Child Care Business Form for Taxes Daycare Match

What is the Child Care Business Form For Taxes Daycare Match

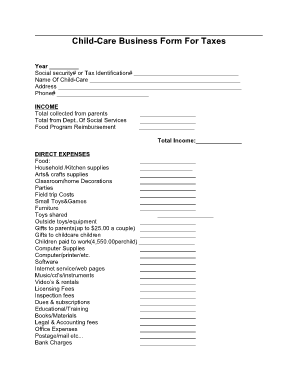

The Child Care Business Form for Taxes Daycare Match is a crucial document for child care providers in the United States. This form helps businesses track and report their income and expenses related to child care services. It is essential for tax purposes, ensuring that providers can accurately claim deductions and comply with IRS regulations. The form typically includes information about the business structure, revenue generated, and expenses incurred during the tax year.

Steps to complete the Child Care Business Form For Taxes Daycare Match

Completing the Child Care Business Form for Taxes Daycare Match involves several key steps:

- Gather all necessary financial documents, including income statements, expense receipts, and any relevant tax documents.

- Fill in your business information, including the name, address, and type of business entity.

- Detail your income sources, ensuring to include all payments received for child care services.

- List all allowable expenses, such as supplies, utilities, and wages paid to employees.

- Review the form for accuracy, ensuring all information is complete and correct before submission.

Legal use of the Child Care Business Form For Taxes Daycare Match

The legal use of the Child Care Business Form for Taxes Daycare Match is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted by the appropriate deadlines. Electronic signatures are acceptable, provided they comply with the ESIGN Act and UETA. This ensures that the form is legally binding and can be used in case of audits or disputes with tax authorities.

IRS Guidelines

The IRS provides specific guidelines for completing the Child Care Business Form for Taxes Daycare Match. These guidelines include instructions on what constitutes taxable income, allowable deductions, and record-keeping requirements. Providers must adhere to these guidelines to ensure compliance and avoid penalties. It is advisable to consult the IRS website or a tax professional for the most current information regarding tax obligations related to child care services.

Filing Deadlines / Important Dates

Filing deadlines for the Child Care Business Form for Taxes Daycare Match are critical for compliance. Generally, the form must be submitted by April fifteenth of the following tax year. However, if you are unable to meet this deadline, you may file for an extension. It is essential to stay informed about any changes in deadlines that may occur due to new legislation or IRS updates.

Required Documents

To complete the Child Care Business Form for Taxes Daycare Match, several documents are required:

- Income statements detailing all earnings from child care services.

- Receipts for business-related expenses.

- Any previous tax returns that may provide context for the current year's filing.

- Documentation of any licenses or permits required to operate a child care business.

Quick guide on how to complete child care business form for taxes daycare match

Set Up Child Care Business Form For Taxes Daycare Match effortlessly on any gadget

Online document management has become widely embraced by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the necessary form and securely save it online. airSlate SignNow provides all the resources needed to create, edit, and eSign your documents rapidly without any hold-ups. Manage Child Care Business Form For Taxes Daycare Match on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The simplest way to modify and eSign Child Care Business Form For Taxes Daycare Match without hassle

- Obtain Child Care Business Form For Taxes Daycare Match and then click Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for those purposes.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Adjust and eSign Child Care Business Form For Taxes Daycare Match and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the child care business form for taxes daycare match

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Child Care Business Form For Taxes Daycare Match?

The Child Care Business Form For Taxes Daycare Match is a specialized document designed to help daycare providers track expenses and income for tax purposes. It simplifies the process of preparing your finances for tax season and ensures you meet all legal requirements. Utilizing this form can help you take full advantage of available tax deductions to maximize your refund.

-

How can airSlate SignNow help with the Child Care Business Form For Taxes Daycare Match?

airSlate SignNow provides an easy-to-use platform for sending and eSigning the Child Care Business Form For Taxes Daycare Match. Our solution streamlines the process, allowing you to manage documents efficiently without the hassle of paper. Additionally, you can quickly gather signatures and keep track of submissions in one secure location.

-

What are the pricing options for using airSlate SignNow to manage my Child Care Business Form For Taxes Daycare Match?

airSlate SignNow offers several pricing plans to accommodate businesses of all sizes, allowing you to choose a plan that best fits your needs for handling the Child Care Business Form For Taxes Daycare Match. These plans include a free trial and scalable options based on your usage and required features. Check our pricing page for more details on what each plan includes.

-

Can I integrate airSlate SignNow with other software I use for daycare management?

Yes, airSlate SignNow seamlessly integrates with various tools and software commonly used for daycare management. This integration allows you to manage the Child Care Business Form For Taxes Daycare Match alongside your existing systems, making it easier to organize and share information. Explore our integration options to see how we can fit into your current workflow.

-

What benefits do I get from using the Child Care Business Form For Taxes Daycare Match with airSlate SignNow?

Using the Child Care Business Form For Taxes Daycare Match with airSlate SignNow offers numerous benefits, including time savings, enhanced organization, and improved accuracy in your financial reporting. The digital format reduces errors and keeps everything organized, making tax preparation a breeze. Additionally, the ability to eSign documents removes the need for physical signatures, speeding up the process.

-

Is it secure to use airSlate SignNow for my Child Care Business Form For Taxes Daycare Match?

Absolutely! airSlate SignNow prioritizes security and employs advanced encryption protocols to protect your sensitive data, including the Child Care Business Form For Taxes Daycare Match. Our platform ensures that all documents are safely stored, and access is granted only to authorized users. You can rest easy knowing your information is secure.

-

How do I get started with the Child Care Business Form For Taxes Daycare Match on airSlate SignNow?

Getting started with the Child Care Business Form For Taxes Daycare Match on airSlate SignNow is simple. Sign up for an account, choose the appropriate plan, and access our templates to customize your forms based on your daycare’s needs. Our user-friendly interface guides you through the entire process, from document creation to sending for signatures.

Get more for Child Care Business Form For Taxes Daycare Match

- Carefirst reimbursement form

- Write trace amp say the numbers 11 20 form

- Independent work behavior checklist form

- Go vzw com changeaddress form

- Linear quadratic exponential worksheet form

- Dscb 19 17 2 form

- Nevada standard application form fill online printable

- Skill performance evaluation certificate renewal application

Find out other Child Care Business Form For Taxes Daycare Match

- Sign California Banking Claim Online

- Sign Arkansas Banking Affidavit Of Heirship Safe

- How To Sign Arkansas Banking Forbearance Agreement

- Sign Arizona Banking Permission Slip Easy

- Can I Sign California Banking Lease Agreement Template

- How Do I Sign Colorado Banking Credit Memo

- Help Me With Sign Colorado Banking Credit Memo

- How Can I Sign Colorado Banking Credit Memo

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online