Form it 204 CP New York Corporate Partners Schedule K 1 Tax Year 2023

Understanding the Form IT 204 CP New York Corporate Partners Schedule K-1 Tax Year

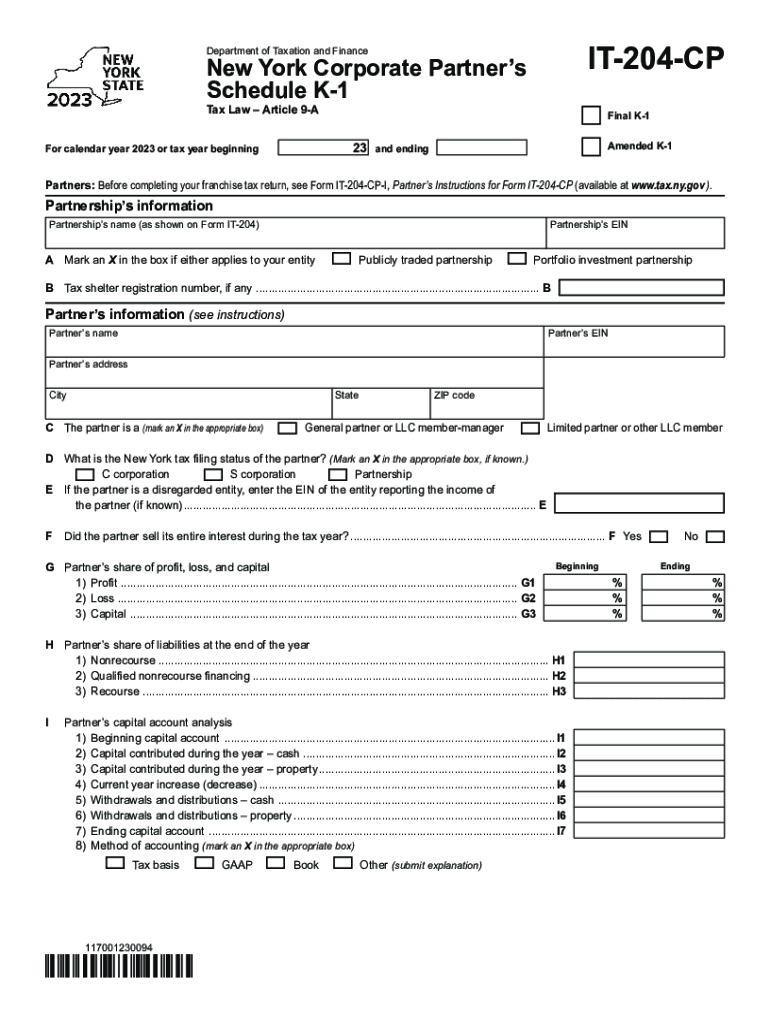

The IT 204 CP is a tax form used by partnerships in New York to report income, deductions, and credits to their partners. This form is essential for partners to accurately report their share of the partnership's income on their personal tax returns. The K-1 section of the form provides detailed information on each partner's share of the partnership's income, losses, and other tax-related items. It is crucial for partners to receive this form to ensure compliance with both state and federal tax regulations.

Steps to Complete the Form IT 204 CP New York Corporate Partners Schedule K-1 Tax Year

Completing the IT 204 CP involves several key steps:

- Gather necessary financial information for the partnership, including income, deductions, and credits.

- Fill out the partnership's identifying information at the top of the form.

- Report the partnership's income and deductions in the appropriate sections.

- Distribute the K-1 portion to each partner, ensuring that each partner's share is accurately calculated.

- Review the completed form for accuracy before submission.

Key Elements of the Form IT 204 CP New York Corporate Partners Schedule K-1 Tax Year

The IT 204 CP consists of several key elements that partners need to be aware of:

- Partnership Information: This section includes the name, address, and identification number of the partnership.

- Partner Information: Each partner's name, address, and identification number must be listed.

- Income and Deductions: Detailed reporting of each partner's share of income, losses, and deductions is crucial for accurate tax reporting.

- Credits: Any applicable tax credits that partners may claim should be clearly outlined.

Obtaining the Form IT 204 CP New York Corporate Partners Schedule K-1 Tax Year

The IT 204 CP can be obtained through the New York State Department of Taxation and Finance website. It is available as a downloadable PDF, which can be filled out electronically or printed for manual completion. Additionally, tax professionals and accountants may provide this form as part of their services to partnerships.

Filing Deadlines for the Form IT 204 CP New York Corporate Partners Schedule K-1 Tax Year

It is important for partnerships to be aware of the filing deadlines associated with the IT 204 CP. Typically, the form must be filed by the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March fifteen. Partners should also ensure they receive their K-1 forms in a timely manner to meet their personal tax filing deadlines.

Legal Use of the Form IT 204 CP New York Corporate Partners Schedule K-1 Tax Year

The IT 204 CP serves a legal purpose in tax reporting for partnerships in New York. It ensures that income is reported accurately to both the state and federal tax authorities. Proper use of this form helps prevent penalties for non-compliance and ensures that partners are appropriately taxed based on their share of the partnership's income. It is essential for partnerships to maintain accurate records and provide this form to partners as required by law.

Quick guide on how to complete form it 204 cp new york corporate partners schedule k 1 tax year

Manage Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year with ease

- Obtain Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and electronically sign Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 204 cp new york corporate partners schedule k 1 tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 204 cp new york corporate partners schedule k 1 tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow in New York CP?

The pricing for airSlate SignNow in New York CP is designed to be cost-effective and flexible to meet various business needs. You can choose from monthly or annual subscription plans that provide full access to our eSigning features, including document templates and advanced integrations. Additionally, we offer a free trial so you can explore the platform before making a financial commitment.

-

What features does airSlate SignNow offer for New York CP users?

airSlate SignNow offers a comprehensive set of features for New York CP users, including customizable templates, bulk sending, and real-time tracking of document statuses. Users can also enjoy robust security features, such as two-factor authentication and encrypted document storage, ensuring that all essential documents remain protected throughout the signing process.

-

How can airSlate SignNow benefit businesses in New York CP?

Businesses in New York CP can greatly benefit from airSlate SignNow by streamlining their document workflows and reducing turnaround times with electronic signatures. This not only enhances efficiency but also helps in maintaining compliance with legal standards for digital signatures. Additionally, the platform allows teams to collaborate seamlessly without the hassle of printed documents.

-

Can airSlate SignNow integrate with other tools commonly used in New York CP?

Yes, airSlate SignNow provides integration capabilities with various tools commonly used by businesses in New York CP. You can easily integrate our platform with applications like Google Drive, Salesforce, and Microsoft Office to enhance your workflow. These integrations allow for smoother data transfer and improved productivity across your existing systems.

-

Is airSlate SignNow legally compliant for use in New York CP?

Absolutely, airSlate SignNow is compliant with e-signature laws such as ESIGN and UETA, making it legally valid for use in New York CP. This compliance ensures that any documents signed through our platform are recognized as legally binding. You can confidently conduct business transactions knowing that your electronic signatures meet all legal requirements.

-

What customer support options are available for New York CP users of airSlate SignNow?

New York CP users of airSlate SignNow can access a variety of customer support options, including live chat, email support, and a comprehensive knowledge base. Our support team is dedicated to providing timely assistance and helping users resolve any issues they may encounter. Additionally, we offer an extensive library of video tutorials and FAQs to enhance your experience.

-

How secure is the airSlate SignNow platform for New York CP businesses?

Security is a top priority for airSlate SignNow, especially for businesses in New York CP handling sensitive documents. Our platform employs advanced encryption protocols and secure cloud storage technologies to protect all data. Furthermore, features like audit trails and access controls help ensure that only authorized users interact with sensitive information.

Get more for Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year

Find out other Form IT 204 CP New York Corporate Partners Schedule K 1 Tax Year

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free