Group Term Life Insurance Beneficiary Designation Form

What is the Group Term Life Insurance Beneficiary Designation

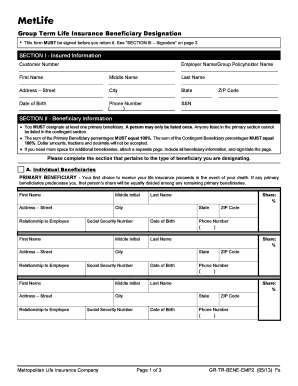

The Group Term Life Insurance Beneficiary Designation is a formal document that allows policyholders to specify who will receive the benefits of their life insurance policy upon their death. This designation is crucial as it ensures that the intended beneficiaries receive the financial support they need during a difficult time. The form typically requires the policyholder's personal information, including name, address, and relationship to the beneficiaries. It may also require the beneficiaries' information, such as their names and contact details.

Steps to Complete the Group Term Life Insurance Beneficiary Designation

Completing the Group Term Life Insurance Beneficiary Designation form involves several clear steps:

- Gather necessary personal information, including your full name, address, and policy number.

- Identify your beneficiaries, ensuring you have their full names and contact information.

- Specify the percentage of benefits each beneficiary will receive, if applicable.

- Review the form for accuracy and completeness.

- Sign and date the form to validate your designation.

- Submit the completed form according to your insurance provider's instructions.

Legal Use of the Group Term Life Insurance Beneficiary Designation

The legal use of the Group Term Life Insurance Beneficiary Designation is governed by state laws and regulations. It is essential for the form to be filled out correctly to ensure that the designation is legally binding. This includes adhering to any specific requirements set forth by the insurance company, as well as ensuring that the policyholder has the legal capacity to make such designations. In most cases, the designation must be signed by the policyholder and may need to be witnessed or notarized, depending on state laws.

Key Elements of the Group Term Life Insurance Beneficiary Designation

Several key elements are essential when filling out the Group Term Life Insurance Beneficiary Designation:

- Policyholder Information: Full name, address, and policy number.

- Beneficiary Details: Names, addresses, and relationships to the policyholder.

- Distribution Percentages: Clear indication of how benefits are divided among beneficiaries.

- Signature: The policyholder's signature is required to validate the designation.

- Date: The date of signing the form is crucial for legal purposes.

How to Obtain the Group Term Life Insurance Beneficiary Designation

To obtain the Group Term Life Insurance Beneficiary Designation form, policyholders can typically access it through their insurance provider's website or customer service. Many insurance companies provide downloadable forms that can be filled out electronically or printed for manual completion. It is advisable to contact the insurance provider directly if the form is not readily available online, as they can provide the most current version and any specific instructions for completion.

Form Submission Methods

Submitting the Group Term Life Insurance Beneficiary Designation can be done through various methods, depending on the insurance provider's policies:

- Online Submission: Many providers allow for digital submission through their secure portals.

- Mail: Completed forms can often be sent via postal mail to the designated address provided by the insurance company.

- In-Person: Some policyholders may prefer to submit the form in person at a local branch or office of the insurance provider.

Quick guide on how to complete group term life insurance beneficiary designation

Complete Group Term Life Insurance Beneficiary Designation effortlessly on any device

Web-based document management has gained traction among companies and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to generate, edit, and eSign your documents swiftly and without delays. Manage Group Term Life Insurance Beneficiary Designation on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to edit and eSign Group Term Life Insurance Beneficiary Designation with ease

- Locate Group Term Life Insurance Beneficiary Designation and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your edits.

- Select how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Modify and eSign Group Term Life Insurance Beneficiary Designation and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the group term life insurance beneficiary designation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Group Term Life Insurance Beneficiary Designation?

Group Term Life Insurance Beneficiary Designation refers to the process by which policyholders identify individuals or entities to receive the insurance benefits in the event of their passing. It is crucial for ensuring that the intended beneficiaries receive financial support promptly, aligning with your family’s or organization's needs.

-

How does Group Term Life Insurance Beneficiary Designation work?

In Group Term Life Insurance, the policyholder selects one or more beneficiaries during the application process. Upon the policyholder's death, the insurance benefits are paid directly to the designated beneficiaries, making the process straightforward and efficient, especially when using tools like airSlate SignNow.

-

Can I change my Group Term Life Insurance Beneficiary Designation?

Yes, you can change your Group Term Life Insurance Beneficiary Designation at any time by updating your policy details. It's advisable to review your beneficiary choices regularly, especially after signNow life events, to ensure they reflect your current wishes.

-

What information do I need for Group Term Life Insurance Beneficiary Designation?

To designate a beneficiary, you will typically need their full name, relationship to you, and contact information. Some insurers may also require Social Security numbers to streamline the claims process, ensuring that the Group Term Life Insurance Beneficiary Designation is accurate and up-to-date.

-

Are there costs associated with Group Term Life Insurance Beneficiary Designation?

Designating a beneficiary on your Group Term Life Insurance policy is usually free of charge. However, it's essential to note that the overall policy premium may vary based on coverage limits and other factors, and using platforms like airSlate SignNow can help simplify your documentation.

-

What are the benefits of having a Group Term Life Insurance Beneficiary Designation?

Having a Group Term Life Insurance Beneficiary Designation ensures that your loved ones receive financial support quickly and efficiently. This designation can help prevent disputes and delays, providing peace of mind knowing your family is taken care of after your passing.

-

Can I designate multiple beneficiaries under my Group Term Life Insurance?

Yes, you can designate multiple beneficiaries in your Group Term Life Insurance Beneficiary Designation. This flexibility allows you to allocate percentages of the benefit to different individuals, providing a tailored approach to your loved ones' financial security.

Get more for Group Term Life Insurance Beneficiary Designation

- Fill in the correct form of the verb all tenses

- Iga application form 28017744

- Soil texture worksheet answer key form

- Special services at home application pdf form

- Mc certificate download form

- Wfg trade ticket form

- Umregistration form

- Current annuity application ages 65 the orchard foundation theorchard form

Find out other Group Term Life Insurance Beneficiary Designation

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT