R 1356 L Louisiana Department of Revenue Form

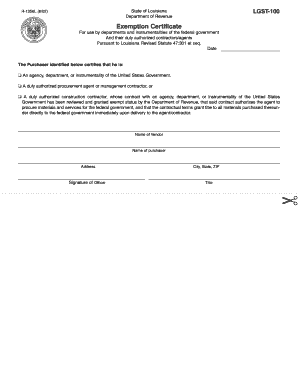

What is the R 1356 L Louisiana Department Of Revenue

The R 1356 L Louisiana Department Of Revenue form is a specific document used for tax purposes within the state of Louisiana. This form is typically utilized by individuals or businesses to report certain types of income or to claim specific tax credits. Understanding its purpose is essential for compliance with state tax regulations and for ensuring accurate reporting of financial information.

Steps to complete the R 1356 L Louisiana Department Of Revenue

Completing the R 1356 L form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as income statements and previous tax returns. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay special attention to any calculations, as errors can lead to delays or penalties. Once the form is filled out, review it thoroughly before submission to confirm that all data is correct.

Legal use of the R 1356 L Louisiana Department Of Revenue

The R 1356 L form is legally binding when completed and submitted according to the regulations set forth by the Louisiana Department of Revenue. This means that the information provided must be truthful and accurate, as any discrepancies can lead to legal repercussions, including fines or audits. It is important to understand the legal implications of submitting this form, as it serves as an official record of your tax obligations.

How to obtain the R 1356 L Louisiana Department Of Revenue

The R 1356 L form can be obtained directly from the Louisiana Department of Revenue's official website or by visiting their local office. Additionally, many tax preparation software programs include this form as part of their offerings, allowing users to fill it out digitally. It is advisable to ensure you are using the most current version of the form to comply with any recent changes in tax law.

Form Submission Methods (Online / Mail / In-Person)

The R 1356 L form can be submitted through various methods to accommodate different preferences. Individuals may choose to file online through the Louisiana Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax documents. Alternatively, the form can be mailed to the appropriate tax office or delivered in person. Each submission method has its own set of guidelines and deadlines, so it is important to follow the instructions carefully.

Required Documents

When completing the R 1356 L form, certain documents are required to support the information provided. These may include income statements, previous tax returns, and any relevant documentation related to tax credits or deductions being claimed. Having these documents on hand will facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Quick guide on how to complete r 1356 l louisiana department of revenue

Handle R 1356 L Louisiana Department Of Revenue seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and safely store it online. airSlate SignNow equips you with all the features you need to create, modify, and electronically sign your documents promptly without delays. Manage R 1356 L Louisiana Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign R 1356 L Louisiana Department Of Revenue effortlessly

- Obtain R 1356 L Louisiana Department Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign R 1356 L Louisiana Department Of Revenue and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 1356 l louisiana department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the R 1356 L Louisiana Department Of Revenue form used for?

The R 1356 L Louisiana Department Of Revenue form is used to report and pay various taxes to the Louisiana revenue department, facilitating compliance with state tax regulations. By utilizing this form, businesses can ensure they are meeting their tax obligations efficiently and accurately.

-

How can airSlate SignNow help with the R 1356 L Louisiana Department Of Revenue form?

airSlate SignNow offers an easy-to-use solution for businesses to electronically sign and send the R 1356 L Louisiana Department Of Revenue form. This streamlines the filing process, saves time, and enhances your overall compliance with Louisiana tax requirements.

-

What are the costs associated with using airSlate SignNow for the R 1356 L Louisiana Department Of Revenue?

airSlate SignNow offers competitive pricing plans that can accommodate businesses of all sizes while ensuring easy access to capabilities for handling the R 1356 L Louisiana Department Of Revenue form. Specific pricing may vary based on the features you require and the volume of documents processed, making it a cost-effective solution.

-

What features does airSlate SignNow provide for managing the R 1356 L Louisiana Department Of Revenue?

With airSlate SignNow, you receive features such as document templates, real-time tracking, and cloud storage that simplify the management of the R 1356 L Louisiana Department Of Revenue form. This allows users to prepare, sign, and store all essential documents in one place securely.

-

How does airSlate SignNow ensure the security of the R 1356 L Louisiana Department Of Revenue form?

airSlate SignNow uses advanced security protocols including encryption and secure access controls to protect sensitive data related to the R 1356 L Louisiana Department Of Revenue form. This commitment to security allows businesses to handle their tax documents with peace of mind.

-

Can airSlate SignNow integrate with other applications for handling the R 1356 L Louisiana Department Of Revenue?

Yes, airSlate SignNow offers integrations with a variety of applications, enabling seamless workflows for the R 1356 L Louisiana Department Of Revenue form. This allows businesses to connect their eSigning process with their existing tools, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for the R 1356 L Louisiana Department Of Revenue?

Utilizing airSlate SignNow for the R 1356 L Louisiana Department Of Revenue form provides numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance. The digital solution allows for faster processing times and easier access to necessary documents.

Get more for R 1356 L Louisiana Department Of Revenue

Find out other R 1356 L Louisiana Department Of Revenue

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free