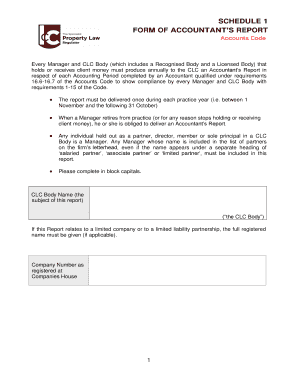

Clc Accountants Report Form

What is the CLC Accountants Report?

The CLC Accountants Report is a formal document prepared by certified accountants, providing an overview of a company's financial status. This report typically includes an analysis of financial statements, compliance with accounting standards, and an assessment of internal controls. It serves as a vital tool for stakeholders, including investors, creditors, and regulatory bodies, to evaluate the financial health and operational efficiency of a business.

Key Elements of the CLC Accountants Report

A comprehensive CLC Accountants Report includes several key components that enhance its utility and credibility:

- Financial Statements: Detailed breakdowns of the balance sheet, income statement, and cash flow statement.

- Management Discussion: Insights from management regarding financial performance and future outlook.

- Compliance Assessment: Evaluation of adherence to relevant accounting standards and regulations.

- Internal Control Review: Analysis of the effectiveness of internal controls in safeguarding assets and ensuring accurate financial reporting.

Steps to Complete the CLC Accountants Report

Completing the CLC Accountants Report involves several methodical steps to ensure accuracy and compliance:

- Gather Financial Data: Collect all relevant financial documents, including ledgers, invoices, and bank statements.

- Prepare Financial Statements: Create the necessary financial statements, ensuring they reflect the company's financial position accurately.

- Conduct Analysis: Analyze the financial data to identify trends, discrepancies, and areas for improvement.

- Draft the Report: Compile the findings into a structured report format, including all key elements.

- Review and Revise: Conduct a thorough review of the report for accuracy and completeness before finalization.

Legal Use of the CLC Accountants Report

The CLC Accountants Report holds significant legal weight, particularly in financial disclosures and audits. It must adhere to established accounting principles and regulations to be considered valid. When prepared correctly, it can be used in legal proceedings, as evidence of financial status, and to demonstrate compliance with regulatory requirements. Ensuring that the report is signed and dated by a licensed accountant enhances its legal standing.

How to Obtain the CLC Accountants Report

To obtain a CLC Accountants Report, businesses typically need to engage a certified public accountant (CPA) or an accounting firm. The process generally involves:

- Contacting a CPA or firm with expertise in the relevant industry.

- Providing necessary financial documents and information.

- Agreeing on the scope of the report and associated fees.

- Receiving the completed report within the agreed timeframe.

Examples of Using the CLC Accountants Report

The CLC Accountants Report can be utilized in various scenarios, including:

- Investment Decisions: Investors may review the report to assess the viability of investing in a company.

- Loan Applications: Banks often require this report to evaluate the creditworthiness of a business seeking financing.

- Regulatory Compliance: Companies may need to submit the report to comply with state or federal regulations.

Quick guide on how to complete clc accountants report

Complete Clc Accountants Report effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It presents an excellent eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, alter, and electronically sign your documents swiftly without delays. Manage Clc Accountants Report on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Clc Accountants Report with ease

- Obtain Clc Accountants Report and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Clc Accountants Report while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the clc accountants report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the report form accounting feature in airSlate SignNow?

The report form accounting feature in airSlate SignNow enables users to create customizable report forms that track and manage various accounting processes. This function provides a streamlined way to collect financial data, ensuring accurate reporting for your business needs.

-

How does airSlate SignNow handle pricing for report form accounting?

airSlate SignNow offers competitive pricing plans for businesses of all sizes, including features for report form accounting. You can choose a plan that best fits your accounting needs and budget, with options that scale as your business grows.

-

Can I integrate airSlate SignNow with existing accounting software for report form accounting?

Yes, airSlate SignNow integrates seamlessly with many popular accounting software solutions, allowing you to enhance your report form accounting practices. This integration ensures that your financial documents are easily accessible and can be managed within your preferred accounting system.

-

What are the benefits of using airSlate SignNow for report form accounting?

Using airSlate SignNow for report form accounting provides numerous benefits, including increased efficiency and time savings. You can automate document workflows, reduce errors associated with manual entry, and enhance collaboration among your accounting team.

-

Is airSlate SignNow secure for handling sensitive report form accounting data?

Absolutely! airSlate SignNow prioritizes the security of your data, implementing advanced encryption and compliance measures to protect sensitive report form accounting information. You can confidently manage your financial documents without worrying about data bsignNowes.

-

How can I customize report forms within airSlate SignNow?

Customizing report forms within airSlate SignNow is simple and user-friendly. You can use the drag-and-drop interface to add and edit fields, ensuring that your report form accounting documents meet your specific requirements.

-

What support options are available for using report form accounting in airSlate SignNow?

airSlate SignNow provides robust support options, including a comprehensive knowledge base and dedicated customer service. Whether you need help setting up your report form accounting or troubleshooting issues, our support team is here to assist you.

Get more for Clc Accountants Report

Find out other Clc Accountants Report

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe