Enforcement Rules of the Corporate Income Tax Act Form No 2012-2026

Understanding the Enforcement Rules of the Corporate Income Tax Act Form 72

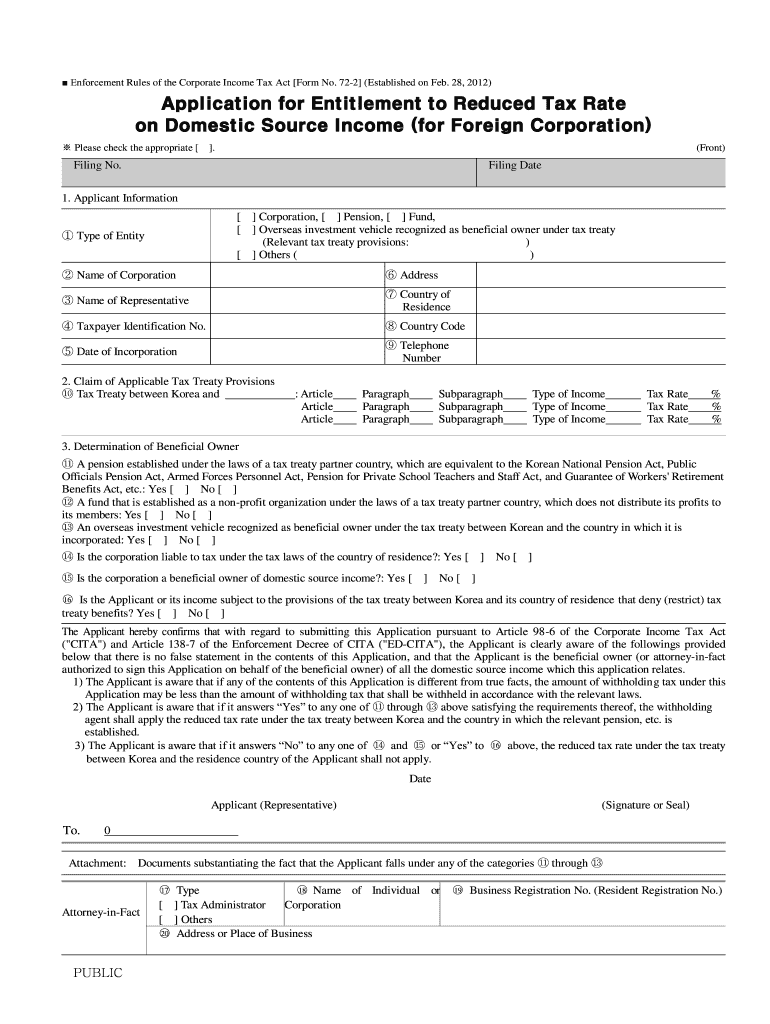

The Enforcement Rules of the Corporate Income Tax Act Form 72 is a crucial document for businesses seeking to apply for a reduced tax rate on domestic source income. This form is designed to ensure compliance with U.S. tax regulations, particularly for entities that qualify under specific criteria. Understanding the legal framework and requirements associated with Form 72 is essential for accurate completion and submission.

Steps to Complete the Enforcement Rules of the Corporate Income Tax Act Form 72

Completing Form 72 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including proof of income and any relevant tax identification numbers. Next, carefully fill out each section of the form, paying close attention to the eligibility criteria outlined in the instructions. After completing the form, review it thoroughly for any errors or omissions before submission. This careful approach helps prevent delays or issues with your application.

Eligibility Criteria for Form 72

To qualify for the benefits offered by the Enforcement Rules of the Corporate Income Tax Act Form 72, businesses must meet specific eligibility criteria. These typically include being a domestic corporation or partnership, having a certain level of income derived from domestic sources, and fulfilling any additional requirements set forth by the IRS. It is important for applicants to review these criteria closely to determine their eligibility before proceeding with the application process.

Required Documents for Submission

When submitting Form 72, several documents are typically required to support your application. These may include financial statements, tax returns from previous years, and documentation proving the source of income. Ensuring that all required documents are included with your submission can significantly improve the chances of a successful application and reduce the likelihood of follow-up inquiries from tax authorities.

Legal Use of Form 72

The legal use of the Enforcement Rules of the Corporate Income Tax Act Form 72 is governed by federal tax laws. It is essential for businesses to understand that submitting this form does not guarantee approval for a reduced tax rate. Instead, it initiates a review process by the IRS, which will determine eligibility based on the information provided. Adhering to all legal guidelines and requirements is crucial to avoid potential penalties or compliance issues.

Form Submission Methods

Form 72 can be submitted through various methods, including online filing, mail, or in-person submission at designated IRS offices. Each method has its own set of procedures and timelines, so it is important for applicants to choose the method that best suits their needs. Online submission is often the fastest and most efficient option, allowing for immediate confirmation of receipt by the IRS.

Filing Deadlines for Form 72

Filing deadlines for the Enforcement Rules of the Corporate Income Tax Act Form 72 are critical to ensure compliance with tax regulations. Typically, forms must be submitted by a specific date to be considered for the current tax year. It is advisable for businesses to stay informed about these deadlines and plan accordingly to avoid late submissions, which can result in penalties or missed opportunities for tax reductions.

Quick guide on how to complete enforcement rules of the corporate income tax act form no

The most effective method to locate and sign Enforcement Rules Of The Corporate Income Tax Act Form No

Across the breadth of your entire organization, ineffective procedures related to document approvals can eat up a signNow amount of work hours. Signing documents such as Enforcement Rules Of The Corporate Income Tax Act Form No is a fundamental aspect of operations in any enterprise, which is why the efficiency of each agreement’s lifecycle is crucial to the overall productivity of the company. With airSlate SignNow, signing your Enforcement Rules Of The Corporate Income Tax Act Form No is as straightforward and swift as it can be. You will discover on this platform the latest version of nearly any document. Even better, you can sign it immediately without the requirement of installing additional software on your computer or printing out physical copies.

How to obtain and sign your Enforcement Rules Of The Corporate Income Tax Act Form No

- Browse our collection by category or use the search bar to locate the document you need.

- View the document preview by clicking on Learn more to verify it is the correct one.

- Click Get form to start editing right away.

- Fill out your document and insert any essential information using the toolbar.

- Once finished, click the Sign feature to sign your Enforcement Rules Of The Corporate Income Tax Act Form No.

- Choose the signature method that suits you best: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to complete your editing and proceed to sharing options when necessary.

With airSlate SignNow, you have everything necessary to manage your documents efficiently. You can find, complete, modify, and even send your Enforcement Rules Of The Corporate Income Tax Act Form No all within one tab without any difficulty. Optimize your workflow by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

How do you claim income tax exemption under Section 10 (18) of the IT Act as no column exists to reflect the said exemption in the ITR form?

The sheet of Taxes Paid and Verification in ITR Form has an option to disclose exempt incomes. You need to manually add Nature of Exempt Income and Amount.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

Create this form in 5 minutes!

How to create an eSignature for the enforcement rules of the corporate income tax act form no

How to generate an electronic signature for the Enforcement Rules Of The Corporate Income Tax Act Form No online

How to create an electronic signature for the Enforcement Rules Of The Corporate Income Tax Act Form No in Chrome

How to generate an eSignature for signing the Enforcement Rules Of The Corporate Income Tax Act Form No in Gmail

How to make an eSignature for the Enforcement Rules Of The Corporate Income Tax Act Form No right from your smartphone

How to create an electronic signature for the Enforcement Rules Of The Corporate Income Tax Act Form No on iOS devices

How to make an electronic signature for the Enforcement Rules Of The Corporate Income Tax Act Form No on Android devices

People also ask

-

What is Form 72 and how does it work with airSlate SignNow?

Form 72 is a specific document used in various industries that can be easily created, sent, and signed using airSlate SignNow. The platform allows users to upload Form 72, apply necessary signatures, and manage the document securely online, streamlining your workflow.

-

How can I send Form 72 for eSignature through airSlate SignNow?

To send Form 72 for eSignature using airSlate SignNow, simply upload the document to the platform, add recipient emails, and customize any signing fields. After you send the form, recipients receive a notification to review and sign the document digitally, making the process quick and efficient.

-

What features does airSlate SignNow offer for managing Form 72?

airSlate SignNow offers various features for managing Form 72, including templates, real-time tracking, and secure storage. Users can also set reminders for signers and integrate with numerous third-party applications to enhance document management capabilities.

-

Is airSlate SignNow affordable for businesses needing Form 72 handling?

Yes, airSlate SignNow provides a cost-effective solution for businesses that frequently handle Form 72. With flexible pricing plans tailored to different business needs, companies can choose an option that maximizes their return on investment while ensuring secure document management.

-

Can I integrate airSlate SignNow with other applications for Form 72 processing?

Absolutely! airSlate SignNow supports seamless integrations with a variety of applications, allowing you to automate the workflow of Form 72 processing. Integrations enable businesses to connect with CRMs, project management tools, and cloud storage services for enhanced efficiency.

-

What are the benefits of using airSlate SignNow for Form 72?

Using airSlate SignNow for Form 72 offers numerous benefits, such as improved turnaround times, enhanced security, and the convenience of remote access. Businesses can ensure compliance and reduce paperwork while providing a user-friendly experience for all signers.

-

Is it easy to track the status of Form 72 in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for Form 72, allowing you to monitor the status of documents from sending to completion. Users receive notifications as the document progresses, ensuring that no action is missed and helping to maintain productivity.

Get more for Enforcement Rules Of The Corporate Income Tax Act Form No

- Sanits compact rechnungen sammeln form

- 3rd quarter payroll tax booklet the city of newark new ci newark nj form

- Hle application form download

- Declaration of compliance form 30258205

- Child enrollment form for day care homes child enrollment form for day care homes

- Md divorce forms pdf fill out ampamp sign online

- Treasurer and depository form

- Form 21 specialist and subspecialist registration

Find out other Enforcement Rules Of The Corporate Income Tax Act Form No

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online