Schedule 8812 2023

What is the Schedule 8812

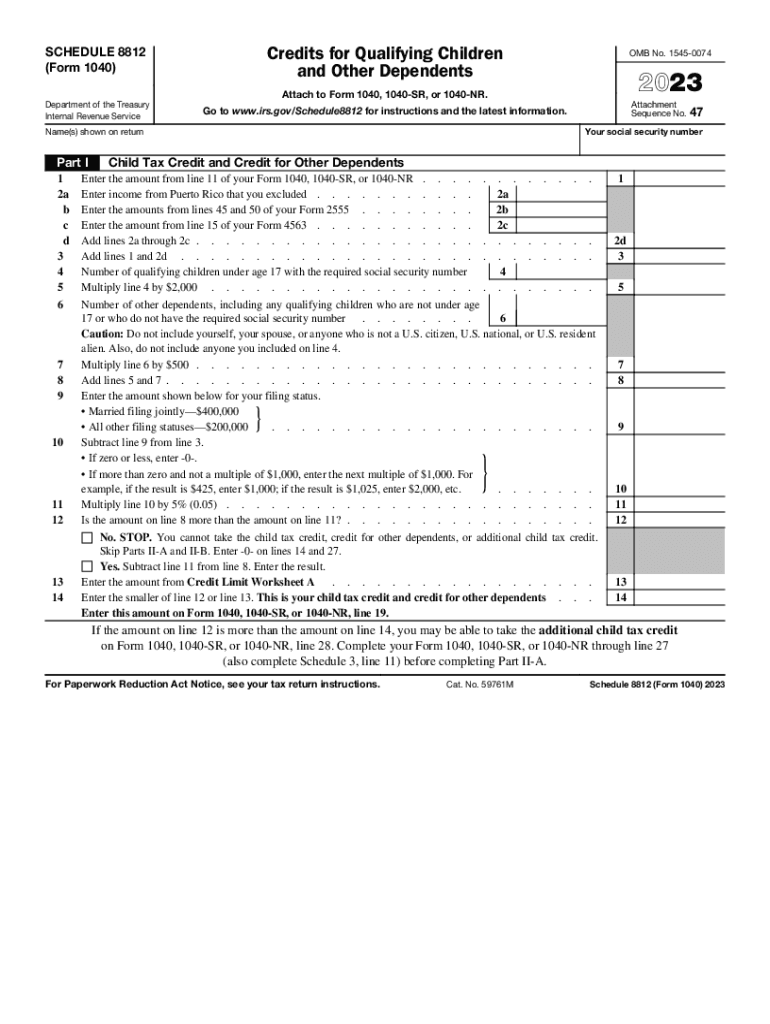

The Schedule 8812 is a tax form used by eligible taxpayers to claim the Child Tax Credit and the Additional Child Tax Credit. This form is essential for those who qualify for these credits, as it helps determine the amount of credit that can be claimed on their federal tax return. The IRS requires this form to be filed along with Form 1040 or Form 1040-SR to ensure proper processing of the credits.

How to use the Schedule 8812

To use the Schedule 8812, taxpayers must first determine their eligibility for the Child Tax Credit. This involves checking income thresholds and the number of qualifying children. Once eligibility is confirmed, the taxpayer should complete the form by providing required information, such as the names and Social Security numbers of qualifying children. After filling out the form, it should be attached to the main tax return when filing.

Steps to complete the Schedule 8812

Completing the Schedule 8812 involves several key steps:

- Gather necessary documents, including Social Security cards for qualifying children and income statements.

- Determine eligibility based on income and the number of qualifying children.

- Fill out the form by entering personal information and details about each qualifying child.

- Calculate the total Child Tax Credit and Additional Child Tax Credit amounts.

- Attach the completed Schedule 8812 to your Form 1040 or Form 1040-SR when filing.

Eligibility Criteria

Eligibility for the Child Tax Credit requires that the taxpayer meets certain criteria, including:

- Filing status: Must be single, married filing jointly, head of household, or qualifying widow(er).

- Income limits: Adjusted gross income must be below specified thresholds, which can vary by filing status.

- Qualifying children: Must be under age 17 at the end of the tax year and meet relationship and residency tests.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Schedule 8812. Taxpayers should refer to the latest IRS publications for updates on eligibility, credit amounts, and instructions for completing the form. It is crucial to stay informed about any changes to tax laws that may affect the Child Tax Credit and its associated forms.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing their tax returns and associated forms, including Schedule 8812. Typically, the deadline for filing federal income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to check the IRS website for any updates regarding filing extensions or changes to deadlines.

Quick guide on how to complete schedule 8812

Effortlessly Prepare Schedule 8812 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the necessary form and securely preserve it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly and without interruptions. Manage Schedule 8812 on any device using the airSlate SignNow apps for Android or iOS, and streamline your document processes today.

The Easiest Method to Alter and eSign Schedule 8812 With Ease

- Find Schedule 8812 and click on Get Form to begin.

- Use the tools provided to fill out your document.

- Highlight important sections of your documents or obscure private information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors requiring new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Schedule 8812 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 8812

Create this form in 5 minutes!

How to create an eSignature for the schedule 8812

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS child tax credit?

The IRS child tax credit is a tax benefit designed to help families with dependents reduce their tax burden. This credit allows eligible parents to receive a refund or decrease their taxes owed based on the number of qualifying children. Knowing how to optimize your tax filings with tools like airSlate SignNow can help ensure that you maximize these benefits.

-

How can airSlate SignNow help with the IRS child tax credit application process?

airSlate SignNow provides a simple and efficient solution for electronically signing and sending documents related to the IRS child tax credit. By using our platform, users can securely handle their tax documents, making the application process less complicated and ensuring that you don’t miss any essential paperwork.

-

Are there any fees associated with using airSlate SignNow for IRS tax documents?

airSlate SignNow offers a cost-effective solution for managing your IRS tax documents, including those for the child tax credit. With our competitive pricing plans, users can choose an option that fits their budget, ensuring that applying for the IRS child tax credit is both accessible and affordable.

-

What features does airSlate SignNow offer to assist with tax document management?

airSlate SignNow includes features such as customizable templates, bulk sending, and secure eSignature capabilities that streamline the management of tax documents, including those for the IRS child tax credit. These tools help businesses and individuals easily create, send, and sign important documents in one platform.

-

Can I integrate airSlate SignNow with my accounting software for IRS tax filing?

Yes, airSlate SignNow can seamlessly integrate with various accounting and tax software applications. This integration simplifies the process of filing for the IRS child tax credit by allowing you to manage all your tax-related documents in one system, enhancing efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for my IRS child tax credit forms?

Using airSlate SignNow for your IRS child tax credit forms brings several benefits including enhanced security, speed, and convenience. The ability to eSign documents remotely ensures that you can file your taxes on time without the hassle of printing and mailing forms, maximizing your chances of receiving your rebate promptly.

-

Is airSlate SignNow user-friendly for first-time tax filers applying for the IRS child tax credit?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for first-time tax filers to navigate through the necessary forms for the IRS child tax credit. Our intuitive interface and helpful resources guide you every step of the way, ensuring you can confidently submit your tax documents.

Get more for Schedule 8812

Find out other Schedule 8812

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy