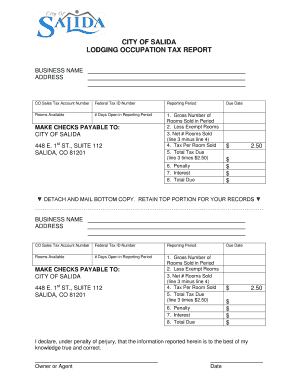

The City of Salida Lodging Occupation Tax Form is a specific document required for lodging providers operating within the city limits of Salida, Colorado. This form is used to report and remit the lodging occupation tax, which is levied on the rental of accommodations. The tax is typically applied to hotels, motels, short-term rentals, and other lodging facilities. Understanding this form is essential for compliance with local tax regulations and ensuring that all required taxes are accurately reported and paid.

How to Use the City of Salida Lodging Occupation Tax Form

Using the City of Salida Lodging Occupation Tax Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial records related to lodging income. This includes receipts, invoices, and any other documentation that reflects the total rental income for the reporting period. Next, fill out the form by entering the required information, such as the total number of rental nights, the applicable tax rate, and the total tax due. Finally, review the completed form for accuracy before submitting it to the appropriate city department.

Steps to Complete the City of Salida Lodging Occupation Tax Form

Completing the City of Salida Lodging Occupation Tax Form can be broken down into a few clear steps:

- Gather all relevant financial documents, including rental agreements and payment records.

- Enter your business information, including name, address, and tax identification number.

- Report total rental income for the period covered by the form.

- Calculate the lodging occupation tax based on the applicable rate.

- Double-check all entries for accuracy and completeness.

- Submit the form by the designated deadline, ensuring you keep a copy for your records.

Legal Use of the City of Salida Lodging Occupation Tax Form

The City of Salida Lodging Occupation Tax Form is legally binding when completed and submitted according to local regulations. It is crucial for lodging providers to understand that failure to accurately report and remit the tax can result in penalties and fines. The form must be filled out truthfully, reflecting all income generated from lodging activities. Compliance with the local tax laws not only supports city services but also helps maintain the integrity of the lodging industry within Salida.

Form Submission Methods

The City of Salida Lodging Occupation Tax Form can typically be submitted through various methods, providing flexibility for lodging providers. Common submission methods include:

- Online submission through the official city website, if available.

- Mailing the completed form to the designated city department.

- In-person delivery at the city office during business hours.

It is advisable to check the latest guidelines from the city to ensure compliance with submission protocols.

Penalties for Non-Compliance

Non-compliance with the requirements of the City of Salida Lodging Occupation Tax Form can lead to significant penalties. Lodging providers may face fines, interest on unpaid taxes, and potential legal action if taxes are not reported or paid on time. It is essential for businesses to stay informed about their obligations and ensure timely submissions to avoid these consequences. Regularly reviewing tax regulations and maintaining accurate records can help mitigate the risk of non-compliance.

Quick guide on how to complete city of salida lodging occupation tax form

Effortlessly Prepare City Of Salida Lodging Occupation Tax Form on Any Device

Managing documents online has gained popularity among both companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it on the web. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly and without delays. Handle City Of Salida Lodging Occupation Tax Form on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The Easiest Way to Revise and eSign City Of Salida Lodging Occupation Tax Form Without Stress

- Obtain City Of Salida Lodging Occupation Tax Form and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight key sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal value as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign City Of Salida Lodging Occupation Tax Form and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of salida lodging occupation tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Salida lodging occupation tax form?

The city of Salida lodging occupation tax form is a document required for lodging businesses in Salida to report and remit taxes on short-term rentals. By utilizing this form, operators can ensure compliance with local tax regulations and avoid potential fines.

-

How do I fill out the city of Salida lodging occupation tax form?

Filling out the city of Salida lodging occupation tax form involves providing details about your lodging business, including revenue, rental days, and guest information. You can easily complete this form using airSlate SignNow for a streamlined eSigning experience.

-

Is there a fee associated with filing the city of Salida lodging occupation tax form?

Yes, there may be fees associated with the city of Salida lodging occupation tax form, depending on your rental activity's revenue. Utilizing airSlate SignNow can help you efficiently manage these transactions while staying on top of your financial obligations.

-

Can I access the city of Salida lodging occupation tax form online?

Absolutely! The city of Salida lodging occupation tax form is typically available online through the official city website. airSlate SignNow simplifies the process of filling out and submitting this form digitally.

-

What features does airSlate SignNow offer for managing the city of Salida lodging occupation tax form?

airSlate SignNow offers features such as eSignature capabilities, document templates, and automated reminders, making it easier for lodging operators to manage the city of Salida lodging occupation tax form efficiently and effectively.

-

How does airSlate SignNow improve the process of submitting the city of Salida lodging occupation tax form?

By leveraging airSlate SignNow, users can complete, sign, and send the city of Salida lodging occupation tax form quickly, reducing paperwork and minimizing errors. This electronic process enhances accuracy and speeds up compliance.

-

Are there integrations available for the city of Salida lodging occupation tax form with airSlate SignNow?

Yes, airSlate SignNow offers integrations with various accounting and property management software, facilitating seamless data transfer related to the city of Salida lodging occupation tax form. This integration helps streamline your overall financial management.

Get more for City Of Salida Lodging Occupation Tax Form

Find out other City Of Salida Lodging Occupation Tax Form

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online