W3 Pr 2023

What is the W-3 PR?

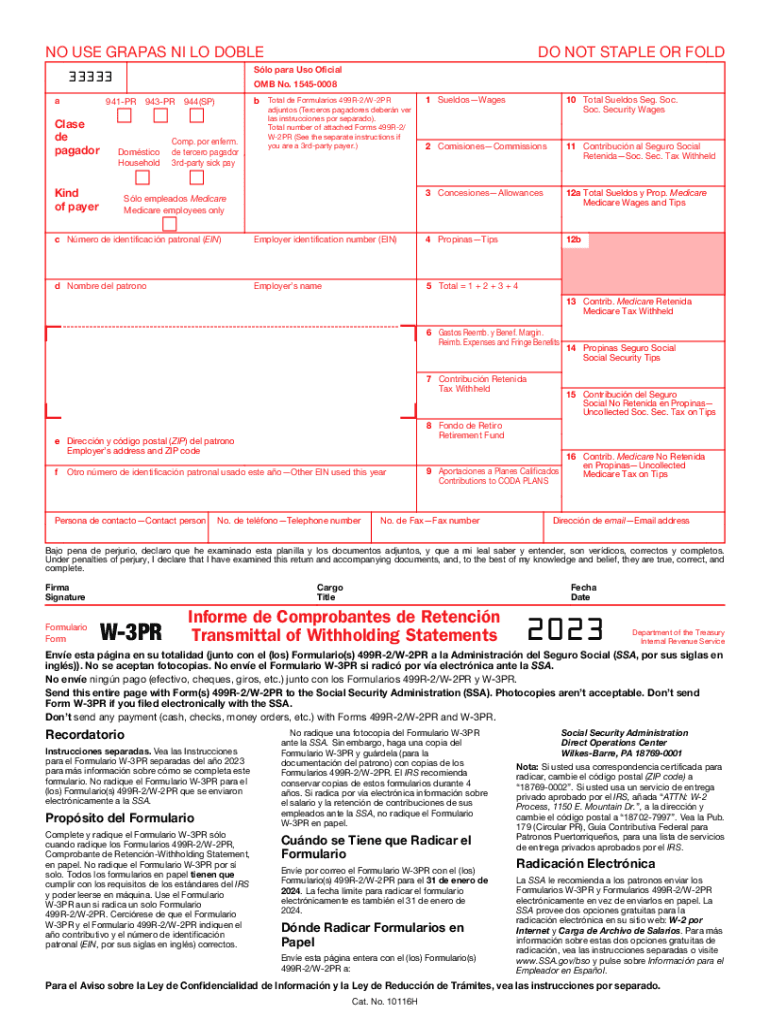

The W-3 PR is a summary form used in Puerto Rico for reporting wages and taxes withheld from employees. It is essential for employers who are required to submit payroll information to the Puerto Rico Department of Treasury. The form consolidates data from individual W-2 PR forms, which detail the earnings and tax withholdings for each employee. Understanding the W-3 PR is crucial for ensuring compliance with local tax regulations and for accurate reporting of employee earnings.

How to Use the W-3 PR

To effectively use the W-3 PR, employers should first gather all W-2 PR forms for their employees. The W-3 PR serves as a summary that includes total wages, tips, and other compensation paid to employees, as well as the total amount of taxes withheld. After compiling this information, employers must accurately fill out the W-3 PR, ensuring that all figures match those reported on the W-2 PR forms. Once completed, the W-3 PR must be submitted to the Puerto Rico Department of Treasury along with the W-2 PR forms.

Steps to Complete the W-3 PR

Completing the W-3 PR involves several key steps:

- Gather all W-2 PR forms for your employees.

- Calculate the total wages and taxes withheld for each employee.

- Fill in the W-3 PR form with the total amounts from the W-2 PR forms.

- Review the form for accuracy, ensuring all figures are correct.

- Submit the completed W-3 PR along with the W-2 PR forms to the Puerto Rico Department of Treasury by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for the W-3 PR align with the annual tax reporting schedule in Puerto Rico. Employers must submit the W-3 PR and accompanying W-2 PR forms by January thirty-first of the following year. It is important to stay informed about any changes to deadlines, as late submissions may result in penalties. Keeping track of these dates ensures compliance and avoids unnecessary complications.

Required Documents

To complete the W-3 PR, employers need the following documents:

- All W-2 PR forms for each employee.

- Payroll records that detail total wages and taxes withheld.

- Any additional documentation required by the Puerto Rico Department of Treasury.

Having these documents organized and readily available will streamline the completion and submission process.

Penalties for Non-Compliance

Failure to file the W-3 PR accurately and on time can lead to significant penalties. The Puerto Rico Department of Treasury may impose fines for late submissions, incorrect information, or failure to submit the required forms altogether. Employers should be aware of these penalties and take proactive steps to ensure compliance, such as maintaining accurate payroll records and adhering to filing deadlines.

Quick guide on how to complete w3 pr

Complete W3 Pr effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as a perfect environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without any delays. Manage W3 Pr on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign W3 Pr with ease

- Locate W3 Pr and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information carefully and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it onto your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Alter and eSign W3 Pr and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w3 pr

Create this form in 5 minutes!

How to create an eSignature for the w3 pr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 499r 2 w 2pr 2023?

The form 499r 2 w 2pr 2023 is a specific document used for tax purposes in certain regions. It is crucial for accurately reporting income and withholding tax information. Utilizing airSlate SignNow can simplify the completion and electronic signing of form 499r 2 w 2pr 2023, making it easier to stay compliant.

-

How can airSlate SignNow help with form 499r 2 w 2pr 2023?

airSlate SignNow allows users to easily prepare, send, and eSign form 499r 2 w 2pr 2023 seamlessly. The platform's intuitive interface streamlines the process, ensuring that all necessary fields are filled out correctly and efficiently. This way, you can focus more on your business and less on paperwork.

-

Is airSlate SignNow cost-effective for handling form 499r 2 w 2pr 2023?

Yes, airSlate SignNow provides a budget-friendly solution for businesses needing to manage form 499r 2 w 2pr 2023. Our pricing plans are designed to accommodate various business sizes, ensuring that you're not spending more than necessary for eSigning services. Plus, the time saved by utilizing our platform translates to additional cost savings.

-

What features does airSlate SignNow offer for form 499r 2 w 2pr 2023?

airSlate SignNow offers features such as customizable templates, in-app signing, and secure storage, which are all perfect for managing form 499r 2 w 2pr 2023. Additionally, tracking and notification options provide real-time updates on your document's status. These features collectively enhance productivity and ensure accuracy.

-

Can I integrate airSlate SignNow with other tools for form 499r 2 w 2pr 2023?

Absolutely! airSlate SignNow seamlessly integrates with various CRM and document management systems, making it easy to incorporate form 499r 2 w 2pr 2023 into your existing workflow. This integration allows for straightforward data transfer and process automation, enhancing efficiency.

-

How secure is the data when using airSlate SignNow for form 499r 2 w 2pr 2023?

Data security is a top priority for airSlate SignNow. When handling form 499r 2 w 2pr 2023, your documents are protected with advanced encryption and secure server infrastructures. This ensures that your sensitive information remains confidential and compliant with regulations.

-

What are the benefits of using airSlate SignNow for form 499r 2 w 2pr 2023?

Using airSlate SignNow for form 499r 2 w 2pr 2023 provides numerous benefits, including faster turnaround times and reduced errors in documentation. The ease of use encourages more timely submissions, leading to better compliance. Moreover, reducing paperwork frees up valuable time for your team to focus on core business activities.

Get more for W3 Pr

Find out other W3 Pr

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship