Philadelphia Annual Reconciliation of Employer Wage Tax Form

What is the Philadelphia Annual Reconciliation Of Employer Wage Tax Form

The Philadelphia Annual Reconciliation of Employer Wage Tax Form is a crucial document for employers operating within the city. This form is used to report the total wages paid to employees and the corresponding wage taxes withheld throughout the year. It ensures that employers comply with local tax regulations and helps the city collect the appropriate revenue for public services. Understanding the purpose of this form is essential for maintaining compliance and avoiding potential penalties.

Steps to complete the Philadelphia Annual Reconciliation Of Employer Wage Tax Form

Completing the Philadelphia Annual Reconciliation of Employer Wage Tax Form involves several key steps:

- Gather all necessary documentation, including payroll records and tax withholding amounts.

- Fill in the employer's information, including name, address, and identification number.

- Report total wages paid to each employee and the corresponding wage tax withheld.

- Ensure all calculations are accurate to avoid discrepancies.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline to ensure compliance.

Key elements of the Philadelphia Annual Reconciliation Of Employer Wage Tax Form

The form contains several key elements that must be accurately completed:

- Employer Information: Name, address, and identification number.

- Employee Details: Names and Social Security numbers of all employees.

- Total Wages: The total amount of wages paid to employees during the reporting period.

- Tax Withheld: The total amount of wage tax withheld from employees’ paychecks.

- Signature: The form must be signed by an authorized representative of the business.

Legal use of the Philadelphia Annual Reconciliation Of Employer Wage Tax Form

The Philadelphia Annual Reconciliation of Employer Wage Tax Form is legally binding when filled out correctly and submitted on time. It serves as an official record of wage payments and tax withholdings, which can be audited by city tax authorities. Compliance with the filing requirements is essential to avoid legal issues and potential fines. Employers should ensure that the form meets all legal standards to maintain its validity.

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting the Philadelphia Annual Reconciliation of Employer Wage Tax Form:

- Online Submission: Many employers prefer to submit the form electronically through the city’s tax portal, which offers a streamlined process.

- Mail Submission: The form can be printed and mailed to the appropriate city department. Ensure that it is sent well before the deadline to allow for processing time.

- In-Person Submission: Employers may also choose to submit the form in person at designated city offices, where they can receive immediate confirmation of receipt.

Filing Deadlines / Important Dates

It is important for employers to be aware of the filing deadlines for the Philadelphia Annual Reconciliation of Employer Wage Tax Form. Typically, the form must be submitted by the end of February following the tax year being reported. Employers should mark their calendars and ensure that all documentation is ready well in advance of this deadline to avoid late penalties.

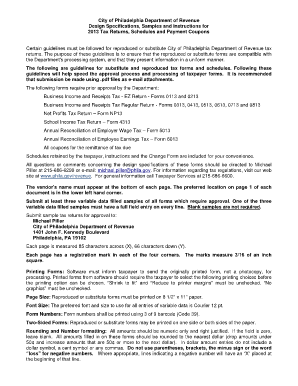

Quick guide on how to complete city of philadelphia annual reconciliation 2018

Prepare city of philadelphia annual reconciliation 2018 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage philadelphia employee earnings tax instructions on any device with airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

How to edit and eSign philadelphia annual reconciliation with ease

- Locate city of philadelphia annual reconciliation of 2019 employee earnings tax and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that necessitate recopying documents. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign annual reconciliation of employee earnings tax and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to city of philadelphia annual reconciliation of employer wage tax

Create this form in 5 minutes!

How to create an eSignature for the city of philadelphia annual reconciliation of 2018 employee earnings tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask phia annual wage reconciliation form

-

What is the airSlate SignNow platform and how can it help with filling out the City of Philadelphia annual reconciliation?

airSlate SignNow is a user-friendly platform that allows you to send and eSign documents efficiently. When it comes to filling out the City of Philadelphia annual reconciliation, our solution simplifies the process by enabling electronic signatures and secure document storage, making it easy to manage your submissions.

-

How do I use airSlate SignNow to fill out the City of Philadelphia annual reconciliation?

To fill out the City of Philadelphia annual reconciliation using airSlate SignNow, simply upload your document to the platform, add fields for signatures and required information, and send it to the necessary parties. Our platform guides you step-by-step to ensure the document is completed accurately.

-

Is there a cost associated with using airSlate SignNow for the City of Philadelphia annual reconciliation?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can choose a plan that fits your budget while ensuring you have the necessary tools to effectively manage the City of Philadelphia annual reconciliation process.

-

Can I integrate airSlate SignNow with other software for my annual reconciliation needs?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications such as Google Drive, Dropbox, and Salesforce. This capability enhances your workflow and provides a streamlined approach to filling out the City of Philadelphia annual reconciliation without having to switch between different platforms.

-

What are the benefits of using airSlate SignNow for document signing in the annual reconciliation process?

Using airSlate SignNow for the annual reconciliation process offers several benefits, including time savings, enhanced security, and improved compliance. Digital signatures are legally binding and help you streamline submissions to the City of Philadelphia, ensuring efficiency and reliability.

-

Is airSlate SignNow secure for handling sensitive documents like the City of Philadelphia annual reconciliation?

Yes, at airSlate SignNow, we prioritize the security of your documents. Our platform complies with industry standards for data protection, ensuring that your information, including the City of Philadelphia annual reconciliation, is kept safe and confidential.

-

How does airSlate SignNow improve collaboration on the City of Philadelphia annual reconciliation?

airSlate SignNow enhances collaboration by allowing multiple users to work on the City of Philadelphia annual reconciliation simultaneously. Everyone involved can review, comment, and eSign the document, thereby fostering efficient communication and reducing delays in the process.

Get more for philadelphia annual reconciliation 2017

- Bestuurders verklaring gericht aan abn amro bank nv form

- Council tax fdean gov uk form

- Advance care planning documentation template form

- Merchant registration number form

- Hemocue quality control log sfgh poct form

- Proof of attendance form

- Gm heat treating dc 9999 01 form

- Opera mini 4 2 apk download form

Find out other philadelphia annual reconciliation 2018

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word