203k Worksheet Form

What is the 203k Worksheet

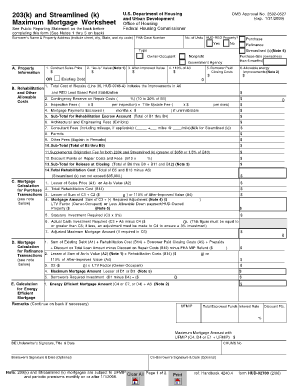

The 203k maximum mortgage worksheet is a crucial document used in the Federal Housing Administration (FHA) 203k loan process. This worksheet helps borrowers determine the maximum mortgage amount they can obtain for a property that requires rehabilitation or repairs. It outlines the necessary calculations based on the purchase price, estimated repair costs, and projected value of the property after improvements. Understanding this worksheet is essential for anyone considering a 203k loan, as it directly impacts financing options and project feasibility.

How to use the 203k Worksheet

Using the 203k worksheet involves several steps that require careful attention to detail. Start by gathering all necessary information, including the property's purchase price and the estimated costs of repairs. Enter these figures into the appropriate sections of the worksheet. The document will guide you through calculations to determine the maximum mortgage amount based on the total costs. It is important to ensure that all entries are accurate, as errors may affect loan approval and the overall financing process.

Steps to complete the 203k Worksheet

Completing the 203k maximum mortgage worksheet involves a systematic approach:

- Gather all relevant financial information, including purchase price and estimated repair costs.

- Fill in the worksheet with the gathered data, ensuring accuracy in all entries.

- Calculate the total costs, including both the purchase price and repairs.

- Determine the after-repair value of the property, which is essential for final calculations.

- Review all entries and calculations to confirm correctness before submission.

Key elements of the 203k Worksheet

The 203k worksheet includes several key elements that are vital for determining the maximum mortgage amount. These elements typically consist of:

- Purchase price of the property.

- Estimated costs for repairs and improvements.

- Projected after-repair value of the property.

- Loan limits based on FHA guidelines.

- Borrower’s financial information, including credit score and income.

Legal use of the 203k Worksheet

For the 203k worksheet to be legally binding, it must be filled out accurately and submitted according to FHA regulations. Electronic signatures can be used to sign the document, provided that they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. It is essential to ensure that all entries are truthful and complete, as any discrepancies could lead to legal issues or loan denial.

Who Issues the Form

The 203k maximum mortgage worksheet is issued by the Federal Housing Administration (FHA). This government agency oversees the 203k loan program, which is designed to help borrowers finance the purchase and rehabilitation of homes. The worksheet is available through various lenders participating in the FHA program, and it is essential for borrowers to obtain the correct version to ensure compliance with current regulations.

Quick guide on how to complete 203k worksheet

Complete 203k Worksheet effortlessly on any device

Managing documents online has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the needed form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle 203k Worksheet on any platform using airSlate SignNow’s Android or iOS apps and enhance any document-related operation today.

How to edit and eSign 203k Worksheet with ease

- Find 203k Worksheet and click Get Form to begin.

- Use the provided tools to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you prefer. Edit and eSign 203k Worksheet and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 203k worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 203k worksheet and how is it used?

A 203k worksheet is a vital document used in the 203k loan process, which allows homebuyers to finance the purchase and renovation of a home. It includes detailed information about the property's conditions and the proposed changes. Utilizing the 203k worksheet enables borrowers to clearly outline their project budget and financing, making it easier for lenders to assess their application.

-

How can airSlate SignNow help with completing a 203k worksheet?

airSlate SignNow offers a user-friendly platform for electronically signing and transmitting your 203k worksheet. With its intuitive interface, users can efficiently complete necessary forms, ensuring they provide all required information for their loan processes. This streamlines the documentation phase, helping you focus more on your renovation project.

-

Is there a cost associated with using airSlate SignNow for 203k worksheets?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for high-volume document signing. The affordable pricing ensures that users can effectively manage their 203k worksheet alongside other document requirements without breaking the bank. Visit our pricing page for more detailed information on subscription options.

-

What features does airSlate SignNow offer for handling 203k worksheets?

airSlate SignNow provides comprehensive features like document templates, real-time tracking, and secure cloud storage that greatly benefit your management of 203k worksheets. Collaboration tools allow multiple parties to complete and sign the worksheet seamlessly. Additionally, integrations with popular apps enhance your workflow efficiency.

-

Can multiple people collaborate on a 203k worksheet using airSlate SignNow?

Absolutely! airSlate SignNow allows for multiple stakeholders to collaborate on a 203k worksheet simultaneously. You can invite team members, contractors, or lenders to review and sign the document, thus simplifying the approval process. This collaborative approach ensures everyone is aligned on the project's requirements.

-

How does airSlate SignNow ensure the security of my 203k worksheet?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption protocols to protect your 203k worksheet and other sensitive documents. Additionally, you can set permissions and use audit trails to monitor who accessed or modified the worksheet for enhanced security and compliance.

-

What are the benefits of using airSlate SignNow for 203k worksheets?

Using airSlate SignNow for your 203k worksheets offers numerous benefits, including increased efficiency, reduced paperwork, and faster turnaround times. The electronic signature capability eliminates the need for scanning and printing, making the entire process much smoother. This not only saves time but also facilitates a better overall experience for all parties involved.

Get more for 203k Worksheet

- Lost receipt form 244070471

- Ahis gap form

- Sh900 form excel

- Esl library pdf form

- Triage form pdf

- Comunicazione di ospitalit eo di assunzione acli milano aclimilano form

- Pre enrollment grant application nyc gov nyc form

- Disc 015 request for statement of witnesses and evidencefor limited civil cases under 35000 judicial council forms

Find out other 203k Worksheet

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document